Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

SUSxander83

|

Apr 28 2021, 02:47 PM Apr 28 2021, 02:47 PM

|

|

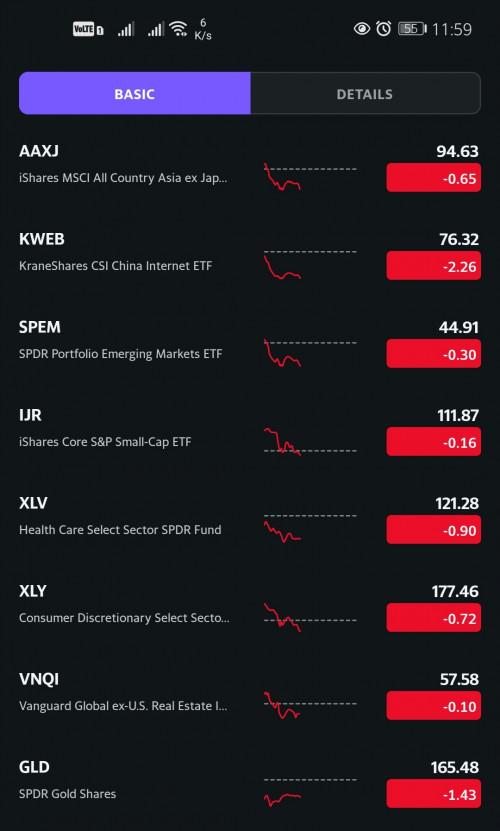

QUOTE(christ14 @ Apr 28 2021, 12:51 PM) thanks for the numbers  If you want the best comparison take SnP500 index compared with Wahed HLAL ETF and SA 30% with IVV check their performance by % it and it should matches up albeit with slightly lower % percentage by 0.8 ratio of in returns For 36% with KWEB heavy weightage it is difficult to track because KWEB has both HKSE and Nasdaq holdings but because of the same weightage as GLD it should mirror indexes in HKSE Tech and Gold prices for a better benchmarking |

|

|

|

|

|

sohailili

|

Apr 28 2021, 03:13 PM Apr 28 2021, 03:13 PM

|

|

» Click to show Spoiler - click again to hide... « QUOTE(honsiong @ Apr 28 2021, 09:43 AM)   Lol return Bro, mind if I ask how long have you invested to get this return? My SRI36% slightly over 2yrs MWR 47.59% My weekly DCA chart  This post has been edited by sohailili: Apr 28 2021, 03:14 PM

This post has been edited by sohailili: Apr 28 2021, 03:14 PM |

|

|

|

|

|

tiramisu83

|

Apr 28 2021, 10:20 PM Apr 28 2021, 10:20 PM

|

|

QUOTE(zstan @ Apr 28 2021, 10:00 AM) how much are you depositing each time? not many, each time RM100 weekly..sometime 2 weeks.. |

|

|

|

|

|

genesic

|

Apr 29 2021, 12:10 AM Apr 29 2021, 12:10 AM

|

|

I also do DCA. Every 2 weekly top up rm100. All auto transfer frm bank into SA.

|

|

|

|

|

|

zstan

|

Apr 29 2021, 12:01 PM Apr 29 2021, 12:01 PM

|

|

QUOTE(tiramisu83 @ Apr 28 2021, 10:20 PM) not many, each time RM100 weekly..sometime 2 weeks.. suggest you do monthly deposit instead so that can get higher impact when market moves. RM100 a week is too little to see the impact of DCA. |

|

|

|

|

|

tiramisu83

|

Apr 29 2021, 02:59 PM Apr 29 2021, 02:59 PM

|

|

QUOTE(zstan @ Apr 29 2021, 12:01 PM) suggest you do monthly deposit instead so that can get higher impact when market moves. RM100 a week is too little to see the impact of DCA. oh you mean if i deposit RM100 every month, the result will be better than weekly? |

|

|

|

|

|

tiramisu83

|

Apr 29 2021, 02:59 PM Apr 29 2021, 02:59 PM

|

|

QUOTE(genesic @ Apr 29 2021, 12:10 AM) I also do DCA. Every 2 weekly top up rm100. All auto transfer frm bank into SA. may i know how is your return? |

|

|

|

|

|

zstan

|

Apr 29 2021, 03:01 PM Apr 29 2021, 03:01 PM

|

|

QUOTE(tiramisu83 @ Apr 29 2021, 02:59 PM) oh you mean if i deposit RM100 every month, the result will be better than weekly? i mean if you are depositing RM100 every week , if you deposit RM400 monthly may be better |

|

|

|

|

|

weisinx7

|

Apr 29 2021, 04:51 PM Apr 29 2021, 04:51 PM

|

Getting Started

|

couldn't confirm the 36% portfolio, is there any requirement?

|

|

|

|

|

|

X_hunter

|

Apr 29 2021, 05:24 PM Apr 29 2021, 05:24 PM

|

Getting Started

|

I saw someone mentioned DCA weekly is better coz the fluctuation not that big. Like top up on every Thursday and by Monday they will buy in already.

Actually is the difference significant between DCA weekly or monthly?

|

|

|

|

|

|

thecurious

|

Apr 29 2021, 05:58 PM Apr 29 2021, 05:58 PM

|

|

QUOTE(X_hunter @ Apr 29 2021, 05:24 PM) I saw someone mentioned DCA weekly is better coz the fluctuation not that big. Like top up on every Thursday and by Monday they will buy in already. Actually is the difference significant between DCA weekly or monthly? This has been discussed so many times already, just search using keyword DCA. plenty of discussion to read. |

|

|

|

|

|

honsiong

|

Apr 29 2021, 06:43 PM Apr 29 2021, 06:43 PM

|

|

QUOTE(weisinx7 @ Apr 29 2021, 04:51 PM) couldn't confirm the 36% portfolio, is there any requirement? Send email/whatsapp to support channel and ask to unlock. |

|

|

|

|

|

weisinx7

|

Apr 29 2021, 06:50 PM Apr 29 2021, 06:50 PM

|

Getting Started

|

QUOTE(honsiong @ Apr 29 2021, 06:43 PM) Send email/whatsapp to support channel and ask to unlock. thanks |

|

|

|

|

|

genesic

|

Apr 30 2021, 12:06 AM Apr 30 2021, 12:06 AM

|

|

QUOTE(tiramisu83 @ Apr 29 2021, 03:59 PM) may i know how is your return? I only started this DCA since April 2020; risk 22% This post has been edited by genesic: Apr 30 2021, 12:33 AM Attached thumbnail(s)

|

|

|

|

|

|

lee82gx

|

Apr 30 2021, 12:22 AM Apr 30 2021, 12:22 AM

|

|

the returns of the portfolio can be easily backtested in many websites such as this https://www.portfoliovisualizer.com/backtes...analysisResultsjust enter the allocation accordingly (it is provided by stashaway) and the amount you start, and monthly contributions. Choose the most frequent rebalance, or you can even choose to input some algorithms inside. You can test backwards 10 years or something to your heart's content. Then you have your answer what's the return look like. But take it from me that the important question is whether you decide to really invest or not, and whether you think actually this can work out. It was great to start during last year, really really great as Covid crash was so fast over and it gave everyone a great opportunity. |

|

|

|

|

|

genesic

|

Apr 30 2021, 12:32 AM Apr 30 2021, 12:32 AM

|

|

I agreed with Lee, if you see my return, mostly comes from last year . Otherwise it was stagnant or minimum profit before this

|

|

|

|

|

|

ken_zie

|

Apr 30 2021, 12:22 PM Apr 30 2021, 12:22 PM

|

|

Currently, I'm DCA-ing into 2 portfolios - 20% and 36%. If I want to open another new portfolio, which new risk index should I consider so that there will be no too much overlapping?

|

|

|

|

|

|

MUM

|

Apr 30 2021, 12:35 PM Apr 30 2021, 12:35 PM

|

|

QUOTE(ken_zie @ Apr 30 2021, 12:22 PM) Currently, I'm DCA-ing into 2 portfolios - 20% and 36%. If I want to open another new portfolio, which new risk index should I consider so that there will be no too much overlapping? Just a quick guess... Maybe wrong... You currently have extreme risk and a middle one,... What abt another of extreme "lowest" risk? |

|

|

|

|

|

DragonReine

|

Apr 30 2021, 01:34 PM Apr 30 2021, 01:34 PM

|

|

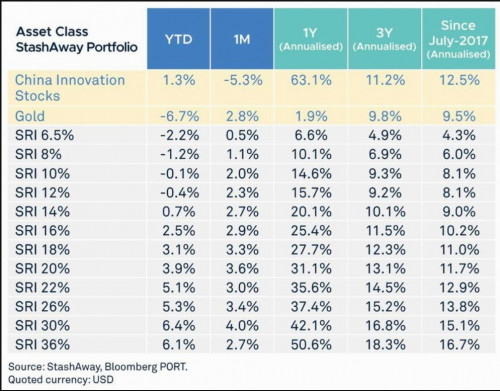

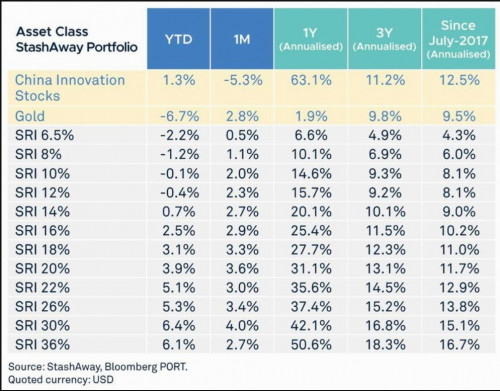

Returns for each SRI vs Asset Class, as of 28 April 2021 |

|

|

|

|

Apr 28 2021, 02:47 PM

Apr 28 2021, 02:47 PM

Quote

Quote

0.1484sec

0.1484sec

0.54

0.54

6 queries

6 queries

GZIP Disabled

GZIP Disabled