What u guys plan to do today for this oil price crash?

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Apr 21 2020, 09:14 AM Apr 21 2020, 09:14 AM

Return to original view | IPv6 | Post

#1

|

Junior Member

995 posts Joined: Dec 2016 |

What u guys plan to do today for this oil price crash?

|

|

|

|

|

|

Jun 15 2020, 05:10 PM Jun 15 2020, 05:10 PM

Return to original view | IPv6 | Post

#2

|

Junior Member

995 posts Joined: Dec 2016 |

I had some PRS directly bought from Affin Hwang capital few years ago. Is it ok if I can move them to FSM? Any sifu can advise?

|

|

|

Jun 15 2020, 05:54 PM Jun 15 2020, 05:54 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

995 posts Joined: Dec 2016 |

QUOTE(yklooi @ Jun 15 2020, 05:48 PM) Few years ago, I did that... No plan to change Prs provider or fund. I bought Affin Hwang growth prs fund, planning to move it to FSM just for easier managing and focus in just FSM platform.Went to fsm office to sign paperwork for the transfer of prs fund bought from affin hwang office to cimb prs funds offered by fsm. It took few months to finalise the transfer so that the fsm a/c can see the units. Btw, you want to transfer affin hwang prs fund to which prs providers? |

|

|

Jul 7 2020, 11:38 AM Jul 7 2020, 11:38 AM

Return to original view | Post

#4

|

Junior Member

995 posts Joined: Dec 2016 |

going to submit document to purchase the ILP life insurance from FSM. the price looks good and can get back 30% of commission cost.

anyone also buying insurance from FSM? |

|

|

Jul 21 2020, 09:15 PM Jul 21 2020, 09:15 PM

Return to original view | IPv6 | Post

#5

|

Junior Member

995 posts Joined: Dec 2016 |

QUOTE(guy3288 @ Jul 21 2020, 08:27 PM) May I know which fund you invest for gold?Based on the performance I saw, in this 10 years RHB gold and general fund perform better than Precious Metal Securities. Their allocation are almost similar. But I saw more people chose precious metal securities. Any reason? |

|

|

Jul 23 2020, 05:00 PM Jul 23 2020, 05:00 PM

Return to original view | Post

#6

|

Junior Member

995 posts Joined: Dec 2016 |

QUOTE(CQT @ Jul 23 2020, 04:40 PM) Hi, I am new here. I got extra cash to put into UT but I dunno what UT suit. I am looking at Bond/Fixed Income fund recently but still can decide which fund to choose for like Affin Bond,Nomura I-Income Fund, KAF Bond Fund and Opus Income Plus Fund. This fund I looking quite ok the performance. The extra money is due to my FD already expired and now the rate is low so I am looking another alternative of putting the money. Thanks I based on their sector allocation, top holding and past years performance to decide which to choosefor FI, I had been topping up for Eastspring DANA AL-ISLAH since June as I saw they hold healthcare and gloves. return not bad |

|

|

|

|

|

Jul 25 2020, 03:17 PM Jul 25 2020, 03:17 PM

Return to original view | Post

#7

|

Junior Member

995 posts Joined: Dec 2016 |

QUOTE(xuzen @ Jul 25 2020, 10:40 AM) Better Sharpe Ratio. Alamak, I did totally terbalik with you yesterday for July ======================== My Jul 2020 rebalancing: 1) SWITCH 100% Manu-Reits to CIMB-China 2) SWITCH 25% of Manu-US to CIMB-China. I am increasing my China exposure. NB: For those who are interested and may not notice; the Std-Dev of US fund has overtaken China fund. That is why I am making my move as part of risk mitigation process. It used to be the other way around. Xuzen p/s 1) Jul 2020 which will end in a week's time is looking to be another fantastic month. Don't stop baby, don't stop! Jun 2020 was an OK-OK month; my port made a <1% M-o-M gain. Sold Eastspring dinasti @+12% Top up: Manulife REIT Manulife US Affin Hwang opportunity |

|

|

Aug 6 2020, 10:37 PM Aug 6 2020, 10:37 PM

Return to original view | IPv6 | Post

#8

|

Junior Member

995 posts Joined: Dec 2016 |

QUOTE(no6 @ Aug 6 2020, 10:21 PM) 0% service charge sounds good, do most of you buy through eunittrust platform for most if not all of your funds ? I buy from both, prefer the FSM platformEUnittrust- only buy during Promotion period on equity fund and park MMF FSM- buy bond fund. If both eUT and FSM no promotion I buy from FSM for DCA |

|

|

Aug 11 2020, 10:46 AM Aug 11 2020, 10:46 AM

Return to original view | IPv6 | Post

#9

|

Junior Member

995 posts Joined: Dec 2016 |

QUOTE(no6 @ Aug 11 2020, 09:12 AM) My eastspring dinasti took quite a dip down -3% immediately after the purchased was done last week, any idea what’s happening? Just my opinion, US, China, tencent, technology ,some keywords for you to googleWould you continue to dca or just leave it to run by itself Does cooling off means can get back the initial invested amount ? Should better know about the holding and allocation of the fund before you purchased |

|

|

Aug 11 2020, 11:05 AM Aug 11 2020, 11:05 AM

Return to original view | IPv6 | Post

#10

|

Junior Member

995 posts Joined: Dec 2016 |

QUOTE(no6 @ Aug 11 2020, 10:54 AM) yupe maybe US vs China, tencent wechat tiktok mr donaldT .... tried out with small allocation, immediate result was hmph .... If you aim for long term investment , then just continue DCA.is there any cut off point for you or continue dca/hold on if medium term I top up last Friday and yesterday on China and Asia Pacific fund when saw Tencent alibaba share price drop, have no worries as plan to lock the money here for some years |

|

|

Aug 11 2020, 03:25 PM Aug 11 2020, 03:25 PM

Return to original view | Post

#11

|

Junior Member

995 posts Joined: Dec 2016 |

|

|

|

Aug 18 2020, 04:21 PM Aug 18 2020, 04:21 PM

Return to original view | Post

#12

|

Junior Member

995 posts Joined: Dec 2016 |

I am looking to increase US equity fund in my portfolio for 3-5 years term investment. any recommendation or suggestion?

personally I think Franklin US opportunity perform better, but coming together with higher volatility? Franklin US opportunity: 40% in IT, 15% in healthcare Manulife Investment US Equity Fund: 20% in IT, 18% communication, 18% financial thanks. |

|

|

Aug 18 2020, 10:30 PM Aug 18 2020, 10:30 PM

Return to original view | Post

#13

|

Junior Member

995 posts Joined: Dec 2016 |

QUOTE(encikbuta @ Aug 18 2020, 06:21 PM) oh cool, i also having the same thought (increasing weightage in USA) and also came down to these two funds. Oh ya thanks for highlighting I just noticed that Franklin US initial investment amount is 10k and min DCA is 1k...need to take this as consideration based on the 5 year historical chart, can see manulife has been leading all the while, just recently only franklin overtake manulife (and even the S&P500 index!). i guess that's credited to the outperformance of the tech sector during this rebound. anyway, despite the performance, i'm leaning towards picking manulife coz the minimum DCA amount is feasible for me. franklin need RM1k for DCA amount P/S: currently my USA exposure is from my United Global Quality Equity Fund but that fund not 100% USA, just 60% nia. i chose this fund coz i sked to invest in a fund that invests in 1 country. but having second thoughts coz actually even though the S&P500 stocks are based in USA, the companies are very 'international'. think Facebook. |

|

|

|

|

|

Aug 19 2020, 05:43 PM Aug 19 2020, 05:43 PM

Return to original view | Post

#14

|

Junior Member

995 posts Joined: Dec 2016 |

QUOTE(pisces88 @ Aug 19 2020, 01:09 PM) applicable for any unit trust fund... means top up RHB cash management fund 2 also will qualify?3. Eligible participants who have successfully purchased ANY Unit Trust Funds of ANY amount between 17 August 2020 to 28 August 2020 will be automatically entitled to participate in this lucky draw. |

|

|

Aug 19 2020, 05:58 PM Aug 19 2020, 05:58 PM

Return to original view | IPv6 | Post

#15

|

Junior Member

995 posts Joined: Dec 2016 |

|

|

|

Aug 27 2020, 04:38 PM Aug 27 2020, 04:38 PM

Return to original view | Post

#16

|

Junior Member

995 posts Joined: Dec 2016 |

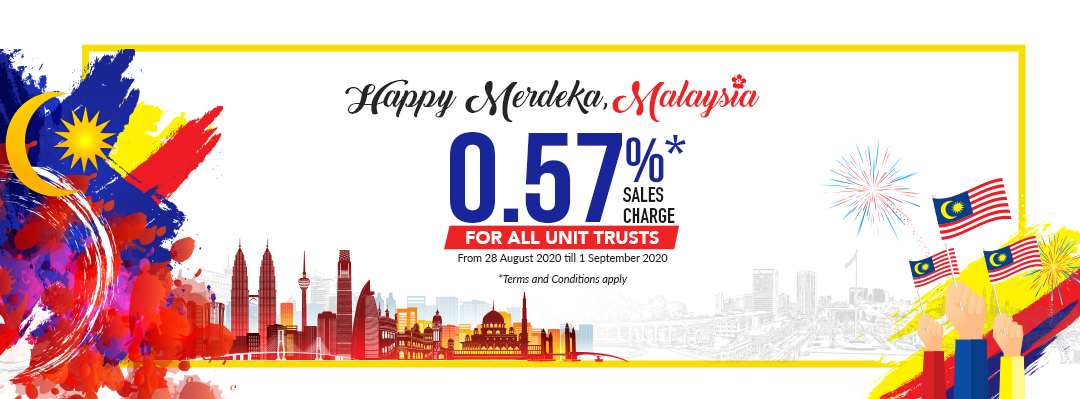

QUOTE(citymetro @ Aug 27 2020, 04:01 PM)  Happy Merdeka Day, Malaysia! Enjoy 0.57% sales charge on ALL Unit Trust Funds! Terms & Conditions: This promotion is valid from 28 August 2020 till 1 September 2020. All cash payments (cheque, internet payments, RHB cash management fund 2 or cash account) must reach us by 3pm on 4 September 2020. Regular Savings Plan (RSP) sales charge will be adjusted (where applicable) to reflect promotional sales charge during the promotion period. This promotion does not apply to transactions involving Intra Switch Buy (same fund house). Account holders under the FSMOne Rewards Program will be given either the promotional sales charge or the FSMOne Rewards Program discount, whichever is lower. This promotional sales charge is applicable to ALL Unit Trusts listed on FSMOne Platform. For further enquiries, please call us at (03) 2149 0567 (KL) or drop us an email at investhelp.my@fundsupermart.com. ------------------------- It's Here!! their competitor is offering 0% s/c promotion until 1-sep |

|

|

Aug 28 2020, 08:12 PM Aug 28 2020, 08:12 PM

Return to original view | IPv6 | Post

#17

|

Junior Member

995 posts Joined: Dec 2016 |

QUOTE(coolguy99 @ Aug 28 2020, 08:50 AM) Any recommendation for US fund? I am thinking of re-entering TA GT but the NAV is like in month high now. Plan to DCA TA Global Tech today but missed out the 3pm cutoff time..In June I also think that US tech stock are high enough the bubble is gonna burst but as you see now what happen. Just go for it , still 2 more months before us election |

|

|

Aug 30 2020, 12:32 PM Aug 30 2020, 12:32 PM

Return to original view | IPv6 | Post

#18

|

Junior Member

995 posts Joined: Dec 2016 |

|

|

|

Aug 31 2020, 08:05 PM Aug 31 2020, 08:05 PM

Return to original view | IPv6 | Post

#19

|

Junior Member

995 posts Joined: Dec 2016 |

QUOTE(YoungMan @ Aug 31 2020, 01:01 PM) Still can't decide to enter gold or not. Currently holding Affin Hwang Select Asia (Ex Japan) and Principal Greater China,. The rest 50% in FI. I entered RHB gold fund on 31/7 and up to date is -5.35%.Completely leave US since Feb this year, otherwise if topup during April will gain steady profit already. Entered Am metal securities in early July, and now is 1.30% Before that I never go into gold or metal fund... but is ok lah as need to see long term return ironman16 liked this post

|

|

|

Sep 3 2020, 05:02 PM Sep 3 2020, 05:02 PM

Return to original view | Post

#20

|

Junior Member

995 posts Joined: Dec 2016 |

QUOTE(GrumpyNooby @ Sep 3 2020, 04:56 PM) Principal Asia Pacific Dynamic Income Fund benchmark is 8% pa thanks for sharing.. now only i know there are two Dynamic fund one is Growth one is Income Principal Asia Pacific Dynamic Growth Fund benchmark is 9% pa As mentioned several posts earlier, fund manager strategy and stance has changed for Principal Asia Pacific Dynamic Income Fund even though its mandate and benchmark retains. If it is no longer fits your portfolio, as recommended just switch to its younger sibling fund. thumbsup: the name so similar i thought only Dynamic Income fund available... p/s: FSM recommended fund is Principal Asia Pacific Dynamic Income Fund |

| Change to: |  0.0673sec 0.0673sec

0.66 0.66

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 12:21 AM |