QUOTE(ChessRook @ Aug 28 2018, 05:33 PM)

Aiyoh. Very sorry to hear that. I will try to record these promo so next time people can take advantage of this

lucky 1 vtop up 1000.00 only.... yesterdayFundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Aug 28 2018, 05:47 PM Aug 28 2018, 05:47 PM

|

Senior Member

5,750 posts Joined: Jan 2012 |

|

|

|

|

|

|

Aug 28 2018, 06:48 PM Aug 28 2018, 06:48 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

Wrong timing for the Merdeka promo.

World stocks hit 6-months high! |

|

|

Aug 28 2018, 07:14 PM Aug 28 2018, 07:14 PM

|

Senior Member

5,750 posts Joined: Jan 2012 |

|

|

|

Aug 28 2018, 07:19 PM Aug 28 2018, 07:19 PM

|

Junior Member

84 posts Joined: Jun 2017 |

|

|

|

Aug 28 2018, 07:31 PM Aug 28 2018, 07:31 PM

|

Junior Member

84 posts Joined: Jun 2017 |

QUOTE(ChessRook @ Aug 28 2018, 04:32 PM) You might consider the am Asia reits or manulife reits, or even India. Hello....I am not so sure it matters if you buy US now if you hold it very long. Say you buy 6% more expensive, over 10 years that would not make it not more than 0.7%ish(?) after taking effect of compounding. Over 20 years, it would not be significant anyway. In long term, I am interested to have these in my allocation, and here are my concern if to buy now... 1. Manulife India - reach all time high recently.. will wait for few more months and see how, maybe wait it drop until NAV 0.95? 2. TA Global Tech - price quite high now.... maybe will wait until NAV drop to 0.63? 3. Manulife US - same... all time high now.... How do you think? TQ. |

|

|

Aug 28 2018, 07:32 PM Aug 28 2018, 07:32 PM

|

Junior Member

84 posts Joined: Jun 2017 |

QUOTE(Ancient-XinG- @ Aug 28 2018, 01:38 PM) if based on region. Wow... thank you for sharing.. will start look on these funds...Global Titan bimb global dividend united quality equity TA tech (main on tech) Asia ex Jp Ponzi 2 Malaysia EI eq income kgf Malaysia Small cap Ei small cap cimb small cap EMB EI GEM (at your risk. since emb now too shaky) India manuIndia US Franklin us myr great cn dinasti cimb great cn bond rhb bond am dynamic Libra asnita REIT Am Reits class b based on your liking..... can see see look look. no need all region also can. Thanks.... |

|

|

|

|

|

Aug 28 2018, 07:38 PM Aug 28 2018, 07:38 PM

|

All Stars

14,856 posts Joined: Mar 2015 |

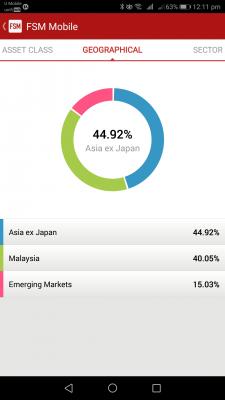

QUOTE(yageosamsung @ Aug 28 2018, 07:19 PM) Hello, sure ...thank you... thanks for the reply.....I have invested in both FSM and Eunittrust, the allocation is the combination of both of them. Around 70% at China and Asia Pacific..... now can see more clearer.... EI Dinasti & Cimb Greater China is 27% of the port AHSAO, EIGEM & Cimb Asia Pac Dynamic is 49% of the port in which 50% of it is in Greater China region which mean > 52% of your port is in China/HK/Taiwan alone.... Developed Countries...you have only 2% in the port......abt US = 0.8%, Europe = 0.6%, Jpn = 0.7% so what you think?....wanna increase more into GTF, add some to india and tech at maybe 7% each to dilute/balance out the heavy China/HK/Taiwan weightage? afraid that the NAV is at all time high? just think of it this way.... if India & Tech is at 7% each,...if both NAV were to drop 10% NAV, your port will be affected by 1.4% if Greater China region is at >50% of the port, if it were to drop 5% of NAV, your port will be affected by 2.5% which one got higher chances of dropping, 5% NAV or 10% Nav? This post has been edited by MUM: Aug 28 2018, 09:02 PM |

|

|

Aug 29 2018, 08:57 AM Aug 29 2018, 08:57 AM

|

Junior Member

84 posts Joined: Jun 2017 |

QUOTE(MUM @ Aug 28 2018, 07:38 PM) thanks for the reply..... Thank you for your reply...now can see more clearer.... EI Dinasti & Cimb Greater China is 27% of the port AHSAO, EIGEM & Cimb Asia Pac Dynamic is 49% of the port in which 50% of it is in Greater China region which mean > 52% of your port is in China/HK/Taiwan alone.... Developed Countries...you have only 2% in the port......abt US = 0.8%, Europe = 0.6%, Jpn = 0.7% so what you think?....wanna increase more into GTF, add some to india and tech at maybe 7% each to dilute/balance out the heavy China/HK/Taiwan weightage? afraid that the NAV is at all time high? just think of it this way.... if India & Tech is at 7% each,...if both NAV were to drop 10% NAV, your port will be affected by 1.4% if Greater China region is at >50% of the port, if it were to drop 5% of NAV, your port will be affected by 2.5% which one got higher chances of dropping, 5% NAV or 10% Nav? I'm still new to UT, joined since Oct 2017. Have a lesson learn recently that I should diverse my allocation to different variances of geographical and specialist sectors.... I have 3 questions: 1. For other people, is now the best time to add % for Asia Pacific and China funds? Since most of them are in lower NAV now 2. Normally for this type of SC discount (let it be 0.57% or 0.8%), is it wise to top up in a lumpsum? or continue DCA? But I don't think it is good to wait only for the SC discount to top up... 0.57% - 1.5% = 0.93%... might get much for timing the market?? 3. Is it recommended if I just put min. investment qty (1000) on each US, tech, India at this moment? TQ |

|

|

Aug 29 2018, 09:03 AM Aug 29 2018, 09:03 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(yageosamsung @ Aug 29 2018, 08:57 AM) Thank you for your reply... 1) Yes...if you trusted FSM...look at the Star Rating...I'm still new to UT, joined since Oct 2017. Have a lesson learn recently that I should diverse my allocation to different variances of geographical and specialist sectors.... I have 3 questions: 1. For other people, is now the best time to add % for Asia Pacific and China funds? Since most of them are in lower NAV now 2. Normally for this type of SC discount (let it be 0.57% or 0.8%), is it wise to top up in a lumpsum? or continue DCA? But I don't think it is good to wait only for the SC discount to top up... 0.57% - 1.5% = 0.93%... might get much for timing the market?? 3. Is it recommended if I just put min. investment qty (1000) on each US, tech, India at this moment? TQ https://www.fundsupermart.com.my/main/resea...tarRatings.svdo 2) Best is continue DCA now for the current market sentiment is not very strong......normally if the market is strong more, Lumpsum Is better. 3) Yes, if you got money to spare and you wanted to diversify your port......just not sure how many % will it constitute in your port with 1000 money..... |

|

|

Aug 29 2018, 09:11 AM Aug 29 2018, 09:11 AM

|

All Stars

24,333 posts Joined: Feb 2011 |

QUOTE(yageosamsung @ Aug 29 2018, 08:57 AM) Thank you for your reply... 1. Yes good time. But for me,I won't add. Let thrump impose further tarriff and let China debts I'm still new to UT, joined since Oct 2017. Have a lesson learn recently that I should diverse my allocation to different variances of geographical and specialist sectors.... I have 3 questions: 1. For other people, is now the best time to add % for Asia Pacific and China funds? Since most of them are in lower NAV now 2. Normally for this type of SC discount (let it be 0.57% or 0.8%), is it wise to top up in a lumpsum? or continue DCA? But I don't think it is good to wait only for the SC discount to top up... 0.57% - 1.5% = 0.93%... might get much for timing the market?? 3. Is it recommended if I just put min. investment qty (1000) on each US, tech, India at this moment? TQ 2. Never wait for discount from FSM or eUT. Those discount are just bonus. 3. Up to you. For me, I will avoid US as is all time high. |

|

|

Aug 29 2018, 09:21 AM Aug 29 2018, 09:21 AM

|

Senior Member

4,999 posts Joined: Jan 2003 |

The only thing that looks cheap now is China , share price is at 2015 level.

but with trump, you never know what he is going to do next. |

|

|

Aug 29 2018, 09:29 AM Aug 29 2018, 09:29 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

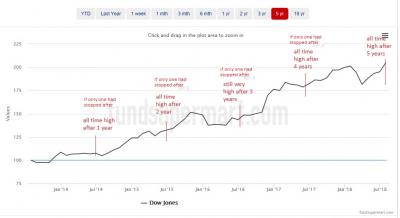

just for thought...

you are not sailang all into it... have some to catch the trend is the US PE extremely high? is the US market sentiment weak? if it fall, will other regions also fall? the cost of waiting https://www.fundsupermart.com.my/main/resea...ompounding--160 Attached thumbnail(s)

|

|

|

Aug 29 2018, 09:48 AM Aug 29 2018, 09:48 AM

|

Senior Member

1,258 posts Joined: Dec 2008 From: /k/ |

QUOTE(yklooi @ Aug 29 2018, 09:29 AM) just for thought... Always stay invested, and leave some space for extra bullet.you are not sailang all into it... have some to catch the trend is the US PE extremely high? is the US market sentiment weak? if it fall, will other regions also fall? the cost of waiting https://www.fundsupermart.com.my/main/resea...ompounding--160 Of course, unless you got algozen |

|

|

|

|

|

Aug 29 2018, 02:47 PM Aug 29 2018, 02:47 PM

|

Senior Member

5,750 posts Joined: Jan 2012 |

most of the fund fly high.

let's hope this is the end of correction year. god bless. |

|

|

Aug 30 2018, 11:35 AM Aug 30 2018, 11:35 AM

|

Junior Member

31 posts Joined: Aug 2012 |

|

|

|

Aug 30 2018, 11:41 AM Aug 30 2018, 11:41 AM

|

Senior Member

5,750 posts Joined: Jan 2012 |

|

|

|

Aug 30 2018, 12:26 PM Aug 30 2018, 12:26 PM

Show posts by this member only | IPv6 | Post

#14857

|

Junior Member

523 posts Joined: Aug 2007 |

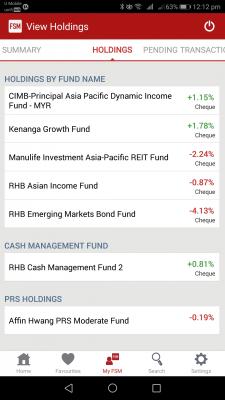

Hi bros, can comment on my portfolio? Currently i have some extra fund from matured fd and also now got merdeka promo. Any recommendations for me? To make my portfolio more balanced and diversified.

Ohh ya.. I have bought aggressive managed portfolio also....but now still about 2% negative... This post has been edited by jusTinMM: Aug 30 2018, 12:28 PM Attached thumbnail(s)

|

|

|

Aug 30 2018, 02:08 PM Aug 30 2018, 02:08 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

Aug 2018 has been a

|

|

|

Aug 30 2018, 02:35 PM Aug 30 2018, 02:35 PM

|

Junior Member

438 posts Joined: Apr 2007 From: Petaling Jaya |

how to cash out from UT? can sell anytime?

|

|

|

Aug 30 2018, 03:22 PM Aug 30 2018, 03:22 PM

|

Junior Member

375 posts Joined: Mar 2018 |

QUOTE(jusTinMM @ Aug 30 2018, 12:26 PM) Hi bros, can comment on my portfolio? Currently i have some extra fund from matured fd and also now got merdeka promo. Any recommendations for me? To make my portfolio more balanced and diversified. 1) Aggressive funds are great during good times but horrible during bad times. Thats why it is called aggressive. Ohh ya.. I have bought aggressive managed portfolio also....but now still about 2% negative... 2) From your port, it looks like you might want to diversify into US; you can pick TA Global Tech, or CIMB Global Titans or other US funds. You can try the morningstar x-ray portfolio to see how well correlated your UTs are. See 255 for more details. |

| Change to: |  0.0215sec 0.0215sec

0.59 0.59

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 12:05 PM |