QUOTE(hafizmamak85 @ Jun 11 2025, 11:48 AM)

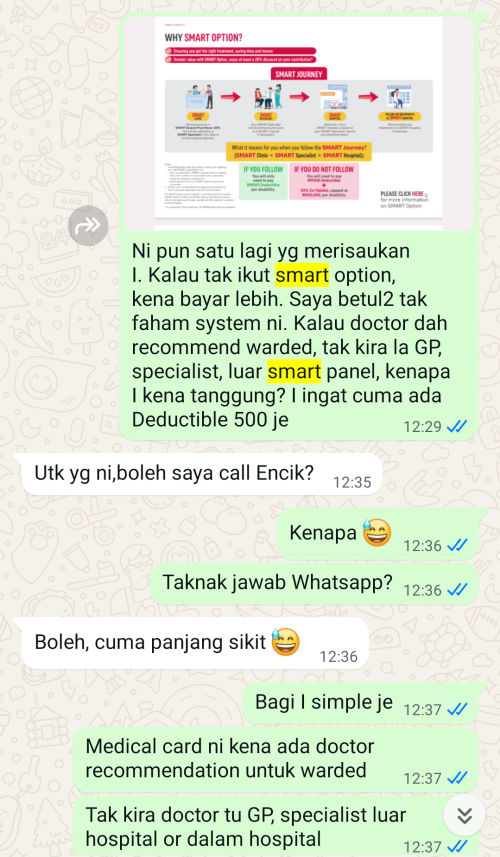

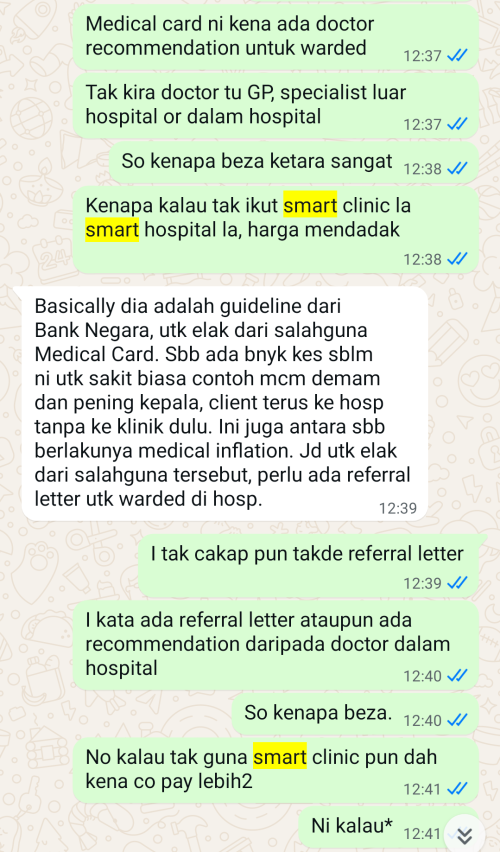

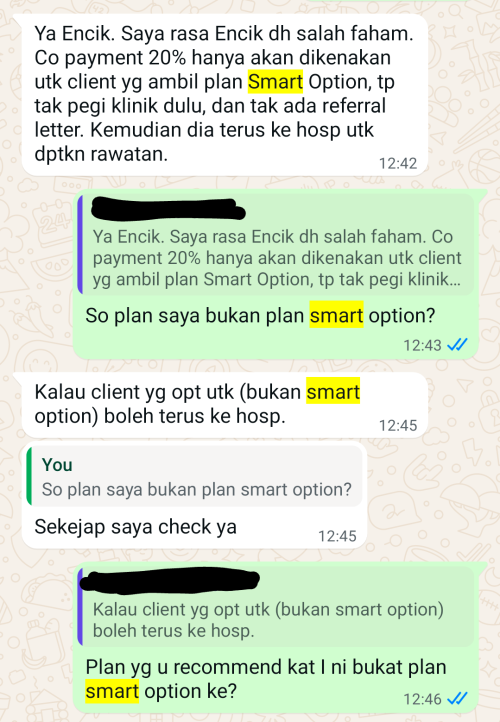

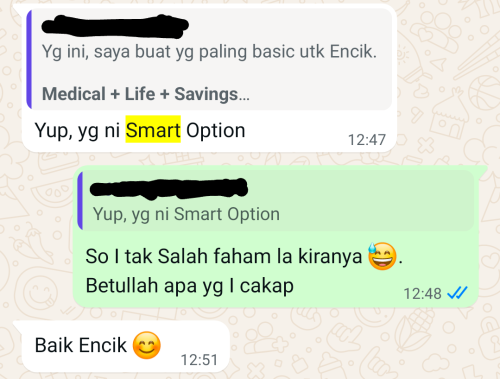

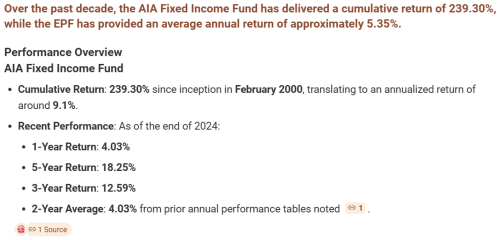

There is no relationship between the reduction in premium amount and the smart option track other than the expectation the smart option track would help reduce overall claims by hopefully limiting medically unnecessary claims and unreasonable and uncustomary fees/charges.

However, AIA smart option track does not have monopoly on the determination on what is medically necessary and reasonable and customary fees/charges.

The determination of what is medically necessary and reasonable and customary excludes the AIA smart option track consideration.

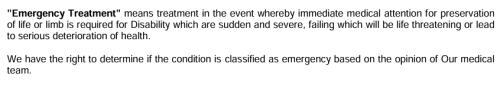

The contract underpinning the AIA smart option track is still based on coverage for medically necessary treatments/procedures based on reasonable/customary fees/charges regardless of who the health service provider is.

It doesn't make any sense to impose an arbitrary and unfair 20% co-pay on non smart option track claims if the claims fulfill the medically necessary and reasonable/customary standards.

Then maybe opt out of the SMART Option?However, AIA smart option track does not have monopoly on the determination on what is medically necessary and reasonable and customary fees/charges.

The determination of what is medically necessary and reasonable and customary excludes the AIA smart option track consideration.

The contract underpinning the AIA smart option track is still based on coverage for medically necessary treatments/procedures based on reasonable/customary fees/charges regardless of who the health service provider is.

It doesn't make any sense to impose an arbitrary and unfair 20% co-pay on non smart option track claims if the claims fulfill the medically necessary and reasonable/customary standards.

Jun 11 2025, 01:31 PM

Jun 11 2025, 01:31 PM

Quote

Quote

0.0226sec

0.0226sec

0.52

0.52

6 queries

6 queries

GZIP Disabled

GZIP Disabled