china fund please look at HK china listed index HSCEI

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Nov 23 2017, 01:12 PM Nov 23 2017, 01:12 PM

|

All Stars

10,859 posts Joined: Jan 2003 From: Sarawak |

china fund please look at HK china listed index HSCEI

|

|

|

|

|

|

Nov 23 2017, 01:53 PM Nov 23 2017, 01:53 PM

|

Senior Member

1,046 posts Joined: Nov 2014 |

|

|

|

Nov 23 2017, 02:02 PM Nov 23 2017, 02:02 PM

Show posts by this member only | IPv6 | Post

#10223

|

Senior Member

3,200 posts Joined: Jan 2003 From: IPOH |

|

|

|

Nov 23 2017, 02:07 PM Nov 23 2017, 02:07 PM

|

Junior Member

613 posts Joined: Jun 2011 |

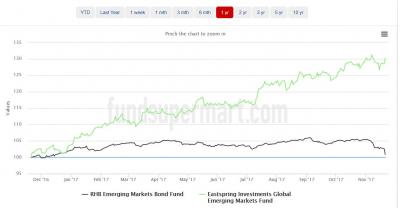

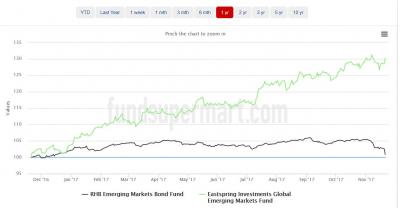

what happened to RHB Emerging market bond fund? bleeding these past 2 weeks

|

|

|

Nov 23 2017, 02:09 PM Nov 23 2017, 02:09 PM

|

Junior Member

664 posts Joined: Dec 2006 |

Noob question here, platform fee deducted from our CMF is in ringgit form right?

|

|

|

Nov 23 2017, 02:16 PM Nov 23 2017, 02:16 PM

|

Senior Member

1,186 posts Joined: Nov 2004 |

QUOTE(thesnake @ Nov 23 2017, 02:07 PM) election risk?https://www.bloomberg.com/news/articles/201...ket-local-bonds https://www.wsj.com/articles/junk-bond-outf...loff-1510913580 This post has been edited by gu~wak_zhai: Nov 23 2017, 02:17 PM |

|

|

|

|

|

Nov 23 2017, 02:27 PM Nov 23 2017, 02:27 PM

|

Senior Member

696 posts Joined: Feb 2008 |

|

|

|

Nov 23 2017, 02:34 PM Nov 23 2017, 02:34 PM

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(funnyface @ Nov 23 2017, 02:27 PM) Honestly i dont know why so many of you want to follow Xuzen Crystal ball bulat-bulat I think he added it in because of its weak correlation to other funds.RHB EMB was never a good performer for global emerging market (dont shoot me sifus >_< )

Personally if you kept to 10% of allocation to your port, it shouldn’t be hurting your overall port. Stop panicking guys. Seriously I wonder why the stock guys are much calmer than some of you eventho their paper loss per day is more than anyone combined in a week here. |

|

|

Nov 23 2017, 02:34 PM Nov 23 2017, 02:34 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(funnyface @ Nov 23 2017, 02:27 PM) Honestly i dont know why so many of you want to follow Xuzen Crystal ball bulat-bulat RHB EMB was never a good performer for global emerging market (dont shoot me sifus >_< )

Well done! Let's compare a bond fund against an equity fund, and bash it for its lack of growth. ========== BTW The local bond funds suddenly jump up in yesterday's nav price, gaining about 2 weeks worth of the usual daily increments. |

|

|

Nov 23 2017, 02:37 PM Nov 23 2017, 02:37 PM

|

All Stars

33,633 posts Joined: May 2008 |

QUOTE(gu~wak_zhai @ Nov 23 2017, 02:16 PM) election risk? Likely the strengthening of MYR also got direct impact.https://www.bloomberg.com/news/articles/201...ket-local-bonds https://www.wsj.com/articles/junk-bond-outf...loff-1510913580 |

|

|

Nov 23 2017, 02:42 PM Nov 23 2017, 02:42 PM

|

Senior Member

696 posts Joined: Feb 2008 |

QUOTE(j.passing.by @ Nov 23 2017, 02:34 PM) Well done! Let's compare a bond fund against an equity fund, and bash it for its lack of growth. ========== BTW The local bond funds suddenly jump up in yesterday's nav price, gaining about 2 weeks worth of the usual daily increments. |

|

|

Nov 23 2017, 03:03 PM Nov 23 2017, 03:03 PM

|

Junior Member

523 posts Joined: Aug 2007 |

when im trying to buy fund...error below keep come out..

"Please update your bank account" I got no problem previously when buying managed portfolio. |

|

|

Nov 23 2017, 03:03 PM Nov 23 2017, 03:03 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(funnyface @ Nov 23 2017, 02:42 PM) If you want a FI, the RHB EMB is a VERY bad FI due to high volatility. The reason you want this bond is for low correlation to other like bro Avangelice mentioned. Whar correlation is there when the funds are in different asset catergory - with one a bond fund, and the other an equity fund?Bond funds and fixed income funds are for lessening the overall portfolio risk by lowering the equity portion within the portfolio. Lower the equity portion by having a higher bond/fixed income portion. This particular bond fund is a totally foreign bonds... its higher than normal growth in the recent past 2 years was due to the fall of the ringgit. It is like putting money into a fixed dposit in a Singapore bank in 2012 and wait for the ringgit to fall... you would gained returns in the region of 25-30% eventhough the FD interest is miserable. The gains this year would be flat or negative due to the forex again. Lastly, try to make apple to apple comparisons. Making apple to orange comparison is a bit silly... and generally, would not get us anywhere. Cheers. This post has been edited by j.passing.by: Nov 23 2017, 03:04 PM |

|

|

|

|

|

Nov 23 2017, 03:18 PM Nov 23 2017, 03:18 PM

|

Senior Member

696 posts Joined: Feb 2008 |

QUOTE(j.passing.by @ Nov 23 2017, 03:03 PM) Whar correlation is there when the funds are in different asset catergory - with one a bond fund, and the other an equity fund? Bond funds and fixed income funds are for lessening the overall portfolio risk by lowering the equity portion within the portfolio. Lower the equity portion by having a higher bond/fixed income portion. This particular bond fund is a totally foreign bonds... its higher than normal growth in the recent past 2 years was due to the fall of the ringgit. It is like putting money into a fixed dposit in a Singapore bank in 2012 and wait for the ringgit to fall... you would gained returns in the region of 25-30% eventhough the FD interest is miserable. The gains this year would be flat or negative due to the forex again. Lastly, try to make apple to apple comparisons. Making apple to orange comparison is a bit silly... and generally, would not get us anywhere. Cheers. Anyway, i has done my talking here. The reason i did the comparison is the show if you want to diversify your portfolio to Emerging Market, there are better funds out there. If you want to lower your risk by buying this RHB EMB, you are picking a very bad FI fund as there are way better FI out there with lower volatility You can continue keep your RHB EMB, i have my own selection....after all this is a DIY platform...you like your tea while i like my coffee.... |

|

|

Nov 23 2017, 03:39 PM Nov 23 2017, 03:39 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(funnyface @ Nov 23 2017, 03:18 PM) What is there to talk about when you only want to listen to yourself and stubbornly refuse to listen to others when they present a valid counterpoint to you?This is not an exchange of thoughts or opinions... it is more like "I am correct. Since I am correct, what yoo said is wrong. You wasted my time in talking to you." Cheers. This post has been edited by j.passing.by: Nov 23 2017, 03:39 PM |

|

|

Nov 23 2017, 03:40 PM Nov 23 2017, 03:40 PM

|

All Stars

33,633 posts Joined: May 2008 |

QUOTE(funnyface @ Nov 23 2017, 03:18 PM) Anyway, i has done my talking here. The reason i did the comparison is the show if you want to diversify your portfolio to Emerging Market, there are better funds out there. If you want to lower your risk by buying this RHB EMB, you are picking a very bad FI fund as there are way better FI out there with lower volatility You can continue keep your RHB EMB, i have my own selection....after all this is a DIY platform...you like your tea while i like my coffee.... What if today the one got hit is the China funds ? What do you have to say ? |

|

|

Nov 23 2017, 03:49 PM Nov 23 2017, 03:49 PM

|

Senior Member

696 posts Joined: Feb 2008 |

QUOTE(j.passing.by @ Nov 23 2017, 03:39 PM) What is there to talk about when you only want to listen to yourself and stubbornly refuse to listen to others when they present a valid counterpoint to you? I show all the points yet your reply give none. I did agree that the reason you want to keep RHB EMB is due to low correlation with other funds, nothing to do with FI or EQ.This is not an exchange of thoughts or opinions... it is more like "I am correct. Since I am correct, what yoo said is wrong. You wasted my time in talking to you." Cheers. QUOTE(puchongite @ Nov 23 2017, 03:40 PM) Let me play the devil advocate here. We all gonna KO since everyone hold enough Ponzi2/dinasti/GC What if today the one got hit is the China funds ? What do you have to say ? |

|

|

Nov 23 2017, 04:00 PM Nov 23 2017, 04:00 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(funnyface @ Nov 23 2017, 03:49 PM) I show all the points yet your reply give none. I did agree that the reason you want to keep RHB EMB is due to low correlation with other funds, nothing to do with FI or EQ. Well, you have shown me nothing... just to tell be both are foreign funds, when I was telling you that one is a bond fund and the other an equity fund, plus I already told you the bond fund is totally a foreign bond fund.Why do you have to be so personal in the opinion and try to counter me by assuming that I am holding this particular bond fund? I don't follow too closely on what Xuzen said in his posts on his recommended portfolio. The thing is that bond/equity ratio is to balance the risk of the entire portfolio. This is what I said in my previous post. So tell me again, what is new that you want to tell me after reading my post above. Just a repeat that an emerging market equity fund is equivalent to an emerging market bond fund? This post has been edited by j.passing.by: Nov 23 2017, 04:04 PM |

|

|

Nov 23 2017, 04:08 PM Nov 23 2017, 04:08 PM

|

Senior Member

696 posts Joined: Feb 2008 |

QUOTE(j.passing.by @ Nov 23 2017, 04:00 PM) Well, you have shown me nothing... just to tell be both are foreign funds, when I was telling you that one is a bond fund and the other an equity fund, plus I already told you the bond fund is totally fund. You see, you first comment was joke about me comparing EI GEM vs RHB EMB. Why? because you are saying i was comparing FI vs EQ.Why do you have to be so personal in the opinion and try to counter me by assuming that I am holding this particular bond fund? I don't follow too closely on what Xuzen said in his posts on his recommended portfolio. The thing is that bond/equity ratio is to balance the risk of the entire portfolio. This is what I said in my previous post. So tell me again, what is new that you want to tell me after reading my post above. Just a repeat that an emerging market equity fund is equivalent to an emerging market bond fund? I explained to you why FI vs EQ does not matter for this comparison. Why? because RHB EMB has high enough volatility that make itself has similar risk with balanced EQ fund. Clear? And then you explain FI will lower the risk blah blah blah...I told you not the case for RHB EMB because it has much higher risk than normal FI funds. Clear? If you want to use FI to lower to risk yet cover Emerging Market region, you can have 30:70 for EI GEM: AFSB vs 100% into RHB EMB. This way gives you better return yet lower risk and cover emerging market. Clear?

|

|

|

Nov 23 2017, 04:17 PM Nov 23 2017, 04:17 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(funnyface @ Nov 23 2017, 04:08 PM) You see, you first comment was joke about me comparing EI GEM vs RHB EMB. Why? because you are saying i was comparing FI vs EQ. "because RHB EMB has high enough volatility that make itself has similar risk with balanced EQ fund. Clear?"I explained to you why FI vs EQ does not matter for this comparison. Why? because RHB EMB has high enough volatility that make itself has similar risk with balanced EQ fund. Clear? And then you explain FI will lower the risk blah blah blah...I told you not the case for RHB EMB because it has much higher risk than normal FI funds. Clear? If you want to use FI to lower to risk yet cover Emerging Market region, you can have 30:70 for EI GEM: AFSB vs 100% into RHB EMB. This way gives you better return yet lower risk and cover emerging market. Clear?

So you can compare 2 funds in 2 different asset category due to its recent history and volatility are the same or almost the same? Read the above post on why the volatility comes about, due to the fall in ringgit... maybe expand the performance chart to 5 or 10 years... and see how its trend was like before 2013... |

| Change to: |  0.0279sec 0.0279sec

0.30 0.30

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 06:12 AM |