QUOTE(nexona88 @ May 30 2023, 02:30 PM)

Only new placement after OPR hike or reduced would take effect new rate...

Whatever placement made before stays the same... As agreed upon 🙏

Don't worry much....

It's already printed in the slip.... It's guarantee payments 🤑💰

got it!

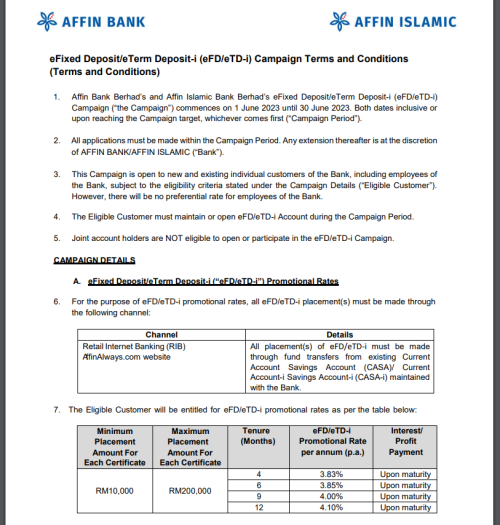

So I went to BI just now and they said got another promo 5.9% 70:30 FD:SA deal. LOL coba nasib cabutan tuah win this & that. Effectively ~4.1x% + lottery ticket

BUT the thing that screw up my day is EPF "promo" On the way to BI, saw EPF "roadshow" saying voluntary contributions increased to 100K wef 1/6 today

As a jobless warga mas, that is very tempting news. Because iinm, **div is calculated yearly but takes into consideration the dates of contributions and withdrawals... not simply the balance at the end of the year. What that means is that we earn div penuh for everyday the money is with kwsp. And we can treat it like a supercharged savings account, masuk keluar sesuka hati vs zero int for premature FD withdrawal. Of course, warga mas only lah

haha I think they are pretty concerned about the withdrawals - that's why raise to 100K from 60K. And I think also good news for FD rates becos now kwsp competing with the banks - surely the banks will respond with higher rates.

So what do u think?

PS: **Hopefully I am not mistaken about how div is calculated cos that's a major factor to consider

May 30 2023, 06:33 PM

May 30 2023, 06:33 PM

Quote

Quote

0.0343sec

0.0343sec

0.76

0.76

6 queries

6 queries

GZIP Disabled

GZIP Disabled