This post has been edited by WhitE LighteR: Jul 4 2020, 10:20 PM

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jul 4 2020, 10:20 PM Jul 4 2020, 10:20 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

This post has been edited by WhitE LighteR: Jul 4 2020, 10:20 PM |

|

|

|

|

|

Jul 6 2020, 10:32 AM Jul 6 2020, 10:32 AM

|

Senior Member

2,429 posts Joined: Jul 2007 |

I'm looking at adding a global equity fund and am looking at United Global Quality Equity Fund and Affin Hwang World Series - Global Equity Fund - MYR. Sharpe ratio quite similar between 2 funds but if i look at month by month or year by year performance returns, Affin seems to be slightly better.

Anyone has experience with these 2 funds? I saw most comments are on United Quality fund but i wonder why most choose United over Affin. This post has been edited by jutamind: Jul 6 2020, 10:32 AM |

|

|

Jul 6 2020, 10:42 AM Jul 6 2020, 10:42 AM

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(jutamind @ Jul 6 2020, 10:32 AM) I'm looking at adding a global equity fund and am looking at United Global Quality Equity Fund and Affin Hwang World Series - Global Equity Fund - MYR. Sharpe ratio quite similar between 2 funds but if i look at month by month or year by year performance returns, Affin seems to be slightly better. the RM1,000 minimum RSP by Affin Hwang puts it out of my reach Anyone has experience with these 2 funds? I saw most comments are on United Quality fund but i wonder why most choose United over Affin. United Global's minimum RSP of RM100 makes it more affordable for me. |

|

|

Jul 6 2020, 12:11 PM Jul 6 2020, 12:11 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

China rallying hard.

|

|

|

Jul 6 2020, 01:48 PM Jul 6 2020, 01:48 PM

|

Senior Member

1,259 posts Joined: Jan 2018 |

|

|

|

Jul 6 2020, 02:56 PM Jul 6 2020, 02:56 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

Topped up in April... pulling some out today.

Making very short term trades to take advantage of the volality in the markets. Buy the dips! |

|

|

|

|

|

Jul 6 2020, 04:02 PM Jul 6 2020, 04:02 PM

Show posts by this member only | IPv6 | Post

#21867

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 12:56 PM |

|

|

Jul 6 2020, 04:08 PM Jul 6 2020, 04:08 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

So much optimism.

|

|

|

Jul 6 2020, 04:30 PM Jul 6 2020, 04:30 PM

Show posts by this member only | IPv6 | Post

#21869

|

Junior Member

659 posts Joined: May 2013 |

|

|

|

Jul 6 2020, 08:59 PM Jul 6 2020, 08:59 PM

|

All Stars

14,928 posts Joined: Mar 2015 |

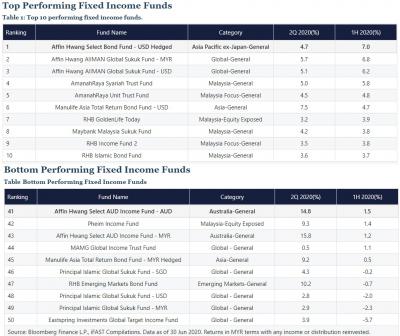

FSM revealed the top and bottom performing fixed income funds for the first half of 2020 on the platform

https://www.fundsupermart.com.my/fsmone/art...back-in-1H-2020 could it be bcos of wholesale fund status? This post has been edited by MUM: Jul 6 2020, 09:06 PM Attached thumbnail(s)

|

|

|

Jul 6 2020, 09:02 PM Jul 6 2020, 09:02 PM

Show posts by this member only | IPv6 | Post

#21871

|

Senior Member

1,269 posts Joined: May 2005 |

|

|

|

Jul 6 2020, 09:37 PM Jul 6 2020, 09:37 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

Gold is trying another run up the hill

|

|

|

Jul 6 2020, 11:15 PM Jul 6 2020, 11:15 PM

Show posts by this member only | IPv6 | Post

#21873

|

Junior Member

867 posts Joined: Feb 2017 |

|

|

|

|

|

|

Jul 6 2020, 11:46 PM Jul 6 2020, 11:46 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

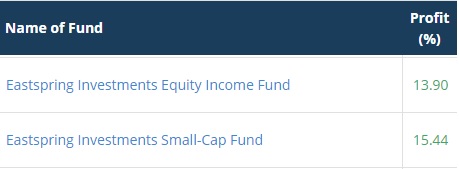

QUOTE(Red_rustyjelly @ Jul 6 2020, 11:15 PM) hi guys. how do you let go of funds at the right time? How to analyze when is right time? at times, i think some people will just follow this rules....what ever that will make one sleep better or let him/her forgo the urge to frequently checking on the indexes.I have 2 funds that already hit 15%, i am thinking to take profit. But the daily increase getting addictive. ....... thus if you have any of this in your heart now,....time to do a reflection. brokenbomb, wongmunkeong, and 1 other liked this post

|

|

|

Jul 7 2020, 12:13 AM Jul 7 2020, 12:13 AM

|

All Stars

10,340 posts Joined: Jan 2003 |

QUOTE(Red_rustyjelly @ Jul 6 2020, 11:15 PM) hi guys. how do you let go of funds at the right time? How to analyze when is right time? Different ppl judge differently. I will keep a fund until the momentum slow down. I will then either partial profit or exit.I have 2 funds that already hit 15%, i am thinking to take profit. But the daily increase getting addictive.  |

|

|

Jul 7 2020, 01:11 AM Jul 7 2020, 01:11 AM

|

Senior Member

2,379 posts Joined: Sep 2017 |

A note of caution on those investing in China.

https://www.bloomberg.com/news/articles/202...nd=premium-asia China Rally Is Fueled by Funds Short Covering, Nomura Says Macro hedge funds and quantitative investors are fueling the Chinese stock market rally as they unwind bearish wagers, according to Nomura. Such investors have been exiting short positions in Chinese equities as market sentiment rises to the highest since March, said Masanari Takada, cross-asset strategist at Nomura, citing positioning data for Asian equities. “It appears that the market gains have been powered by global macro hedge funds and systematic funds,” he said in a note on Monday. Such investors, which include Commodity Trading Advisors and risk-parity funds, are now “covering short positions in a conspicuous way.” QUOTE(xuzen @ Jul 4 2020, 02:08 PM) Defensive is the new offensive. With Trump the madman at helm.... it is good to be defensive. Don't know when he will naik angin again one. Wow, really defensive.Bond 70% + US 15% + China 10%+ Reits 5% with a view to sell off more Reits in future. I am positive on China , neutral on US and bearish on REITs. Bond is to provide me with a huge security cushion. Kiasi nowadays. Just hope Trump loses reelection. M'sia equities = nil at the moment. QUOTE(WhitE LighteR @ Jul 4 2020, 07:06 PM) Thanks for sharingQUOTE(xuzen @ Jul 4 2020, 09:48 PM) Thanks for sharing |

|

|

Jul 7 2020, 11:38 AM Jul 7 2020, 11:38 AM

|

Junior Member

995 posts Joined: Dec 2016 |

going to submit document to purchase the ILP life insurance from FSM. the price looks good and can get back 30% of commission cost.

anyone also buying insurance from FSM? |

|

|

Jul 7 2020, 11:43 AM Jul 7 2020, 11:43 AM

Show posts by this member only | IPv6 | Post

#21878

|

Senior Member

5,621 posts Joined: Apr 2011 From: Kuala Lumpur |

Cashed out some of my principal greater China and Asia pacific just to lock some profit

|

|

|

Jul 7 2020, 11:47 AM Jul 7 2020, 11:47 AM

|

Senior Member

5,621 posts Joined: Apr 2011 From: Kuala Lumpur |

Double post

This post has been edited by victorian: Jul 7 2020, 11:47 AM |

|

|

Jul 7 2020, 11:52 AM Jul 7 2020, 11:52 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(victorian @ Jul 7 2020, 11:43 AM) cash out just the profits only?btw, how many % is the profits earned? Are you expecting some markets corrections to be coming soon? if YES, then what is your expected % of markets "pull back"? This post has been edited by yklooi: Jul 7 2020, 11:56 AM |

| Change to: |  0.0265sec 0.0265sec

0.31 0.31

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 01:40 PM |