QUOTE(nestleomega @ Dec 4 2023, 11:08 PM)

Dose stashaway simple pay dividend monthly? Cos until September I am receiving dividend monthly but then since October no more dividend. Is there any change?

same here, has anyone verified what is going on?Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jan 6 2024, 10:47 PM Jan 6 2024, 10:47 PM

|

Junior Member

9 posts Joined: May 2008 |

|

|

|

|

|

|

Jan 6 2024, 11:15 PM Jan 6 2024, 11:15 PM

Show posts by this member only | IPv6 | Post

#20402

|

Junior Member

252 posts Joined: May 2008 |

QUOTE(MiNjIaT @ Jan 6 2024, 10:47 PM) Clarified with them, this is what they said:-There was no dividend declared by the fund manager for the past two months. As such, your returns will be purely reflected as capital appreciation for these months. You'll be able to see the returns breakdown in your upcoming monthly statements. However, this does not impact the overall projected return of the fund. Whenever a dividend is paid, the share price of a fund would theoretically fall by the amount of dividend paid. Therefore, when there is no dividend paid, the returns would be pure from capital appreciation. Hope this provides more context on the matter |

|

|

Jan 15 2024, 11:51 PM Jan 15 2024, 11:51 PM

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Jan 16 2024, 08:04 PM Jan 16 2024, 08:04 PM

Show posts by this member only | IPv6 | Post

#20404

|

Senior Member

1,615 posts Joined: Mar 2020 |

|

|

|

Jan 16 2024, 09:22 PM Jan 16 2024, 09:22 PM

Show posts by this member only | IPv6 | Post

#20405

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(thecurious @ Jan 16 2024, 08:04 PM) Yes. SA dispose of this asset.Get to know KWEB all because of SA. brokenbomb liked this post

|

|

|

Jan 18 2024, 10:10 AM Jan 18 2024, 10:10 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

SAMY doing well lately?

|

|

|

|

|

|

Jan 18 2024, 11:01 AM Jan 18 2024, 11:01 AM

|

Junior Member

998 posts Joined: May 2014 |

my SA portfolio turn positive

but performance/ returns are not in par with my other US/ malaysia/ Asia pacific asset unit trust….. has withdrawn some fund from the portfolio since…likely will only put in money into the blackrock/ own flexi portfolio when time is right. |

|

|

Jan 18 2024, 11:05 AM Jan 18 2024, 11:05 AM

Show posts by this member only | IPv6 | Post

#20408

|

Senior Member

1,615 posts Joined: Mar 2020 |

|

|

|

Jan 18 2024, 11:09 AM Jan 18 2024, 11:09 AM

Show posts by this member only | IPv6 | Post

#20409

|

All Stars

14,854 posts Joined: Mar 2015 |

QUOTE(tehoice @ Jan 18 2024, 10:10 AM) From their site, ...https://www.stashaway.my/ Looks like SRI 36% did well in year 2023... Failing myr did a part too. Ha ha Attached thumbnail(s)

|

|

|

Jan 18 2024, 11:29 AM Jan 18 2024, 11:29 AM

|

Senior Member

3,483 posts Joined: Jan 2003 |

never ever trust their site. 0.8% management fees never included

|

|

|

Jan 18 2024, 11:34 AM Jan 18 2024, 11:34 AM

|

Senior Member

605 posts Joined: Jan 2003 |

QUOTE(MUM @ Jan 18 2024, 11:09 AM) From their site, ... yep a big part is because of currency exchange. 20.28%(MYR) vs 13.61% (USD).https://www.stashaway.my/ Looks like SRI 36% did well in year 2023... Failing myr did a part too. Ha ha If we just exchange to USD & do absolutely nothing, we gain around 6.7% |

|

|

Jan 18 2024, 11:35 AM Jan 18 2024, 11:35 AM

Show posts by this member only | IPv6 | Post

#20412

|

All Stars

14,854 posts Joined: Mar 2015 |

|

|

|

Jan 18 2024, 11:39 AM Jan 18 2024, 11:39 AM

Show posts by this member only | IPv6 | Post

#20413

|

All Stars

14,854 posts Joined: Mar 2015 |

QUOTE(godhpf @ Jan 18 2024, 11:34 AM) yep a big part is because of currency exchange. 20.28%(MYR) vs 13.61% (USD). Just exchange usd and Do nothing gain 6.7%, but if put into SAMY 36%Sri and do nothing more gained 20%.If we just exchange to USD & do absolutely nothing, we gain around 6.7% Ha ha If we only knows how it goes in future ...ha ha |

|

|

|

|

|

Jan 18 2024, 11:49 AM Jan 18 2024, 11:49 AM

|

Senior Member

605 posts Joined: Jan 2003 |

QUOTE(MUM @ Jan 18 2024, 11:39 AM) Just exchange usd and Do nothing gain 6.7%, but if put into SAMY 36%Sri and do nothing more gained 20%. I don't think you understood what I meant. Ha ha If we only knows how it goes in future ...ha ha The MYR performance is misleading and a big chunk was just currency exchange like what you have mentioned. I was just putting it in numbers. If one wants to compare what would happen if they exchange & do nothing VS exchange & put in SA, they should look at the USD numbers aka real performance. Anyway, I remember that you like MYR numbers instead of USD. Well, you do you. Cheers. |

|

|

Jan 18 2024, 11:59 AM Jan 18 2024, 11:59 AM

|

All Stars

15,856 posts Joined: Nov 2007 From: Zion |

QUOTE(tehoice @ Jan 18 2024, 10:10 AM) already withdrawn my mainportfolio DCA into VOO now Hoshiyuu liked this post

|

|

|

Jan 18 2024, 12:43 PM Jan 18 2024, 12:43 PM

|

Senior Member

4,999 posts Joined: Jan 2003 |

QUOTE(MUM @ Jan 18 2024, 11:09 AM) From their site, ... how does it compare to the blackrock version?https://www.stashaway.my/ Looks like SRI 36% did well in year 2023... Failing myr did a part too. Ha ha |

|

|

Jan 18 2024, 01:13 PM Jan 18 2024, 01:13 PM

|

Junior Member

663 posts Joined: Jun 2017 |

|

|

|

Jan 18 2024, 01:53 PM Jan 18 2024, 01:53 PM

Show posts by this member only | IPv6 | Post

#20418

|

All Stars

14,854 posts Joined: Mar 2015 |

QUOTE(godhpf @ Jan 18 2024, 11:49 AM) I don't think you understood what I meant. I liked to look at SAMY returns in MYR numbers.The MYR performance is misleading and a big chunk was just currency exchange like what you have mentioned. I was just putting it in numbers. If one wants to compare what would happen if they exchange & do nothing VS exchange & put in SA, they should look at the USD numbers aka real performance. Anyway, I remember that you like MYR numbers instead of USD. Well, you do you. Cheers. My epf returns are in MYR My unit trust investnent returns are in MYR My rental income is in MYR My expenses in Malaysia is in MYR. THUS I would like to beable to easily see if my MYR return from my investment can covers my MYR expenses or not This post has been edited by MUM: Jan 18 2024, 01:53 PM rahtid liked this post

|

|

|

Jan 18 2024, 01:56 PM Jan 18 2024, 01:56 PM

Show posts by this member only | IPv6 | Post

#20419

|

All Stars

14,854 posts Joined: Mar 2015 |

|

|

|

Jan 18 2024, 02:37 PM Jan 18 2024, 02:37 PM

Show posts by this member only | IPv6 | Post

#20420

|

Junior Member

246 posts Joined: Jan 2005 |

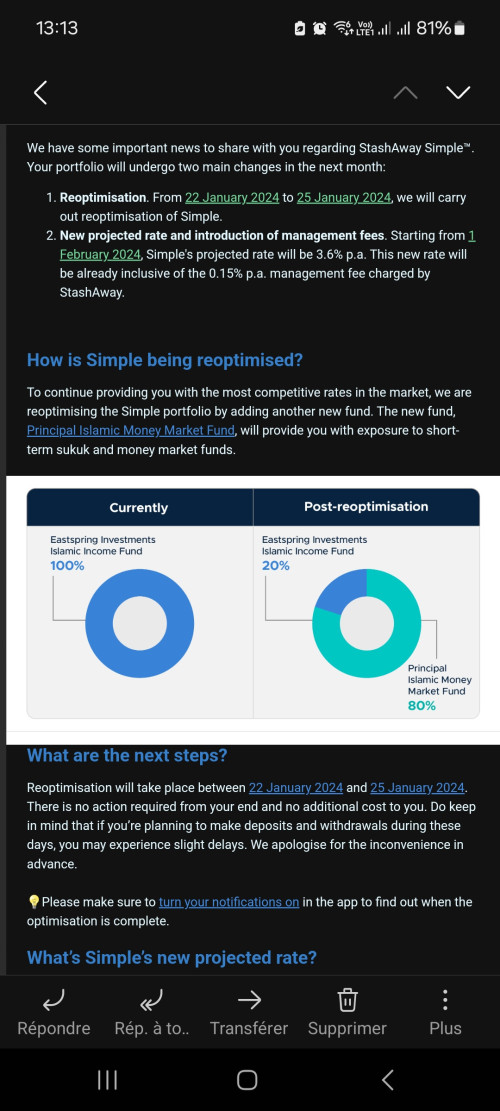

QUOTE(Gabriel03 @ Jan 18 2024, 01:13 PM) Stashaway Simple is reducing to 3.6% pa. There are other money market funds which offer better deposit and withdrawal processing time at the same or better rate. Any other suggestions other than Versa, GO+ and KDI? This post has been edited by siaush: Jan 18 2024, 02:40 PM |

| Change to: |  0.0309sec 0.0309sec

1.57 1.57

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 27th November 2025 - 05:18 AM |