QUOTE(cfc @ May 18 2023, 01:12 PM)

Minimum placement amount is 10KFixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

May 18 2023, 02:23 PM May 18 2023, 02:23 PM

Return to original view | Post

#1

|

Junior Member

147 posts Joined: Nov 2017 |

|

|

|

|

|

|

May 18 2023, 03:08 PM May 18 2023, 03:08 PM

Return to original view | Post

#2

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(BoomChaCha @ May 18 2023, 02:41 PM) So, Bank Islam is the King now for 4.5% 12 months.. I had just placed BI 12mth 4.5% fd.Last time, my Bank Islam FD fell into weekend like Saturday or Sunday, Bank Ismal auto renewed my matured FD to board rate according to the original FD tenure. So when I uplifted on Monday, I lost 1 or 2 days interest. Please double check the maturity date when place FD in Bank Islam.. Placement date today, 18/5/2023 Maturity date is 20/5/2024 as 18/5/2024 which is a Saturday. Expected profit(int) is calculated as Placement Amount x 4.5% x 368/365 I had verified calculated profit/int amount printed on the FD cert to be exactly correct. Extra 3 days is because of Sat & Sun and the fact 2024 is a leap year (29Feb, so another additional day) Since, this is a OTC placement with certificate, I did asked the teller whether I can redeem this FD at another BI branch on maturity. She say can, redemption can be at another branch, need to bring along the cert. However, she did mentioned that I can redeem on maturity ONLINE if I choose to. BoomChaCha liked this post

|

|

|

May 18 2023, 04:17 PM May 18 2023, 04:17 PM

Return to original view | Post

#3

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(X_hunter @ May 18 2023, 03:20 PM) About 40 minutes. I did have an existing Bank Islam Saving A/c with Internet Banking, where I had already transfer the fund over in the morning today.There is no waiting time as there is no queue before me. |

|

|

May 18 2023, 04:23 PM May 18 2023, 04:23 PM

Return to original view | Post

#4

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(joeblow @ May 18 2023, 04:00 PM) I suspected so since Feb is short month. Anyway I lazy to go compute and can only trust the bank not to miscalculate. I did an online fund transfer from another bank a/c (matured FD, roll over rate only 2.85%) in the morning today to my BI saving account. I did have an BI saving a/c with Online Internet ID.Thank you for the info. This is an interesting point. Previously when I placed, the maturity date fell on Sat and I can only suck thumb. But today I placed 1 FD and instructed them to make the maturity date on 20th May 2024. Initially they claim it is system generated, but I think can be manually override. Depends on the person who key in the system I think. So yeah please instruct them and check for the dates yourself. For your case I think you either use Rentas or Bank Cheque right? Btw, I did try to do an online placement for BI FD 12 months. Rate given is only 3.10%. So, promptly cancel and head to the BI branch. Teller confirm this 12mth 4.5% is only available OTC. |

|

|

May 18 2023, 04:30 PM May 18 2023, 04:30 PM

Return to original view | Post

#5

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(romuluz777 @ May 18 2023, 01:20 PM) PIDM coverage is up to RM250K per depositor per member bank.If the bank had conventional and Islamic product, there is a separate 250K insurance limit for these categories. PIDM FAQ romuluz777 liked this post

|

|

|

May 18 2023, 08:56 PM May 18 2023, 08:56 PM

Return to original view | IPv6 | Post

#6

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(BWassup @ May 18 2023, 06:46 PM) Ya, this RHB 3M @ 4.00%, 6M @ 4.10% no longer available for online eFD online placement. Prior last month, was available. Campaign period supposedly up to 31/7/23. Probably quota full. |

|

|

|

|

|

May 19 2023, 07:10 AM May 19 2023, 07:10 AM

Return to original view | IPv6 | Post

#7

|

Junior Member

147 posts Joined: Nov 2017 |

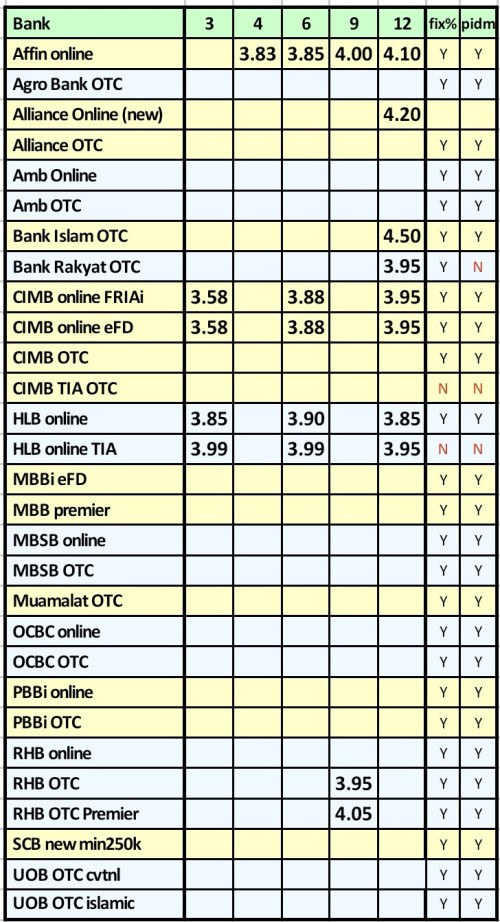

QUOTE(cclim2011 @ May 18 2023, 11:19 PM) thanks for the input ya. updated as below. HLB TIA is actual an investment product, not a deposit product as per HLB product disclosure sheet.let's promote bank islam 4.5 haha none of the cimb officers in the branch knew about this 4.5%  The principal and returns of the investment are not guaranteed and placements are not covered by PIDM. HLB TIA Product Disclosure Sheet |

|

|

May 19 2023, 12:15 PM May 19 2023, 12:15 PM

Return to original view | Post

#8

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(weidasdnbhd @ May 19 2023, 10:36 AM) Hi, Yes, the fund was deduct from my SA account.So do you mean you have SA with BI, you just transfer fund from another bank to BI, and you go to BI to place a FD at 4.5% without bringing any cash or cheque as the fund was deducted from your SA? My fund was transferred in to my SA on the SAME day as the FD placement. It was specified in their Terms and Conditions for this promotion for the fund to be consider "fresh fund". BI TDT Extra Campaign Term & Condition weidasdnbhd liked this post

|

|

|

May 26 2023, 12:38 PM May 26 2023, 12:38 PM

Return to original view | IPv6 | Post

#9

|

Junior Member

147 posts Joined: Nov 2017 |

|

|

|

May 30 2023, 01:07 PM May 30 2023, 01:07 PM

Return to original view | IPv6 | Post

#10

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(okuribito @ May 30 2023, 12:37 PM) TQVM for helpful info. Rate are fixed during placements as per BI promotion. Eg, for this promotion of OPR+1.5%, placements will get 4.5% for the 12mths tenure.May I know what happens if OPR go up or down from current 3% before maturity? Will our rate be adjusted for new OPR? TIA okuribito liked this post

|

|

|

May 30 2023, 01:12 PM May 30 2023, 01:12 PM

Return to original view | IPv6 | Post

#11

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(okuribito @ May 30 2023, 12:50 PM) RE Bank Islam promo, the T&C says Transfer your fund from your other bank account to your BI saving account on the same day you want to the placement. The bank will debited your BI Saving account for the placement of your BI 12mth 4.5% FD placement.I have savings account there. Can i transfer from other bank into my SA & make the deposit from there? Is my SA a Debit Account mentioned in the T&C? TQIA okuribito liked this post

|

|

|

May 30 2023, 02:09 PM May 30 2023, 02:09 PM

Return to original view | IPv6 | Post

#12

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(uglyduckling422 @ May 30 2023, 01:49 PM) omg..why hlb so troublesome. want to change limit then got security question . then it say not correct . ask me go setting change security question. then i go fill in again ..say you already existing hlb connect user. how to go about it? sorry im new to hlbb . done twice still same not able change security question from their FB page ...You can log in at our HLB Connect full website below and follow the steps to change your security questions : Full web : https://s.hongleongconnect.my/rib/app/fo/login Login > Setting > Change Security Questions > Create new Security Questions > Next > Enter TAC Hope this helps. Thank you. HLB How to change security question btw, HLB connect, after changing limit, need to wait 1 hour before can transact |

|

|

May 31 2023, 09:38 PM May 31 2023, 09:38 PM

Return to original view | IPv6 | Post

#13

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(adele123 @ May 31 2023, 05:59 PM) Hi all, have you done eFD from joint account to single account? For eFD promo via FPX, should be able to do placement from any other bank accounts which may or may not belong to same account holder.Example Bank A is joint account. The promo is in Bank H, only one of the person in Bank H is the account holder. And fpx from bank A to Bank H. I had done eFD placement in RHB where FPX payment are from my sibling accounts of another bank. So I reckon, the FPX account can be the same account holder, joint account holder or any other account that can do FPX transfer within set limit and fund availability. However, there may be exceptions. OCBC eFD promo explicitly specified that the FPX must come from the same holder account. They reserved the right to cancel your placement and return your fund (few days later) if the FPX account is not the same account holder as the OCBC account. |

|

|

|

|

|

Jun 6 2023, 11:42 AM Jun 6 2023, 11:42 AM

Return to original view | IPv6 | Post

#14

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(ALEX_L1M @ Jun 6 2023, 10:59 AM) Hi guys, For PIDM, protection is up to 250K per depositor per member bank. If you are able to open a joint account with someone you trust, eg. spouse/siblings/parent etc, you can get a separate 250K insurance protection for each joint account.The BI 4.5% for 12 months FD, is it safe to put more than 250k as PIDM only protected up to 250k. First time use BI, so feel a bit insecure. Anyone put more than 250k? PIDM guidelines Attached thumbnail(s)

|

|

|

Jun 9 2023, 09:52 AM Jun 9 2023, 09:52 AM

Return to original view | Post

#15

|

Junior Member

147 posts Joined: Nov 2017 |

|

|

|

Jun 12 2023, 04:52 PM Jun 12 2023, 04:52 PM

Return to original view | IPv6 | Post

#16

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(thirumaran @ Jun 12 2023, 03:58 PM) Are we able to view our FD placement from the Bank Islam online banking system? Yes, you can view.Sorry, going to open an account tmrow Attached thumbnail(s)

nexona88 liked this post

|

|

|

Jun 12 2023, 06:45 PM Jun 12 2023, 06:45 PM

Return to original view | IPv6 | Post

#17

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(sweetpea123 @ Jun 12 2023, 06:17 PM) Bank Islam 12m @ 4.5% , monthly interest ? Bank Islam 12m @ 4.5% profit(interest) is paid at the end of the 12 month tenure. Not monthly.Is there an option to open non-fee savings acc (WITHOUT debit card ) or is savings account OPTIONAL should there be no monthly interest? You can open a Basic Saving Account -i. No service or maintenance charge will be imposed on the account. Bank Islam Basic Saving Account - i Attached thumbnail(s)

sweetpea123 and nexona88 liked this post

|

|

|

Jun 13 2023, 11:08 AM Jun 13 2023, 11:08 AM

Return to original view | Post

#18

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(X_hunter @ Jun 13 2023, 10:28 AM) After I opened basic SA with Bank Islam, the officer asked me to register internet banking and also their GO by Bank Islam app. I also received SMS twice to activate online banking and app. I have already registered the online banking. But for GO app, I didn't install it because I see the reviews is very bad. Did you use the GO app? I do have the Bank Islam Go mobile app. Hardly use as I prefer to use desktop to access the bank website for performing online transactions.However, I will need the GO app for the GO secure feature to approve transactions, maintenance such as change limits etc. Most bank now no longer use SMS OTP, need mobile device linked to the account for transaction signing such as approval for fund transfer etc. https://www.bankislam.com/personal-banking/...ices/go-secure/ Attached thumbnail(s)

|

|

|

Jun 15 2023, 11:44 AM Jun 15 2023, 11:44 AM

Return to original view | IPv6 | Post

#19

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(joice11 @ Jun 15 2023, 11:10 AM) BI 4.5% 12month is a promotional/campaign product available for OTC placement only.It is FD with certificate. Surprisingly, I was told by bank teller that I can withdrawal via online. Normally, FD with certificate required surrendering the certificate during redemption and normally not available as an online feature. I had checked my BI online screen. Indeed, the feature to do online withdrawal is there. However, I did not complete all the way. Not sure whether there are further checking to stop the withdrawal. Hope this help. Btw, for withdrawal at branch, was told can be done at any BI branch. Need to bring cert. If not at original placement branch, withdrawal is not immediately. Teller explained to me that they need to email details to the original branch. Original placement branch will performed the actual withdrawal transaction. They ensured me that the process will be completed within the same day. Customer will get the fund within the same day but not immediately. Attached thumbnail(s)

BLANk_ liked this post

|

|

|

Jun 15 2023, 03:35 PM Jun 15 2023, 03:35 PM

Return to original view | IPv6 | Post

#20

|

Junior Member

147 posts Joined: Nov 2017 |

QUOTE(X_hunter @ Jun 15 2023, 02:47 PM) Just want to share my experience placing FD at BI today. First officer A that helped me to proceed with the FD opening, asked me whether I want the interest to be credited half yearly? I was like huh? I thought interest will only be credited upon maturity (after 12 months). Since she asked, I said ok, half yearly then. After that, she passed to the counter officer B to process. Did you placed your FD today (15/6/23) or yesterday? Maybe for next year Hari Raya Haji, 17 June 2024 could be a tentative date subjected to sighting of the new moon.After waiting for quite some time, passed to officer C at the normal desk pulak. Officer C was the one helping me to open the BSA previously. Btw, when I double checked with officer C, she told me interest will only be credited upon maturity. I told her officer A said can half yearly, some more let me choose. At that time, officer A not at her desk. If not I will ask C to check with A. Then after done everything, she asked me to check the cert. Matured date is 17 June 2024. I thought if I place today, it will be matured on 14 June 2024 (Friday). Seeing they give extra interest, I was ok. Then when back home, I checked again, apparently 17 June 2024 is Hari Raya Haji. Means by right they should put to 18 June 2024 right? |

| Change to: |  0.0660sec 0.0660sec

0.69 0.69

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 05:30 AM |