Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

ZeneticX

|

Feb 20 2020, 05:35 PM Feb 20 2020, 05:35 PM

|

|

i've just started stashaway as well and been reading replies in the last few pages here

can anybody explain to me what is DCA and how it relates when it comes to investing in stashaway?

btw I've created 2 portfolios as a start. 1 for general investment with 20% risk index, the other is goal based index (buy a car in 7 years) with 16% index. Already transferred 1k as a start for both, with recurring deposits of 100 for both every month. Is all good?

|

|

|

|

|

|

ZeneticX

|

Feb 20 2020, 07:02 PM Feb 20 2020, 07:02 PM

|

|

QUOTE(GrumpyNooby @ Feb 20 2020, 05:39 PM) DCA is not critical. DCA = dollar cost averaging I don't do DCA. thanks for input but still would like to know about it and how it applies to stashaway |

|

|

|

|

|

ZeneticX

|

Apr 22 2020, 12:42 PM Apr 22 2020, 12:42 PM

|

|

you guys started topping up edi? or still keeping bullets?

|

|

|

|

|

|

ZeneticX

|

May 14 2020, 12:03 PM May 14 2020, 12:03 PM

|

|

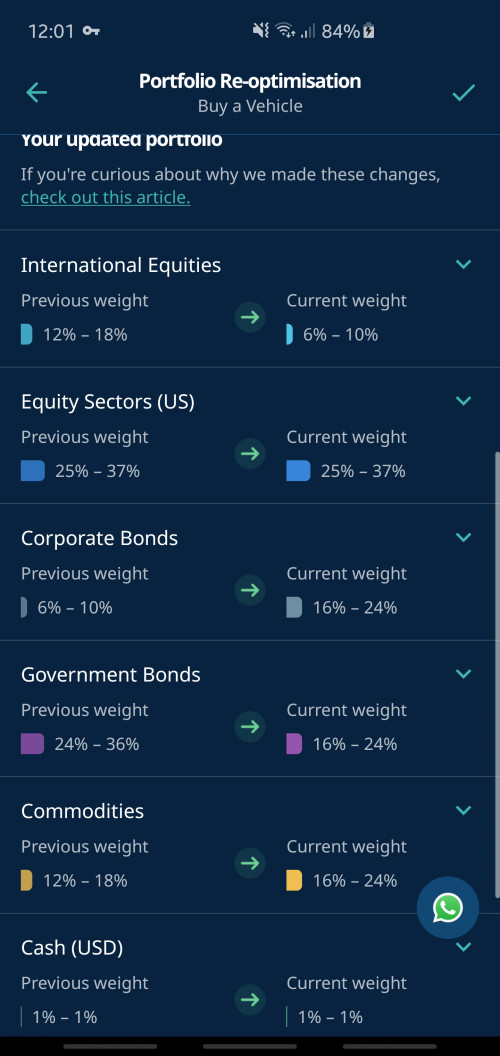

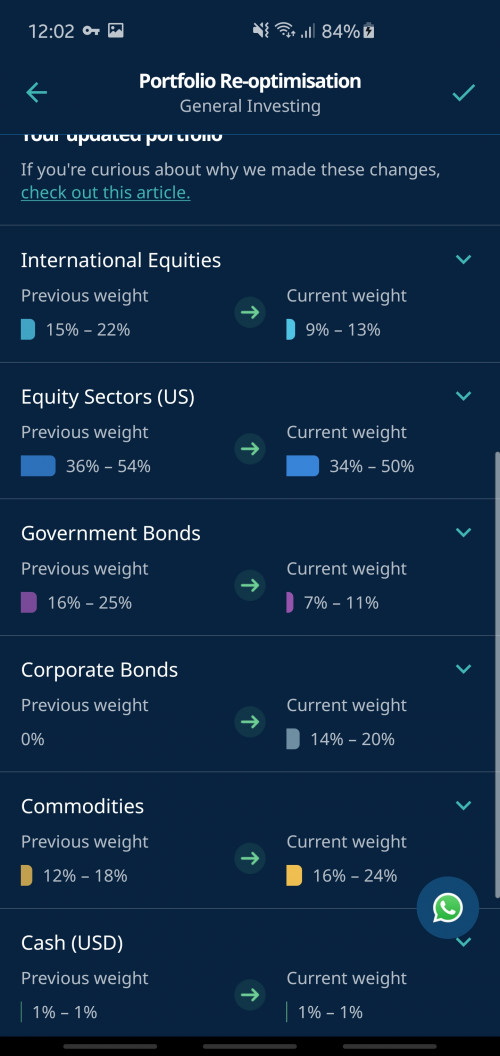

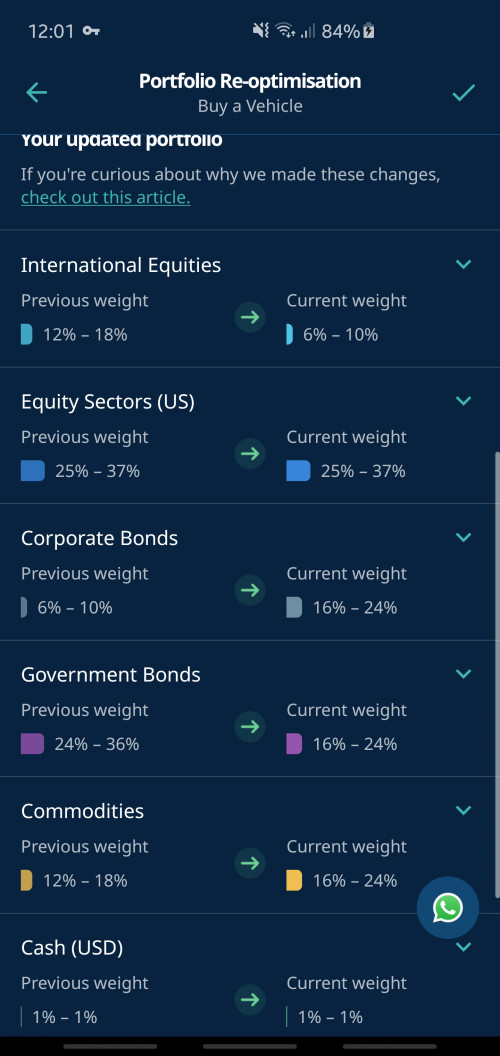

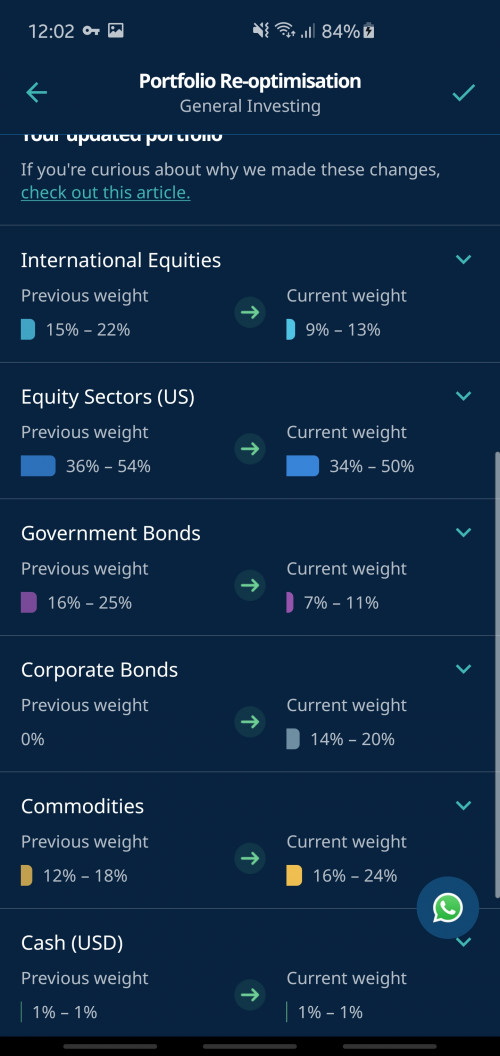

For 16%  For 22%  |

|

|

|

|

|

ZeneticX

|

May 14 2020, 01:48 PM May 14 2020, 01:48 PM

|

|

i remember someone here mentioning to use interbank giro to set up monthly deposit instead of using direct debit or jompay

why is that?

|

|

|

|

|

|

ZeneticX

|

May 22 2020, 12:30 PM May 22 2020, 12:30 PM

|

|

happy with 18 and 22% here

|

|

|

|

|

|

ZeneticX

|

Jun 5 2020, 05:10 PM Jun 5 2020, 05:10 PM

|

|

QUOTE(chiangth @ Jun 5 2020, 02:42 PM) Hi, newb here. May I ask everyone here have different portfolios on different risk index? Or do you only invest in just 1 risk index portfolio? And which risk index do you recommend putting in? I putting in 20% because it has lower corp bond compared to the other lower risk index. Again, I am really a novice in investing so seeking a little advise from various sifus here. i use it according to SA intention - for me i have 1 goal based portfolio and 1 general investment portfolio i set my goal based portfolio at 18% and general investment at 22% i know there's some here who have several portfolio with varying risk % in order to spread out the returns and losses totally up to you how you want to use it This post has been edited by ZeneticX: Jun 5 2020, 05:11 PM |

|

|

|

|

|

ZeneticX

|

Jun 8 2020, 11:38 PM Jun 8 2020, 11:38 PM

|

|

I remember reading a few posted here that setting up recurring jompay is better than monthly direct debit. may I know why? jompay processing is faster?

|

|

|

|

|

|

ZeneticX

|

Jun 10 2020, 07:41 PM Jun 10 2020, 07:41 PM

|

|

QUOTE(hihihehe @ Jun 10 2020, 07:30 PM) i haven't read through the stashaway method but planning to deposit rm500 one off with 18% risk for now then monitor along the way or i should setup direct debit in lower amount instead of manual way? rm500 just to test market i started off with 2k on Feb, split evenly between 2 portfolio, 18% and 22% and monthly deposit of RM100 to each pretty happy with the performance so far other than the drop when market crash during March now I have total of 5k+ after several deposits and I increased my monthly deposit to RM200 each. Planning to top up more as time goes the lower risk portfolios still focus mainly on US equities while the higher risks have more China tech investments iinm... so thats something to take note |

|

|

|

|

|

ZeneticX

|

Jun 10 2020, 07:57 PM Jun 10 2020, 07:57 PM

|

|

QUOTE(hihihehe @ Jun 10 2020, 07:49 PM) not bad so you were doing auto-debit? yes auto debit |

|

|

|

|

|

ZeneticX

|

Jun 12 2020, 05:52 PM Jun 12 2020, 05:52 PM

|

|

if you've survived the march drop, this drop is nothing lol

for new comers, just keep calm and DCA

This post has been edited by ZeneticX: Jun 12 2020, 05:53 PM

|

|

|

|

|

|

ZeneticX

|

Jun 29 2020, 10:38 AM Jun 29 2020, 10:38 AM

|

|

From some post that I've read here so far... some people are better off spending their effort on self investing in ETFs and stocks rather than using robo advisor...

I mean whats the point of constant withdrawing and entering on this platform? Its being heavily misused this way.

Still trying my best not to judge, maybe its a strategy that works for some

|

|

|

|

|

|

ZeneticX

|

Jul 27 2020, 08:41 PM Jul 27 2020, 08:41 PM

|

|

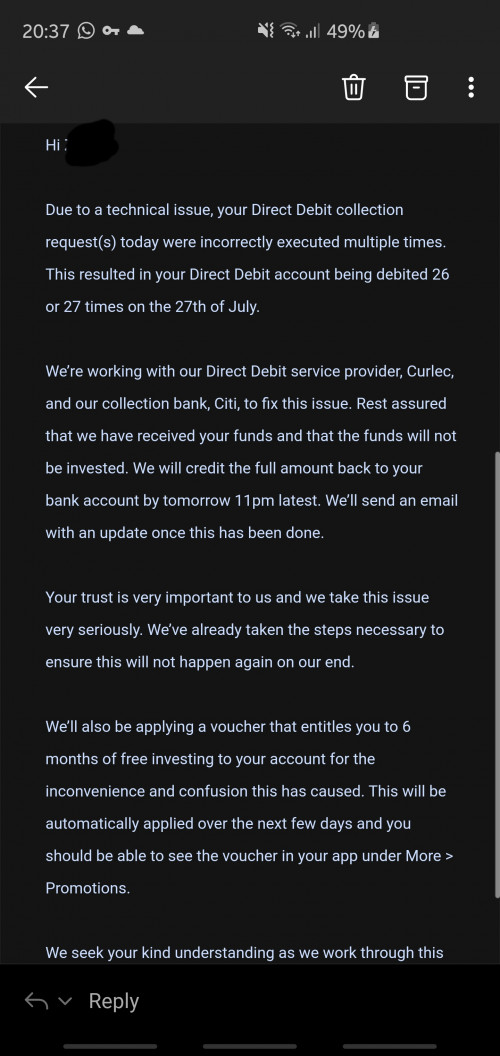

QUOTE(heartache @ Jul 27 2020, 08:36 PM) Guys can we collectively lodge report with bnm or SC any channels? My account now left rm56 due to this. I was debited 18times. Wtf Why? Its not a scam or anything. They already sent out email that they're recrifying the issue QUOTE(majorarmstrong @ Jul 27 2020, 08:37 PM) After this crazy bug or system glitch will you continue to invest with SAMY or will you switch out to other robo advisor? Will still stick with them. Im not severely affected by the issue but will see how they handle it This post has been edited by ZeneticX: Jul 27 2020, 08:42 PM |

|

|

|

|

|

ZeneticX

|

Jul 27 2020, 08:46 PM Jul 27 2020, 08:46 PM

|

|

they screwed up, but its not necessarily their fault. it could be Curlec's as well as mentioned in their email

as long the extra money is given back I don't see anything major here. provided they keep to their promise that this will not happen again

This post has been edited by ZeneticX: Jul 27 2020, 08:47 PM

|

|

|

|

|

|

ZeneticX

|

Jul 28 2020, 10:09 AM Jul 28 2020, 10:09 AM

|

|

Actually.... if you dont use direct debit then this issue doesnt affect you at all right?

Just stop using direct debit lahh

|

|

|

|

|

|

ZeneticX

|

Jul 28 2020, 05:41 PM Jul 28 2020, 05:41 PM

|

|

QUOTE(Ancient-XinG- @ Jul 28 2020, 04:51 PM) Lol humans. Imaging if SA like the octopus bank saga. Lock your account. You can't do shit. Call no pickup. No proper answer. All you will report police ad I think and create concert to tarnish SA. This make me think somehow SA did a good job as compared to old bank. the over reaction here is really over the top been reading the replies since yesterday after the incident  |

|

|

|

|

|

ZeneticX

|

Jul 28 2020, 10:06 PM Jul 28 2020, 10:06 PM

|

|

received my full refund... as promised before 11pm

fully satisfied with the way they handle the issue

hope they keep their promise that this will never happen again but all in all this is really bad PR for them. now people will bring this issue up whenever SA is being compared or discussed

|

|

|

|

|

|

ZeneticX

|

Jul 29 2020, 12:04 AM Jul 29 2020, 12:04 AM

|

|

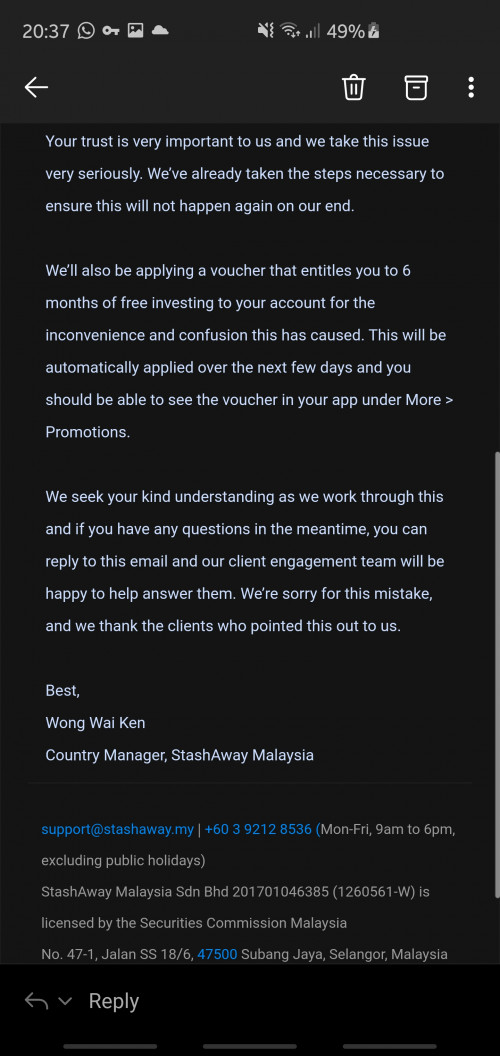

updated email from them QUOTE Hi XXXXX,

Yesterday, we discovered clients whose direct debit accounts had been incorrectly debited multiple times. You should have received an email in the evening about this.

At 3pm today, we’ve sent out all of the funds back to our clients’ accounts and as of now, you should have received the full amount that was deducted from your account, unless you’ve requested for us to send the money to a different bank account.

We’ll publish a detailed tech post-mortem in the next few days and in that analysis, we’ll explain the root cause of this and how we intend to prevent this situation from happening again. As of now, what we can share is that the error seems to be related to an anomaly that appeared while transacting with Curlec, our direct debit service provider.

You should have also seen by now that we have applied that 6 months of free investing promotion to your account. You can see the voucher in your app under More > Promotions.

We’ve taken the necessary steps to prevent this from happening again but we’ll be temporarily suspending direct debits for now. You’ll not be able to make direct debit transfers and we’ll let you know once we resume this transfer method. In the meantime, you can do an Interbank-GIRO or a JomPay transfer to your StashAway account instead.

We’ve also published an Ask Me Anything Live webinar for clients affected by this issue and you can sign up here. Michele, our CEO and Co-Founder, and Wai Ken, StashAway Malaysia’s Country Manager, will be there to answer all of your questions live.

We are truly sorry for the trouble caused by this disruption. We don't take your trust for granted and we will do our best to prevent this from ever happening again. If you have any questions or any concerns about your refund, simply reply to this email and our client engagement team will be happy to help.

Best,

Wong Wai Ken

Country Manager, StashAway Malaysia still not satisfied? |

|

|

|

|

|

ZeneticX

|

Jul 29 2020, 11:04 AM Jul 29 2020, 11:04 AM

|

|

for those who are still not satisfied... just join the QnA session with the co founder and country manager... then bombard them all you want lor

no point venting your frustrations here

|

|

|

|

|

Feb 20 2020, 05:35 PM

Feb 20 2020, 05:35 PM

Quote

Quote

0.0465sec

0.0465sec

1.60

1.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled