Hello guys, how do you think about the FSM Fund Choice March 2018- Manulife Asia Pacific Growth Fund?

TQ.

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Mar 6 2018, 04:06 PM Mar 6 2018, 04:06 PM

Return to original view | Post

#1

|

Junior Member

84 posts Joined: Jun 2017 |

Hello guys, how do you think about the FSM Fund Choice March 2018- Manulife Asia Pacific Growth Fund?

TQ. |

|

|

|

|

|

Mar 6 2018, 05:30 PM Mar 6 2018, 05:30 PM

Return to original view | Post

#2

|

Junior Member

84 posts Joined: Jun 2017 |

Thank you guys....

yes... I am saying the Manulife Asia Pacific Income and Growth Fund... sorry for the missing word. From my allocation on Equity (Asia Ex japan), Affin Hwang Select Asia (Ex Japan) Opportunity Fund - 83% CIMB-Principal Asia Pacific Dynamic Income Fund - 17% Any advice? p/s: Equity (Asia Ex japan) is 32% out of my total UT investment. TQ. |

|

|

Mar 24 2018, 01:58 PM Mar 24 2018, 01:58 PM

Return to original view | Post

#3

|

Junior Member

84 posts Joined: Jun 2017 |

Have been started UT investment for 7 months but still see "red" today... maybe the time I started was the beginning of 'bad market time".

I am still new and not much experience on this... Base on your guys experience, in current situation what shall we do actually? - continue to perform DCA? - on hold top up or? Appreciate any advise, thanks... |

|

|

Mar 24 2018, 02:28 PM Mar 24 2018, 02:28 PM

Return to original view | Post

#4

|

Junior Member

84 posts Joined: Jun 2017 |

just curious... when I read back the those previous old pages in this thread....

I found out that your guys talked about "lock the profit" by transferring the "earning Equity fund" to bond fund... so when market drop, will switch back these bond funds again to equity fund? not quite understand.... i have some questions... - switch "earning EQ fund" to bond fund is just to hold more bond fund unit as the bullet in future? - Why bond fund? is it because of 0% SC (or say earn credit) or is because bond fund is more stable? - shall I hold these bond fund unit for long period, or sell them to lock profit? - or wait until market drop switch them to the EQ fund that I am interested? how if the bond fund is not performing or drop? how to earn in this way? - can I conclude that we should hold more bond fund in good market and hold more EQ fund when market drop? (i mean in allocation %) Appreciate for advise from experienced investors.... TQ. |

|

|

Mar 24 2018, 02:38 PM Mar 24 2018, 02:38 PM

Return to original view | Post

#5

|

Junior Member

84 posts Joined: Jun 2017 |

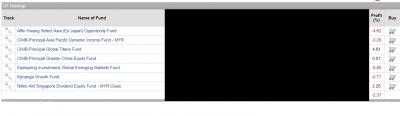

QUOTE(WhitE LighteR @ Mar 24 2018, 02:08 PM) It's just bad luck that u came in wrong timing. 2017 was a good year but 2018 correction wipe out at least the last 6-8 months of 2017 earning. At least this is the case for me. Thank you White Lighter....I adjusted my portfolio allocation a little bit in lieu of recent developments. I've adjusted REIT allocation from 20% to 15%. But still continues my monthly VCA... What is your UT breakdown allocation right now? Affin Hwang Selected Asia Opportunity Fund - 44% EastSpring Investment Dinasti Equity - 29% CIMB Dynamic Income Fund - 9% Kenaga Growth Fund - 6% EastSpring Investment GEM fund - 6% CIMB Principal Global Titan - 3% CIMB Principal Greater China -3% Target to increase the % in Malaysia local fund |

|

|

May 15 2018, 08:41 AM May 15 2018, 08:41 AM

Return to original view | Post

#6

|

Junior Member

84 posts Joined: Jun 2017 |

QUOTE(polarzbearz @ May 14 2018, 09:11 PM) But not sure if Malaysia's equity is really the way to go, since China/Greater China could use some boosting too.. my current portfolio are: FSM Malaysia only [attachmentid=9794717] FSM Malaysia + FSM Hong Kong [attachmentid=9794719] I am thinking about these 2 local fund.... I already have some allocation of KGF... shall I add more into it or go for Eastspring Investments Equity Income Fund ?? Thanks |

|

|

|

|

|

May 15 2018, 10:21 AM May 15 2018, 10:21 AM

Return to original view | Post

#7

|

Junior Member

84 posts Joined: Jun 2017 |

just top up KGF for monthly DCA.....

|

|

|

May 16 2018, 09:31 AM May 16 2018, 09:31 AM

Return to original view | Post

#8

|

Junior Member

84 posts Joined: Jun 2017 |

seems like all fund doing good yesterday!

My portfolio turns green already... |

|

|

May 16 2018, 11:54 AM May 16 2018, 11:54 AM

Return to original view | Post

#9

|

Junior Member

84 posts Joined: Jun 2017 |

|

|

|

May 23 2018, 02:24 PM May 23 2018, 02:24 PM

Return to original view | Post

#10

|

Junior Member

84 posts Joined: Jun 2017 |

|

|

|

May 25 2018, 05:03 PM May 25 2018, 05:03 PM

Return to original view | Post

#11

|

Junior Member

84 posts Joined: Jun 2017 |

|

|

|

May 30 2018, 04:14 PM May 30 2018, 04:14 PM

Return to original view | Post

#12

|

Junior Member

84 posts Joined: Jun 2017 |

|

|

|

May 31 2018, 02:56 PM May 31 2018, 02:56 PM

Return to original view | Post

#13

|

Junior Member

84 posts Joined: Jun 2017 |

|

|

|

|

|

|

Aug 8 2018, 01:22 PM Aug 8 2018, 01:22 PM

Return to original view | Post

#14

|

Junior Member

84 posts Joined: Jun 2017 |

hello guys...

I am not sure is it suitable to discuss PRS here, but would like to ask is this PRS - (CIMB-Principal PRS Plus Asia Pacific Ex Japan Equity - Class C) still good to go this year? TQ |

|

|

Aug 28 2018, 01:20 PM Aug 28 2018, 01:20 PM

Return to original view | Post

#15

|

Junior Member

84 posts Joined: Jun 2017 |

Hello Sifus,

now we have the 0.57% SC discount for 4 days.... Ref. to my funds holding below, my plan is to continue top up based on these geographical sector for September, - Malaysia : Kenaga Growth Fund - Asia Pacific: CIMB Dynamic Income Fund - Emerging Market: Eastspring GEM p/s: I do not have US and India allocation in my portfolio and I also would like to get them actually.... but at this moment I think it is too late to top up on US related funds now... the plan is to hold these funds for at least 2 more years. How do you guys think? TQ. Attached thumbnail(s)

|

|

|

Aug 28 2018, 07:19 PM Aug 28 2018, 07:19 PM

Return to original view | Post

#16

|

Junior Member

84 posts Joined: Jun 2017 |

|

|

|

Aug 28 2018, 07:31 PM Aug 28 2018, 07:31 PM

Return to original view | Post

#17

|

Junior Member

84 posts Joined: Jun 2017 |

QUOTE(ChessRook @ Aug 28 2018, 04:32 PM) You might consider the am Asia reits or manulife reits, or even India. Hello....I am not so sure it matters if you buy US now if you hold it very long. Say you buy 6% more expensive, over 10 years that would not make it not more than 0.7%ish(?) after taking effect of compounding. Over 20 years, it would not be significant anyway. In long term, I am interested to have these in my allocation, and here are my concern if to buy now... 1. Manulife India - reach all time high recently.. will wait for few more months and see how, maybe wait it drop until NAV 0.95? 2. TA Global Tech - price quite high now.... maybe will wait until NAV drop to 0.63? 3. Manulife US - same... all time high now.... How do you think? TQ. |

|

|

Aug 28 2018, 07:32 PM Aug 28 2018, 07:32 PM

Return to original view | Post

#18

|

Junior Member

84 posts Joined: Jun 2017 |

QUOTE(Ancient-XinG- @ Aug 28 2018, 01:38 PM) if based on region. Wow... thank you for sharing.. will start look on these funds...Global Titan bimb global dividend united quality equity TA tech (main on tech) Asia ex Jp Ponzi 2 Malaysia EI eq income kgf Malaysia Small cap Ei small cap cimb small cap EMB EI GEM (at your risk. since emb now too shaky) India manuIndia US Franklin us myr great cn dinasti cimb great cn bond rhb bond am dynamic Libra asnita REIT Am Reits class b based on your liking..... can see see look look. no need all region also can. Thanks.... |

|

|

Aug 29 2018, 08:57 AM Aug 29 2018, 08:57 AM

Return to original view | Post

#19

|

Junior Member

84 posts Joined: Jun 2017 |

QUOTE(MUM @ Aug 28 2018, 07:38 PM) thanks for the reply..... Thank you for your reply...now can see more clearer.... EI Dinasti & Cimb Greater China is 27% of the port AHSAO, EIGEM & Cimb Asia Pac Dynamic is 49% of the port in which 50% of it is in Greater China region which mean > 52% of your port is in China/HK/Taiwan alone.... Developed Countries...you have only 2% in the port......abt US = 0.8%, Europe = 0.6%, Jpn = 0.7% so what you think?....wanna increase more into GTF, add some to india and tech at maybe 7% each to dilute/balance out the heavy China/HK/Taiwan weightage? afraid that the NAV is at all time high? just think of it this way.... if India & Tech is at 7% each,...if both NAV were to drop 10% NAV, your port will be affected by 1.4% if Greater China region is at >50% of the port, if it were to drop 5% of NAV, your port will be affected by 2.5% which one got higher chances of dropping, 5% NAV or 10% Nav? I'm still new to UT, joined since Oct 2017. Have a lesson learn recently that I should diverse my allocation to different variances of geographical and specialist sectors.... I have 3 questions: 1. For other people, is now the best time to add % for Asia Pacific and China funds? Since most of them are in lower NAV now 2. Normally for this type of SC discount (let it be 0.57% or 0.8%), is it wise to top up in a lumpsum? or continue DCA? But I don't think it is good to wait only for the SC discount to top up... 0.57% - 1.5% = 0.93%... might get much for timing the market?? 3. Is it recommended if I just put min. investment qty (1000) on each US, tech, India at this moment? TQ |

|

|

Oct 6 2018, 10:04 AM Oct 6 2018, 10:04 AM

Return to original view | Post

#20

|

Junior Member

84 posts Joined: Jun 2017 |

luckily I did not buy in more Manulife India in end August... at that time my concern is all time high and I have no balls to go in....

|

| Change to: |  0.0501sec 0.0501sec

0.51 0.51

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 09:55 AM |