QUOTE

AznRicy

Jul 9 2017, 11:20 AM

I hav a girlfriend who does not trust gov.

I tried to advise her to make EPF self contribution since it is a worthy investment.

But her reasoning is she does not trust the Malay government n later old, hard to take out d money.

Is this the truth? And growing distrust by many Malaysian Chinese? Too much politic is very bad for our judgement ?

This has been taken from an old thread Jul 9 2017, 11:20 AM

I hav a girlfriend who does not trust gov.

I tried to advise her to make EPF self contribution since it is a worthy investment.

But her reasoning is she does not trust the Malay government n later old, hard to take out d money.

Is this the truth? And growing distrust by many Malaysian Chinese? Too much politic is very bad for our judgement ?

which has been closed.

You gave your girlfriend excellent advice.

I have been telling my nephew, as well as those in the

Fixed Deposits forum, to do the same, but they can't

see very far and don't seem to realize how important our

EPF will be in old age.

Like your girlfriend, my nephew and those in the FD forum

listened to silly rumors from their friends :

" Government is cheating us. EPF very hard to take out. "

" My friend's father said very hard to take out EPF. They give

him all kinds of reasons. "

" Goverment is going bankrupt. They are using our EPF. "

" EPF is a ticking time bomb. "

Did your read the papers ? 70 PERCENT of those reaching 55

have less then $ 50,000 in their EPF.

EPF sounds alarm as most contributors have less than RM50,000 at 54.

http://www.themalaymailonline.com/malaysia...n-rm50000-at-54

There are over 4 million people hitting 55 and over in the

country now.

This means that at least 3 million have less than $ 50,000 in

their EPF.

Like this woman in my ex-office. She said her brother, single,

an engineer, is now in his 60s with just $ 15,000 in his EPF.

If you are married, your children may not bother about you in

old age. Like my aunt in her 80s - I had to use my EPF to take

her see the doctor at the hospital just two months ago.

EPF is FORCED savings.

EPF is the only GUARANTEED support you will have in old age.

Nobody else is going to take care of you.

If you put everything in an FD, chances are you'll spent most

of it away by 55.

I told my nephew, either :

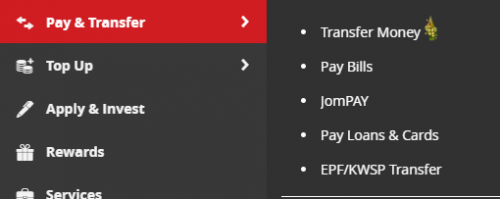

Direct his employer to deduct extra, say $ 500, to his EPF

every month, and/or :

Pump in yourself, as and when you can, up to the $ 60,000

limit EPF allows per year.

EPF interest has remained relatively stable between 4.25 and

8.50 percent for the last 50 years.

Take an average of 6.375 percent.

If you have the money, put in $ 10,000 in the EPF for a start,

rather than any of the fixed deposits.

Then fill in the required EPF form to direct your employer to

deduct an extra $ 500 from your salary every month.

If you are 30 now, you'll have over $ 400,000 by 55.

http://www.calculator.net/interest-calcula...it=0&x=106&y=13

Compounding interest separates the rich from the broke. The great Albert Einstein once said “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn't … pays it.”

http://www.thepennieswesaved.com/compound-...-eighth-wonder/

https://www.youtube.com/watch?v=LK7iadUBPWw/

https://m.youtube.com/watch?v=LK7iadUBPWw

This post has been edited by Tham: Feb 15 2018, 03:50 AM

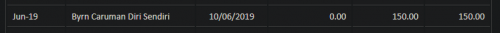

Feb 14 2018, 07:51 PM, updated 5y ago

Feb 14 2018, 07:51 PM, updated 5y ago

Quote

Quote

0.2012sec

0.2012sec

0.65

0.65

6 queries

6 queries

GZIP Disabled

GZIP Disabled