QUOTE(batman1172 @ Apr 20 2023, 02:04 PM)

Not yet retire lar. But I can if I want. 5 more years to go. I'm funding my additional REITS purchase from rental. Good thing is REITS pays me interest like bonds which can use to buy more of it.

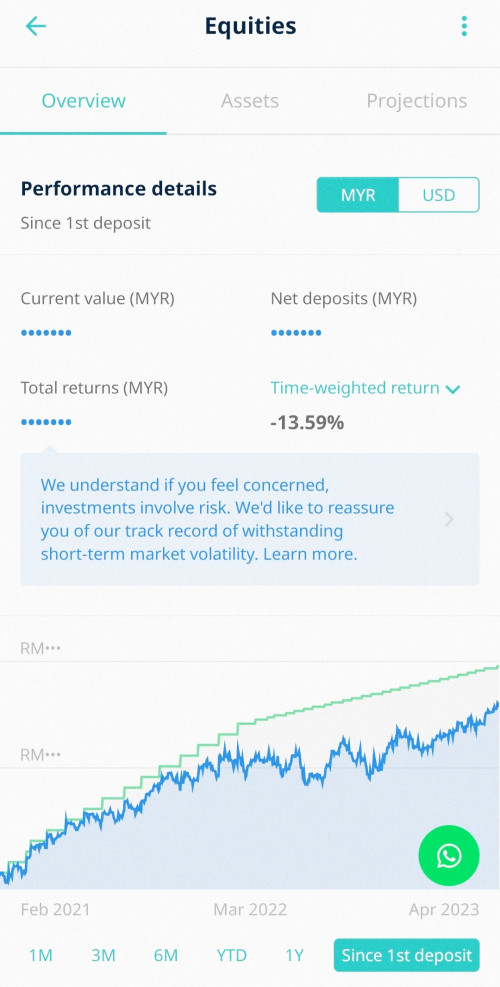

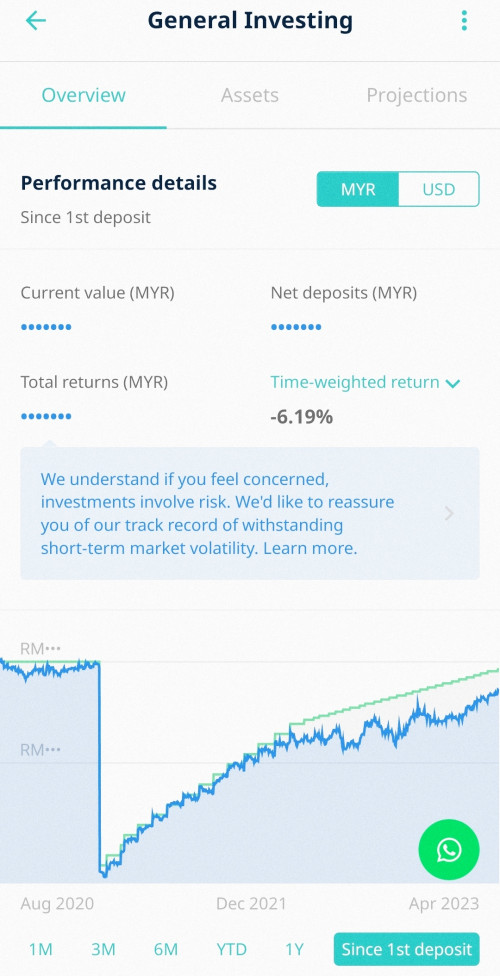

Problem is hard to tell making profit or loss. Every month open the app tell me different number. Lucky didn't use salary to buy.

But I don't think it will be a 10x to 20x growth on capital like I see on my properties.

Anyway I read more on SA last night. its a Robo advisor! Big black box to me. better not touch. At least unitrust and ETF got human make decision.

Robo advisor is just another fancy term only as Asset allocation is decided by human aka via Investment committee and headed by the CIOProblem is hard to tell making profit or loss. Every month open the app tell me different number. Lucky didn't use salary to buy.

But I don't think it will be a 10x to 20x growth on capital like I see on my properties.

Anyway I read more on SA last night. its a Robo advisor! Big black box to me. better not touch. At least unitrust and ETF got human make decision.

Robo advisor only make sure on the execution side particularly on making sure not deviating the allocation set by investment committee 🤦♀️

SA losses and debacles wasn’t even caused by the Robo advisor but the human itself through Investment committee with recent KWEB debacle 🤦♀️

Apr 20 2023, 03:05 PM

Apr 20 2023, 03:05 PM

Quote

Quote

0.0308sec

0.0308sec

0.70

0.70

6 queries

6 queries

GZIP Disabled

GZIP Disabled