Outline ·

[ Standard ] ·

Linear+

OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

|

zenquix

|

Dec 4 2019, 09:42 PM Dec 4 2019, 09:42 PM

|

|

there was someone else with this dbl setup.

I am concerned whether need to pay 6 bills (3 from 360, 3 from 360-i)

i suspect RM500 cc for 360, RM500 debit card for 360-i

|

|

|

|

|

|

zenquix

|

Dec 6 2019, 05:55 AM Dec 6 2019, 05:55 AM

|

|

QUOTE(jefftan4888 @ Dec 5 2019, 02:37 PM) I’m testing 360-i with the following 1) Setting up 3 x RM1 recurring payment for 3 x MBB CC 2) Transfer 500 from 360 to 360-i 3) Charge 500 to Debit Card Will know the results in Jan 2020 the rm500 no need fresh fund? |

|

|

|

|

|

zenquix

|

Dec 8 2019, 11:27 PM Dec 8 2019, 11:27 PM

|

|

what is installed in your phones to trigger this?

|

|

|

|

|

|

zenquix

|

Dec 9 2019, 09:33 PM Dec 9 2019, 09:33 PM

|

|

QUOTE(wyh @ Dec 9 2019, 09:14 PM) Haha 5 days already, no one get back to me that's strange. i got a call a working day after |

|

|

|

|

|

zenquix

|

Dec 17 2019, 11:21 PM Dec 17 2019, 11:21 PM

|

|

QUOTE(~Curious~ @ Dec 17 2019, 11:47 AM) but the funny thing is 365 charging annual fee, whilst titanium not.. din think of it initially,i can top-up Boost with d CC to fulfil one of d criteria for d SA.then from boost only pay mah bills =) im asking d OCBC if i can convert my application from 365 to titanium..lol 365 is 1% for all transactions up to 1k titanium 1% only for online and overseas transaction |

|

|

|

|

|

zenquix

|

Dec 20 2019, 04:13 PM Dec 20 2019, 04:13 PM

|

|

QUOTE(Just2Clear @ Dec 20 2019, 10:39 AM) this is my 1st month using OCBC Credit card... my statement out on 11th. there show the 0.1%... until today.. i also didnt see the 0.9%. i call CS.. CS told me the 0.9% will only show in next month statement. QUOTE(TongCN @ Dec 20 2019, 11:38 AM) Nani =.= ? They change rules ? in theory they are still consistent. Based on standard behaviour (not refresh online banking daily  ) you will see the 0.9% in the next paper statement in the past. |

|

|

|

|

|

zenquix

|

Dec 23 2019, 05:54 PM Dec 23 2019, 05:54 PM

|

|

QUOTE(CALexChai @ Dec 23 2019, 04:43 PM) Ya.. deposited fd to faster the process and increase my credit limit. The previous banker didn’t told me can’t cash out even after mature. sry you got conned. What you were "adviced" to do was likely a secured credit card (compared standard credit card being unsecured i.e. no collateral). Yout credit limit same as the FD amount correct? QUOTE(Lazygenes @ Dec 23 2019, 04:17 PM) I went to OCBC DU today and they told me if I already have a 360 account, cannot open a 360i account. May I know which branch did you open your 360 accounts? Thanks. that's worrying. was planning to go to the same branch to open a 360i next week. This post has been edited by zenquix: Dec 23 2019, 05:55 PM |

|

|

|

|

|

zenquix

|

Dec 24 2019, 05:20 PM Dec 24 2019, 05:20 PM

|

|

QUOTE(avinlim @ Dec 24 2019, 02:11 PM) Got people report here cannot. But I think should be able to open. I cannot brain if bank is also that racist.  different bank but SCB Saadiq cannot open non islamic accounts (although can deposit if already opened etc.). So I would recommend confirming. QUOTE(ohcipala @ Dec 24 2019, 04:04 PM) OK. Thank you. Yup, deposited the rm20k straight after account opening. Just wondering how would ringgitplus know that we actually opened the account? Do they verify with the bank? QUOTE(avinlim @ Dec 24 2019, 04:06 PM) Need to show bank your sms from Ringgitplus with your ic when u opening account at bank. Must deposit 20k on the same day, sometimes bank will not tell u this, so take note. I showed my sms to the banker and they have no idea what to do with it, even after checking with their manager. They just tell me to liaise with ringgitplus like ohcipala. Hoping i will get the free gift *shrugg* This post has been edited by zenquix: Dec 24 2019, 05:24 PM |

|

|

|

|

|

zenquix

|

Dec 26 2019, 05:59 PM Dec 26 2019, 05:59 PM

|

|

QUOTE(cucikaki @ Dec 26 2019, 04:38 PM) Call CS to register ur OTP, happened to almost everyone that’s new to the bank last time sadly i think is happening to all new debit cards regardless old or new to bank |

|

|

|

|

|

zenquix

|

Dec 26 2019, 07:05 PM Dec 26 2019, 07:05 PM

|

|

for those running ocbc360 + ocbc360i -- can we repeat the bills or the 3x bills must be to 6 distinct billers/accounts?

|

|

|

|

|

|

zenquix

|

Dec 26 2019, 10:31 PM Dec 26 2019, 10:31 PM

|

|

QUOTE(Leroi2x @ Dec 26 2019, 08:15 PM) Offer letter address put kampung which at rawang Work place kl I currently stay puchong They ask me back rawang…which i seldom back rawang Any1 use the online open account features ,after open online still nid go branch? why not just change the address (free) and get a new IC (RM10) Due to KYC rules, you will need to go to branch just to get the debit card and IC scan with fingerprint This post has been edited by zenquix: Dec 26 2019, 10:46 PM |

|

|

|

|

|

zenquix

|

Jan 3 2020, 09:51 PM Jan 3 2020, 09:51 PM

|

|

QUOTE(rocketm @ Jan 3 2020, 08:34 PM) Do you guys still looking and place fixed deposit since this account giving 4.1%pa of interest? only if got more than 200k funds |

|

|

|

|

|

zenquix

|

Jan 4 2020, 08:37 AM Jan 4 2020, 08:37 AM

|

|

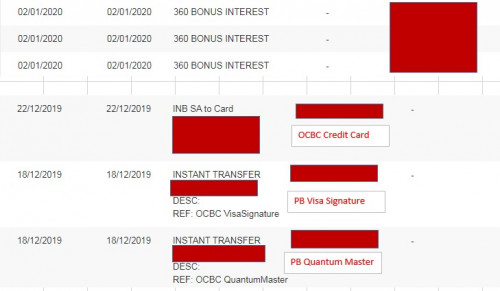

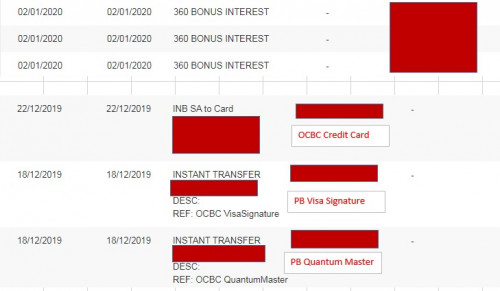

QUOTE(smartfreak @ Jan 3 2020, 11:57 PM) I believe should be OK. I am paying the same set of 3 CC bills (3 different CC numbers) for OCBC 360 and 360i and still entitle for the bonus interest. No need to pay 6 different bills as I thought previously. [attachmentid=10388729] thanks for the sharing |

|

|

|

|

|

zenquix

|

Jan 4 2020, 11:13 PM Jan 4 2020, 11:13 PM

|

|

QUOTE(smartfreak @ Jan 4 2020, 09:10 PM) please note it is 1-time new to bank only. so i would suggest max it out at 300k or don't tap it at all unless expiring. but they seem to be renewing it as of late. |

|

|

|

|

|

zenquix

|

Jan 10 2020, 09:12 PM Jan 10 2020, 09:12 PM

|

|

QUOTE(000022 @ Jan 10 2020, 08:59 PM) Can definitely confirm, opened both 360 and 360i at Puchong branch. Too bad I got rejected from CC application, can't really fulfill all of 360i's condition that way. did u ask for a 2nd debit card for islamic. It is a different entity. QUOTE(mitkey06 @ Jan 10 2020, 09:07 PM) finally receive instruction to claim xiaomi mi band 3 after 3 weeks same. just got the email This post has been edited by zenquix: Jan 10 2020, 09:13 PM |

|

|

|

|

|

zenquix

|

Jan 10 2020, 11:21 PM Jan 10 2020, 11:21 PM

|

|

QUOTE(22 @ Jan 10 2020, 10:28 PM) Am already fulfilling all 3 criterias for the normal 360 account ( I opened this earlier), via the debit card I have. From what I know: 1) An OCBC customer can only have 1 debit card 2) The debit card's criteria transactions may only be linked with 1 main account 3) Therefore if I have no credit card, I cannot link my debit card to the 360i account as the main account, as there is no credit card for me to fulfill 360's account criteria do check as what i was told was OCBC360i added to fast cash. But I cannot add OCBC360 as a primary account (to check balance) because OCBC360i is already an islamic account. When the staff was clicking the application screen, i can see Debit Card, and Debit-Card-i. That's why I am thinking maybe can get a separate debit card for your islamic account |

|

|

|

|

|

zenquix

|

Jan 12 2020, 11:30 AM Jan 12 2020, 11:30 AM

|

|

can anyone confirm paying my OCBC credit card counts as 1 bill payment? Their T&C is not clear.. QUOTE Pay Bonus Interest

A minimum of 3 Bill Payments must be made from your OCBC 360 Account within the calendar month to be eligible for the Pay Bonus

Interest. This includes payment via standing instruction to your OCBC home loan facility and/or retail payment channel of OCBC

Online Banking to:

(a) your OCBC/OCBC Al-Amin home loan facility; or

(b) any account with any bank or financing institution other than the Bank and OCBC Al-Amin Bank Berhad (Company No.

200801017151 / 818444-T); or

© any participating billing organisations; or

(d) payment by Interbank GIRO/Duitnow conducted through OCBC Online Banking, but excluding any payment by the

Financial Process Exchange (FPX) platform.

Multiple payments within the calendar month to the same merchant/payee/account/billing organization shall be deemed as one Bill

Payment. For example:

(a) multiple payments to the same home loan facility account; or

(b) multiple payments to the same participating billing organisation, unless each payment is uniquely identified to a different

account; or

© multiple payments to the same account with any bank or financing institution |

|

|

|

|

|

zenquix

|

Jan 12 2020, 10:27 PM Jan 12 2020, 10:27 PM

|

|

QUOTE(smartfreak @ Jan 12 2020, 07:02 PM) If my understanding is correct, I believe yes when I check their website. https://www.ocbc.com.my/personal-banking/accounts/360/Pay at least 3 bills online every month. Suggestions Use OCBC Internet Banking to pay your credit cards, loans or bills from over 1,400 billers with JomPay Bills include your credit cards, loans and installments with OCBC or other banks. hmm thanks. their T&C very vague on this.. so hoping someone has tried. |

|

|

|

|

|

zenquix

|

Jan 12 2020, 10:28 PM Jan 12 2020, 10:28 PM

|

|

-dup-

This post has been edited by zenquix: Jan 13 2020, 01:00 AM

|

|

|

|

|

|

zenquix

|

Jan 13 2020, 11:18 PM Jan 13 2020, 11:18 PM

|

|

QUOTE(smartfreak @ Jan 13 2020, 04:18 PM) After double checking the bank statement, OCBC CC payment is counted as 1 payments also for paying bills.  QUOTE(avinlim @ Jan 13 2020, 05:31 PM) Yes, cc payment, instant transfer to SA/CA, duitnow, all counted as eligible transaction as bill payment. *Note: Providing not multiple payment to same acc no that consider as 1 payment only. thanks! |

|

|

|

|

Dec 4 2019, 09:42 PM

Dec 4 2019, 09:42 PM

Quote

Quote

0.0189sec

0.0189sec

0.85

0.85

7 queries

7 queries

GZIP Disabled

GZIP Disabled