QUOTE(Cookie101 @ Dec 9 2016, 06:21 PM)

How they even workout that effective rate?? That is so misleading!

At the placement of 1:1 , even renewal at same rate also not going to get you anywhere near that 4%

Perhaps someone can enlighten me... Maybe just go for UOB FD- tomorrow 4% 12m

I'm doing a simple calculation based on months, might not be that accurate, but close enough, so don't flame me.

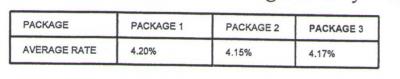

Let's say you are taking option no.1 which is 2 months @ 3.58% and 15 months @ 4.28%, placing $100,000 for example.

That means you are placing at $100,000.00 for 17 months.

The first 2 months your interest would be $100,000 x 3.58% per annum (=$3,580.00), divide by 12 months and then multiply 2 months = $596.67

The next 15 months your interest would be $1000,000 x 4.28% per annum (=$4,280), divide by 12 months and multiply by 15 months = $5,345.00

Therefore total interest you receive for 17 months is $596.67 + $5,345.00 = $5,946.67.

To get average interest amount per annum, you divide the $5,946.67 by 17 months and multiply by 12 months which is 5,946.67/17 x 12 =$4,197.65.

Therefore average interest would be $4,197.65 divided by RM100,000 and multiply by 100 (to get percentage) = 4197.65 / 100,000 x 100 = 4.19765% per annum (which is close enough to 4.2%)

The above is my understanding and should it not be correct, please by all means correct me.

Dec 9 2016, 03:33 PM

Dec 9 2016, 03:33 PM

Quote

Quote

0.0292sec

0.0292sec

0.45

0.45

6 queries

6 queries

GZIP Disabled

GZIP Disabled