Anyone know what happen to the money if the owner die? How can the owner make sure his beneficial get the money?

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jun 28 2020, 09:19 PM Jun 28 2020, 09:19 PM

Return to original view | Post

#1

|

Junior Member

292 posts Joined: Aug 2013 |

Anyone know what happen to the money if the owner die? How can the owner make sure his beneficial get the money?

|

|

|

|

|

|

Jul 7 2020, 11:20 AM Jul 7 2020, 11:20 AM

Return to original view | Post

#2

|

Junior Member

292 posts Joined: Aug 2013 |

Is StashAway Simple capital guaranteed?

|

|

|

Jul 12 2020, 06:11 PM Jul 12 2020, 06:11 PM

Return to original view | Post

#3

|

Junior Member

292 posts Joined: Aug 2013 |

Want to ask some opinion here. I plan to move some fund into SA, is it better to DCA over a few weeks/months or just put them in lump sum?

|

|

|

Jul 12 2020, 08:18 PM Jul 12 2020, 08:18 PM

Return to original view | Post

#4

|

Junior Member

292 posts Joined: Aug 2013 |

QUOTE(kelvinfixx @ Jul 12 2020, 07:43 PM) You can lump sum, DCA monthly weekly daily hourly secondly is up to you, but don't treat it like trading platform, it is not, and if you have anxiety when loosing money, don't invest assume it is FD, it is not. Thanks for the advice. I never intended to treat it like a trading platform, my plan is to DCA investing for 12-20 years and after that take ~0.5% every month out as part of my retirement fund while keeping the rest inside to roll.It is stock investment, and you may loose money. |

|

|

Jul 12 2020, 08:30 PM Jul 12 2020, 08:30 PM

Return to original view | Post

#5

|

Junior Member

292 posts Joined: Aug 2013 |

|

|

|

Jul 12 2020, 09:51 PM Jul 12 2020, 09:51 PM

Return to original view | Post

#6

|

Junior Member

292 posts Joined: Aug 2013 |

QUOTE(yklooi @ Jul 12 2020, 08:32 PM) oh, it is 0.5% of the expected returns per month, NOT 0.5% pm of the expected available sum in the a/c Sorry I'm confused. Isn't 0.5% return equals to 0.5% of available sum of fund?thus just have to include the sump of the monthly DCA amount x 20 yrs, to see if this 0.5% returns pm at the end of 20 yrs is enough for you... |

|

|

|

|

|

Jul 18 2020, 08:58 PM Jul 18 2020, 08:58 PM

Return to original view | Post

#7

|

Junior Member

292 posts Joined: Aug 2013 |

|

|

|

Jul 19 2020, 11:25 AM Jul 19 2020, 11:25 AM

Return to original view | Post

#8

|

Junior Member

292 posts Joined: Aug 2013 |

QUOTE(gundamsp01 @ Jul 18 2020, 11:46 PM) quite a long video, but when he talks negatively on other users reviewing on their experience, i seriously got turned off. Do you know any roboadvisor platform that went bankrupt before? What happened to the funds?But some points sort of valid. robo-advisor is not a sure win platform. robo-advisor doesn't provide human touch to customer, but then, the agents i deal with don't either. So not much concern for me. stashaway is relatively new without mass numbers of clients now, and may follow the same footstep of those apps that bankrupt before that (i am kind of worry on this to be frank, i can't see 10-20 years later, but then this may also happen to wealth management firm as well) other points like robo-advisor doesn't bring as much return as what they claimed, and human advisors can do better, etc etc etc. |

|

|

Jul 19 2020, 05:18 PM Jul 19 2020, 05:18 PM

Return to original view | Post

#9

|

Junior Member

292 posts Joined: Aug 2013 |

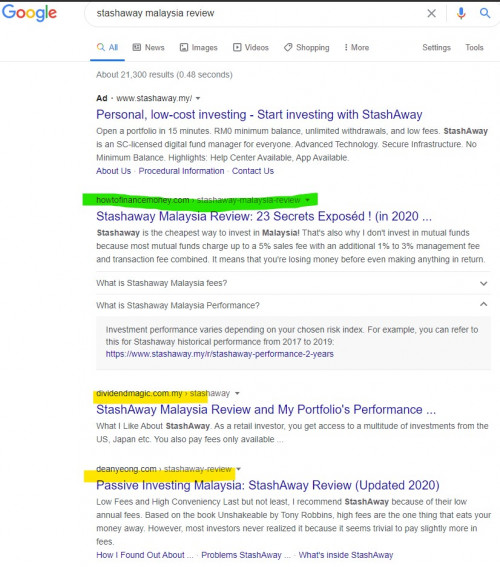

QUOTE(Auron @ Jul 19 2020, 01:52 PM) I think everyone reading this long post need to differentiate between opinions and facts. Zero affiliate links doesn't mean unbiased. SA is his competitor hence it makes sense for him to not use/promote it and hence no affiliate links.For example, the many Stashaway reviews by bloggers and youtubers out there are nothing but some rehashed opinions which ultimately persuade you to sign up to SA using their affiliate links (the 'I help u, u help me' approach). Do a Google search you'll notice this EVERYWHERE. The only unbiased SA reviews so far (zero affiliate links whatsover) is the one highlighted in GREEN (see below) when you Google - 'stashaway malaysia review' ... that will also save your time browsing 380+ pages on this thread...becoz it'd have answered most of the questions you asked here anyway ....apart from containing in-depth info most bloggers /youtubers failed to reveal in the first place hope that helps.  |

|

|

Jul 25 2020, 03:17 PM Jul 25 2020, 03:17 PM

Return to original view | Post

#10

|

Junior Member

292 posts Joined: Aug 2013 |

QUOTE(footie_ft @ Jul 25 2020, 12:59 PM) I think for SA you will need to put it for long term to see profit. I started when it was introduced, highest return I got before MCO was 10% from my capital, then it goes south during march. Continued DCA and now back at 10% of capital as well. I'm curious. Do you DCA consistently all these while or just lumpsum when it started? |

|

|

Jul 25 2020, 11:41 PM Jul 25 2020, 11:41 PM

Return to original view | Post

#11

|

Junior Member

292 posts Joined: Aug 2013 |

|

|

|

Jul 27 2020, 12:26 PM Jul 27 2020, 12:26 PM

Return to original view | Post

#12

|

Junior Member

292 posts Joined: Aug 2013 |

QUOTE(Ivan113 @ Jul 27 2020, 11:45 AM) I still don't understand how Time weighted vs Money weighted, anyone know how to explain in layman's term? haha Time Weighted Returns https://www.stashaway.my/r/how-stashaway-calculates-returns - Percentage of your portfolio's return regardless of your invested amount and time, since your 1st deposit. Example 1: You invest in Share A at price of RM1, 1 year later it becomes RM1.20, your TWR is 20%. Money Weighted Returns - Percentage of your return based on your invested money. Example 1b: You invest RM100 in Share A at a price of RM1, 1 year later it becomes RM1.20, your MWR is 20%. Example 2b: You invest RM50 in Share A at a price of RM1, half year later it drops to RM0.80 and you invest another RM50. Another half year later, it becomes RM1.20. Your MWR would be 30%. (RM30 profit from RM100 total invest) The TWR in all 3 examples are 20%. But the MWR in example 1b and 2b are different due to the timing of your invest. In short, MWR is your actual returns in monetary terms. TWR is usually used to judge the performance of the portfolio/fund. |

|

|

Jul 30 2020, 08:33 PM Jul 30 2020, 08:33 PM

Return to original view | Post

#13

|

Junior Member

292 posts Joined: Aug 2013 |

QUOTE(yeeck @ Jul 30 2020, 05:40 PM) Wow, what age is this still using timestamp identifier up to seconds only instead of something truly unique? Also if it's synchronous call, once the request is received at Curlec's side the request should be immediately acknowledged before processing, so that from SA's side the request is already considered transferred to Curlec's responsibility. Terrible integration design. Ya... and they should have a unique transaction id sent from SA to Curlec so no matter how many retry attempts the id remains the same hence prevent the duplication no matter what happens between SA and Curlec. |

|

|

|

|

|

Jul 30 2020, 09:15 PM Jul 30 2020, 09:15 PM

Return to original view | Post

#14

|

Junior Member

292 posts Joined: Aug 2013 |

QUOTE(lee82gx @ Jul 30 2020, 09:11 PM) Latest corrective action got deduplication, I suppose they are doing it now lo.... Even if their corrective action include this, it's still quite surprising a Fintech do not have this in the first place...Is this a systemic breakdown? I hope not.....BTW did you guys see that they only have 1000+ clients. I would have thought it should be 10x that by now. Imagine a significant no. of customers doing transactions, they need to scale very quickly. I suppose the 1000+ is the number of affected clients, who had auto debit scheduled on that day. So including those scheduled on other days of month and those who don't do auto debit, I'm guessing their clients should be at least 30x more. |

|

|

Jul 31 2020, 09:36 AM Jul 31 2020, 09:36 AM

Return to original view | Post

#15

|

Junior Member

292 posts Joined: Aug 2013 |

|

|

|

Jul 31 2020, 10:53 AM Jul 31 2020, 10:53 AM

Return to original view | Post

#16

|

Junior Member

292 posts Joined: Aug 2013 |

Even with DCA we'll not constantly buying gold at high price. The fresh fund will go into rebalancing aka buying the under-performed assets in the portfolio. In my 36% portfolio case, the fresh fund will go into global reits.

|

|

|

Jul 31 2020, 12:48 PM Jul 31 2020, 12:48 PM

Return to original view | Post

#17

|

Junior Member

292 posts Joined: Aug 2013 |

QUOTE(chichabom @ Jul 31 2020, 12:16 PM) yeah but am just factoring in the risk and possibility their algo may hiccup only haha. But so far everything seems to be in place. Ya this is SA concept of investing. By maintaining same level of risk in a portfolio and let it grow passively due to the 'increasing of money into market'. And by doing constant DCA, due to rebalancing, our fund will always buy least performed assets in a portfolio, optimizing our MWR in the long run.good to know that at least they are buying more of the underperforming assets to smoothen out things |

|

|

Aug 4 2020, 12:47 PM Aug 4 2020, 12:47 PM

Return to original view | Post

#18

|

Junior Member

292 posts Joined: Aug 2013 |

This is what I do. I setup an excel, calculate the expected TWR of my portfolio each month. At the beginning of each month when I want to deposit, I'll compare the actual TWR with the expected TWR, if the TWR is lower by a certain percentage, I'll do additional deposit.

|

|

|

Aug 4 2020, 04:29 PM Aug 4 2020, 04:29 PM

Return to original view | Post

#19

|

Junior Member

292 posts Joined: Aug 2013 |

QUOTE(lee82gx @ Aug 4 2020, 03:40 PM) Actually this is just my way, might not be the best way and I'm sure others have their own way of doing it.This is what I do: Every month I set aside certain fresh fund for SA. (In this example I'll use RM1000) I will split the RM1000 into RM750 and RM250. The RM750 will go into my 36% portfolio regardless of the TWR. If the TWR is less than expected TWR, the RM250 will be deposited into the portfolio, making the deposit full RM1000. If the TWR is more than expected TWR, the RM250 will be parked into some highly liquid and stable fund (like Simple or SSPN). If the TWR is a lot lower than expected TWR (10% lower than expected), deposit additional fund from the stable fund. The expected TWR is taken from SA (in 36% portfolio their expected annual ROI is 12.8%). This is roughly equals to 1% ROI per month. |

|

|

Aug 5 2020, 09:02 AM Aug 5 2020, 09:02 AM

Return to original view | Post

#20

|

Junior Member

292 posts Joined: Aug 2013 |

In my opinion, if you're going to take out the whole fund soon, it's better to turn down the risk as low as possible.

But if you're treating it as a passive income source, aka only going to take out the cash portion (<1%) of the portfolio periodically after the fund 'matured', then it's ok to stick to highest risk. Historically higher risk generates higher return averagely in the long run. But due to the higher volatility, some people might not take it and 'cut loss' when it swings down, making them always buy high sell low. That's why SA recommend people to take enough risk according to own 'risk appetite'. |

| Change to: |  0.1114sec 0.1114sec

0.40 0.40

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 11:24 AM |