QUOTE(voyage23 @ Nov 22 2017, 04:06 PM)

And I’m planning to buy the dip on IDS tomorrow for the third time in these 2 weeks! Partly also because I wanna push up the % of IDS in the whole port.

You are fortuneteller? FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Nov 22 2017, 04:10 PM Nov 22 2017, 04:10 PM

|

Senior Member

696 posts Joined: Feb 2008 |

|

|

|

|

|

|

Nov 22 2017, 04:11 PM Nov 22 2017, 04:11 PM

|

Junior Member

368 posts Joined: Jun 2013 |

|

|

|

Nov 22 2017, 04:14 PM Nov 22 2017, 04:14 PM

|

Senior Member

696 posts Joined: Feb 2008 |

|

|

|

Nov 22 2017, 04:19 PM Nov 22 2017, 04:19 PM

|

All Stars

33,613 posts Joined: May 2008 |

|

|

|

Nov 22 2017, 04:23 PM Nov 22 2017, 04:23 PM

|

Junior Member

368 posts Joined: Jun 2013 |

|

|

|

Nov 22 2017, 04:23 PM Nov 22 2017, 04:23 PM

|

Senior Member

696 posts Joined: Feb 2008 |

|

|

|

|

|

|

Nov 22 2017, 04:28 PM Nov 22 2017, 04:28 PM

|

Senior Member

3,019 posts Joined: Oct 2005 |

|

|

|

Nov 22 2017, 04:31 PM Nov 22 2017, 04:31 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(voyage23 @ Nov 22 2017, 04:06 PM) And I’m planning to buy the dip on IDS tomorrow for the third time in these 2 weeks! Partly also because I wanna push up the % of IDS in the whole port. Go big or go home! Don't forget that IDS got its growth not from the listed small-cap companies in Bursa... the high returns are from companies outside the small-cap index... can't recall what's the other index is called, it is something like 'gem' similar to the fledging stocks in the Hong Kong exchange... anyway, these smaller than small companies poses higher risk... any one single unfortunate event can affect its stock, "Notion VTec shares hit limit-down after fire incident ..." http://www.thesundaily.my/news/2017/10/20/...ing-plant-klang I rather risk 90% into Asia Pac or Greater China funds... Anyway, this is unit trusts we are talking about... worst case scenario, short term trading plan becomes long term buy-and-hold strategy. Win-win situation. This post has been edited by j.passing.by: Nov 22 2017, 04:32 PM |

|

|

Nov 22 2017, 04:36 PM Nov 22 2017, 04:36 PM

|

All Stars

33,613 posts Joined: May 2008 |

QUOTE(j.passing.by @ Nov 22 2017, 04:31 PM) Go big or go home! Don't forget that IDS got its growth not from the listed small-cap companies in Bursa... the high returns are from companies outside the small-cap index... can't recall what's the other index is called, it is something like 'gem' similar to the fledging stocks in the Hong Kong exchange... anyway, these smaller than small companies poses higher risk... any one single unfortunate event can affect its stock, "Notion VTec shares hit limit-down after fire incident ..." http://www.thesundaily.my/news/2017/10/20/...ing-plant-klang I rather risk 90% into Asia Pac or Greater China funds... Anyway, this is unit trusts we are talking about... worst case scenario, short term trading plan becomes long term buy-and-hold strategy. Win-win situation. I like the bold. LOL. |

|

|

Nov 22 2017, 05:01 PM Nov 22 2017, 05:01 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(john123x @ Nov 22 2017, 04:28 PM) I am waiting for pre 1mdb exchange rate around 3.8 When the ringgit fell a few years ago, I thought the fall was due to forex manipulation by the big hedge funds... and was waiting for a quick rebounce... and missed one whole year of purchases waiting for the rebound.Ever since 1mdb, i have stopped oversea purchases like ebay.... Let's get real, the current exchange rate is based on solid economic fundamentals. And the underlying economic fundamentals comes from all the developments, and all the social, cultural, education, and infrastructure growth in the past 60 years. Turning all the fundamentala around is like turning a titanic ship around to the right direction... it will take years since social changes can be very, very slow, maybe never... like changing back to having English schools. (English shools was one of the economic edge we have over our neighbouring countries... except Singapore, of course.) In short, don't hold your breath... invest for events that are more possible to happen, rather than invest and hope the event will happen. |

|

|

Nov 22 2017, 05:01 PM Nov 22 2017, 05:01 PM

|

Senior Member

3,200 posts Joined: Jan 2003 From: IPOH |

I'm.holding the risk 8.0 ut.. don't really think my hear will stand for those to risking ut.. almost all ta fund house or affin hwang risk level at 8.0

Any advice for some. It... Most f my ut is based in Asia. |

|

|

Nov 22 2017, 05:05 PM Nov 22 2017, 05:05 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(kenny79 @ Nov 22 2017, 05:01 PM) I'm.holding the risk 8.0 ut.. don't really think my hear will stand for those to risking ut.. almost all ta fund house or affin hwang risk level at 8.0 have core and supplementary funds in a portfolioAny advice for some. It... Most f my ut is based in Asia. higher risk rating funds can go for lesser allocation % (decade old article) Maximise Returns while Minimising Risk with a Core and Supplementary Portfolio https://www.fundsupermart.com.my/main/resea...y-Portfolio--59 |

|

|

Nov 22 2017, 05:09 PM Nov 22 2017, 05:09 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(puchongite @ Nov 22 2017, 04:36 PM) No lah, the emas index is a solid index of the large and mid cap companies that are not included in the KLCI index... or maybe it do includes the top 30 companies in the bursa. Anyway, the emas and the KLCI are the main indices.This smaller-than-small cap index was posted in a recent post a few days ago... too lazy to find and know more, since not too interested in it... knowing more uninterested info is like keeping more garbage in the brain with limited grey cells. =========== Small-cap index https://www.investing.com/indices/ftse-malaysia-small-cap ACE market index https://www.investing.com/indices/ftse-malaysia-ace click the 1W (weekly) view to zoom out the trend to 2015... higher volatility in the ace market. To see the long list of companies listed in the main board and ACE market: http://www.bursamalaysia.com/market/listed...ies/ace-market/ What is the ACE Market? https://capital.com.my/investors-funds/publ...bursa-malaysia/ The ACE Market which stands for ‘Access, Certainty, Efficiency’ is actually the new name for the formerly known MESDAQ (Malaysian Exchange of Securities Dealing and Automated Quotation) market. MESDAQ came into existence in 1997 when it was the home of mainly technological stocks and today it is replaced by the ACE Market under Bursa Malaysia. The ACE Market was derived together with the unification of the Main and Second Board into the Main Market of Bursa Malaysia in 2009. The ACE Market is seen as the ideal market for start-ups and new companies which are run by entrepreneurs who are looking to push for more capital by listing their companies public. This is where they might not have the large and high amount like companies in the Main Market but would probably have a strong product or service portfolio which if given more capital, would surely succeed. The ACE Market is very much like the GEM (Growth Enterprise Market) in Hong Kong or Catalist of Singapore and companies in ACE Market are sponsor-drive and it is not only limited to the technological sector when it was called MESDAQ. This means that companies from any sector or size can apply to be listed in the ACE Market where it is designed to offer a more efficient and certain way for you to do so. Typically, the regulations for listing in ACE market are less stringent and the company need not provide the track records like how it is required in the Main Market. =============== Kuala Lumpur Technology Index https://www.investing.com/indices/kl-technology ... click the 'Components' tab to show the list of companies under this index. This post has been edited by j.passing.by: Nov 22 2017, 07:45 PM |

|

|

|

|

|

Nov 22 2017, 05:27 PM Nov 22 2017, 05:27 PM

|

Senior Member

3,200 posts Joined: Jan 2003 From: IPOH |

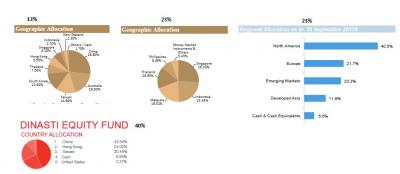

Eastspring investments dinasti equity or eastspring investments Islamic small cap

Any advice on this two it.... |

|

|

Nov 22 2017, 05:34 PM Nov 22 2017, 05:34 PM

|

All Stars

14,863 posts Joined: Mar 2015 |

|

|

|

Nov 22 2017, 05:45 PM Nov 22 2017, 05:45 PM

|

Senior Member

3,200 posts Joined: Jan 2003 From: IPOH |

QUOTE(MUM @ Nov 22 2017, 05:34 PM) I'm holding a ta Asian dividen fund 10k and affin hwang global balance fund rm18k plus ta south east Asia equity fund 18k all bought from bank.. now start at superfundmart think I wan to get some more higher return with risk.. which one more recommend for a fund of rm30k |

|

|

Nov 22 2017, 06:20 PM Nov 22 2017, 06:20 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(kenny79 @ Nov 22 2017, 05:45 PM) I'm holding a ta Asian dividen fund 10k and affin hwang global balance fund rm18k plus ta south east Asia equity fund 18k all bought from bank.. now start at superfundmart think I wan to get some more higher return with risk.. which one more recommend for a fund of rm30k ta Asian dividen fund 10k (13%)ta south east Asia equity fund 18k (23%) affin hwang global balance fund rm18k (23%) x fund 30K (40%) if you go as you liked at EI Dinasti your port will be heavy in CHINA/HK...this will get some more higher return with risk. if you want to get just some higher return with a bit higher risk......may I suggest you get a few funds instead of "a" fund. funds like for example: 10% at dinasti, 10% at Japan, 10% at TA Global tech maybe S'pore at 10% only like example....select those that suits you.... no right or wrong....if you want a fund...just go for it.....only you know yourself better This post has been edited by T231H: Nov 22 2017, 06:22 PM Attached thumbnail(s)

|

|

|

Nov 22 2017, 07:23 PM Nov 22 2017, 07:23 PM

Show posts by this member only | IPv6 | Post

#10198

|

Senior Member

1,046 posts Joined: Nov 2014 |

According to Bloomberg

IDS +1.38% |

|

|

Nov 22 2017, 07:36 PM Nov 22 2017, 07:36 PM

|

Senior Member

3,200 posts Joined: Jan 2003 From: IPOH |

|

|

|

Nov 22 2017, 07:38 PM Nov 22 2017, 07:38 PM

|

All Stars

14,863 posts Joined: Mar 2015 |

QUOTE(kenny79 @ Nov 22 2017, 07:36 PM) INTERPAC DANA SAFI Fundhttps://www.fundsupermart.com.my/main/admin...eetMYIPDASA.pdf |

| Change to: |  0.0210sec 0.0210sec

0.76 0.76

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 05:31 AM |