QUOTE(Deal Hunter @ Aug 10 2017, 02:26 AM)

Please check, the 10k unlikely at 3.95%. wef 1 Jun 2017, 1 year normal board rate was down to 3.80%.

Anyway it is supposed to be CASA and not normal FD.

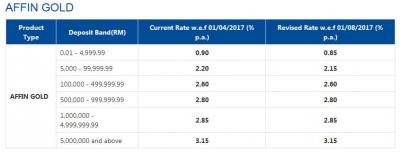

wef 1 August 2017, for the savings band which 10k falls in:-

Affin Gold (senior) Savings at 2.15%

Ordinary, Statement and Junior at 1.45%

Affin Plus at 0.75%

Basic at 0.65%

At best, if 90k FD and 10K at Affin Gold (Senior), get 8244 + 430 = 8674 for 100k lock in.

This is 4.337% p.a. for 2 years.

Not competitive against 4.3% p.a. for 1 year especially if get monthly interest payment at Bank Muamalat and opportunity of rising FD rates.

Note that if 100k FD and 10k SA, the rate is slightly more.

Your calculation is wrong. Where got effective rate 4.337%?Anyway it is supposed to be CASA and not normal FD.

wef 1 August 2017, for the savings band which 10k falls in:-

Affin Gold (senior) Savings at 2.15%

Ordinary, Statement and Junior at 1.45%

Affin Plus at 0.75%

Basic at 0.65%

At best, if 90k FD and 10K at Affin Gold (Senior), get 8244 + 430 = 8674 for 100k lock in.

This is 4.337% p.a. for 2 years.

Not competitive against 4.3% p.a. for 1 year especially if get monthly interest payment at Bank Muamalat and opportunity of rising FD rates.

Note that if 100k FD and 10k SA, the rate is slightly more.

The effective rate is in between 4.28% to 4.3% even if use Affin Gold saving rate to calculate.

Not all fund in Affin Gold saving account will get 2.15%,

First RM 4999.00 in Affin Gold will get 0.85%, then from RM 5000 to RM 99,999.99 will only get 2.15%

http://www.affinbank.com.my/General/Rates-...erest-Rate.aspx

The previous Affin promo straight 4.3% promo is better than this current promo.

QUOTE(Deal Hunter @ Aug 10 2017, 04:05 PM)

Too bad the various Affin savings rates for the lower savings bands are even lower than those mentioned. The final collection will be down more depending how much lower available for placement.

The rate is slightly more than Bank Muamalat at best, but maybe depositors not old enough to qualify for the better rate.

Seems like the FD rates are getting more competitive, and may regret 4.337% for 2 years lock in.

Bank Muamalat: The rate is slightly more than Bank Muamalat at best, but maybe depositors not old enough to qualify for the better rate.

Seems like the FD rates are getting more competitive, and may regret 4.337% for 2 years lock in.

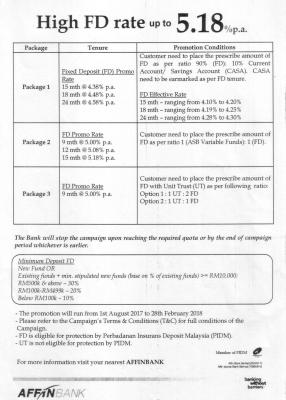

Pro: Competitive 4.3% for 1 year

Cons: Minimum RM 100K. Minimum RM 500K to get monthly interest. Need ATM card (RM 12 per year) for internet banking.

Affin Bank:

Pros: Competitive 4.28% to 4.3%. Minimum RM 10K. Interest will pay every 6 months. No need ATM card for internet banking.

Con: 2 years tenures. But this may be a good thing if interest rate is not going up in next 2 years.

Conclusion: I think Affin bank is slightly better since the interest paid every 6 months and this can compensate the difference of extra 0.02% from Bank Muamalat. Can consider to take a gamble to go for Affin if you do not use your money in next 2 years.

This post has been edited by BoomChaCha: Aug 10 2017, 06:47 PM

Aug 10 2017, 06:22 PM

Aug 10 2017, 06:22 PM

Quote

Quote

0.2167sec

0.2167sec

0.42

0.42

7 queries

7 queries

GZIP Disabled

GZIP Disabled