QUOTE(shihou1 @ Apr 4 2023, 12:18 AM)

This seem good right? will get cashback if top up TNG?

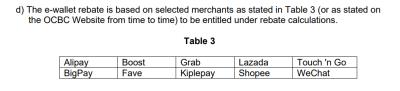

good if you spend rm1286 only, spend more than that you'll get less effective cash back rate. Yes, tng will get CB if you read the tnc.

QUOTE(paogeh @ Apr 4 2023, 12:35 AM)

i have OCBC titanium CC suplementary card .

with new changes in APR

the cash back in Sup is tier or separate from principal card ?

eg: Principal swipe RM1500 ---> CB RM20

Sub swipe RM1500 too ====> CB RM20 as well total RM40 .

or just total RM20 only ?

Thank yoiu

4) Will my Supplementary card enjoy the same benefits as the Principal card?

Yes, Supplementary cardmembers will also enjoy the same benefits as Principal cardmembers.

Supplementary cardmember’s spending will be cumulated with the Principal cardmember’s

spending for rebates reflected in the billing statements of the principal cardmember’s OCBC

Titanium Mastercard (Blue/Pink).

Mar 31 2023, 04:20 PM

Mar 31 2023, 04:20 PM

Quote

Quote

0.0293sec

0.0293sec

0.14

0.14

6 queries

6 queries

GZIP Disabled

GZIP Disabled