QUOTE(MUM @ Mar 23 2023, 05:18 PM)

i have money in EPF,...

EPF has overseas investment

EPF gives out 5.35% ROI

i judge EPF returns in % it gives me

i have money in UT that invested in overseas markets with MYR

these UT returns is in %

i judge the UT returns in % it gives me

i have money in SA with MYR

SA invest in overseas

SA gives me returns in %

i judge SA returns in % it gives me.

Well, let's agree to disagree.

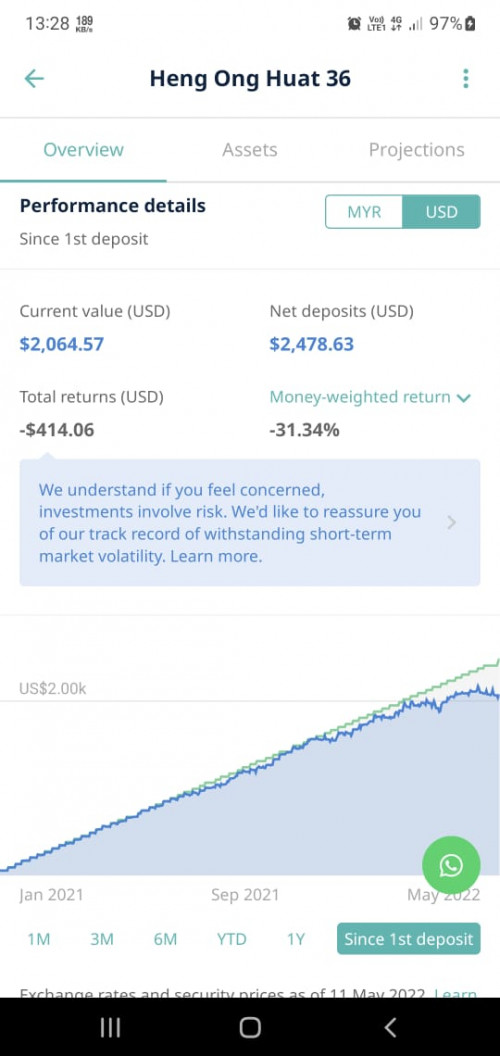

For me, if SA converts it to USD, and USD is the currency of the investments, to judge the investments' performance, we have to use the currency that those uses.

Your example of EPF & UT is not exactly equivalent.

EPF can invest in many different currencies. To judge the performance of those individual investment, you use the currency that those investments are using.

However, we don't get such visibility. We only see the MYR value. Thus we HAVE to judge EPF using the MYR value.

Same goes to UT.

Mar 13 2022, 09:15 AM

Mar 13 2022, 09:15 AM

Quote

Quote

0.0472sec

0.0472sec

0.88

0.88

7 queries

7 queries

GZIP Disabled

GZIP Disabled