QUOTE(batman1172 @ Apr 26 2023, 08:51 PM)

as I know dividend no tax even if repatriate back to Malaysia.

if I re invest sure no tax cause the dividend was earned overseas and never bring back to Malaysia. also depends which country as Malaysia may have DTA with them.

this is true until 2026 for individuals.

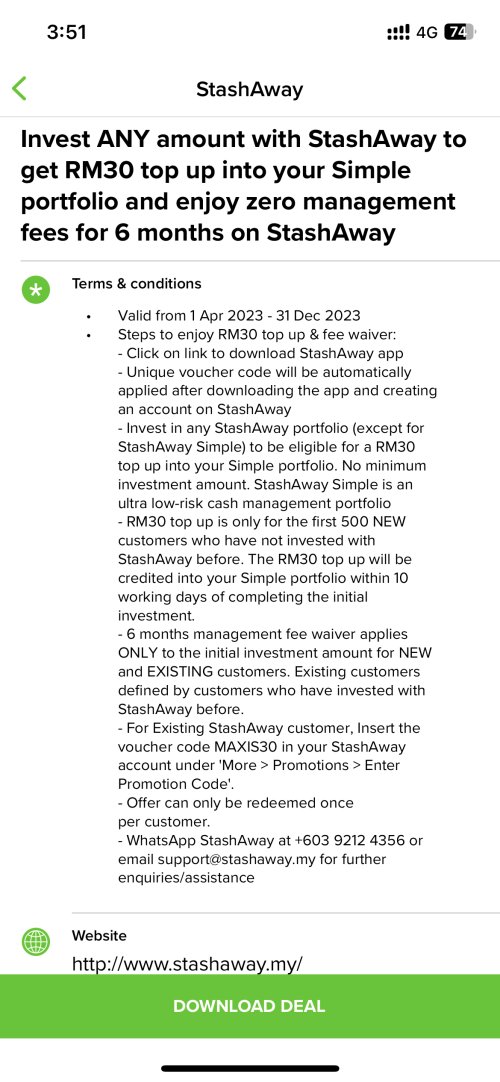

Thanks. Guess I got confused because Stashaway is incorporated in Malaysia (at least for my Stashaway Malaysia account). That's why I keep thinking (unlike overseas brokerage where clearly $ is sitting outside Malaysia) that maybe $/dividend is already considered received in Malaysia even though its automatically invested into the portfolio.

With regards to 'dividend no tax', I think it depends. For Malaysia stocks, dividend is not taxable but for foreign (stocks and maybe ETFs), it may be taxable (looking at the BE form which ask for all those breakdown of foreign source income including dividends) ie maybe declare it and afterwards try to claim tax credit (up till yr 2026).

I think LHDN differentiates between those unit trusts (provided by banks and FSM) vs foreign ETFs and funds (provided by robo-advisors such as Stashaway). What are your thoughts?

Apr 25 2023, 04:25 AM

Apr 25 2023, 04:25 AM

Quote

Quote

0.0337sec

0.0337sec

0.77

0.77

6 queries

6 queries

GZIP Disabled

GZIP Disabled