Outline ·

[ Standard ] ·

Linear+

OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

|

contestchris

|

Mar 11 2021, 09:10 PM Mar 11 2021, 09:10 PM

|

|

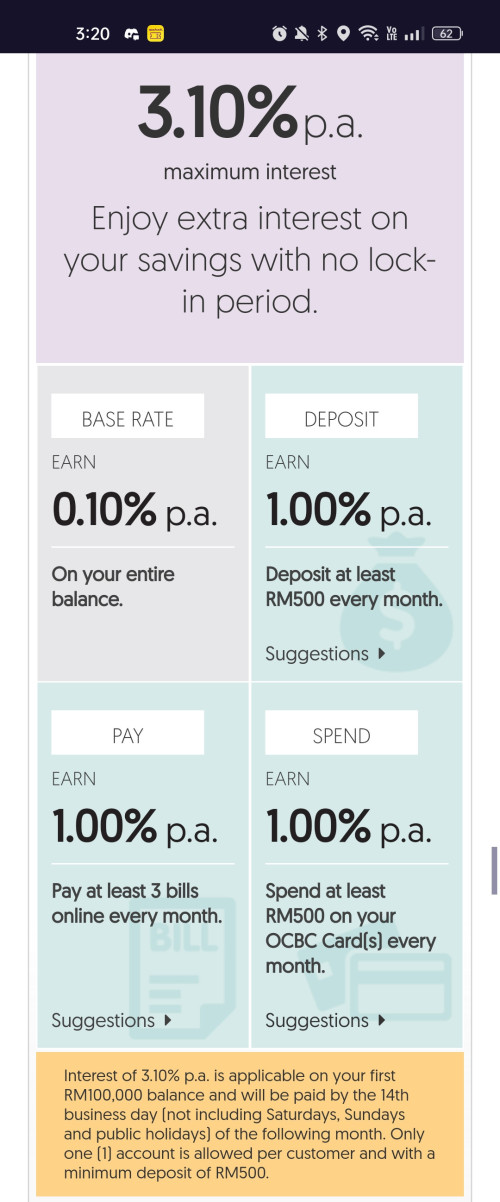

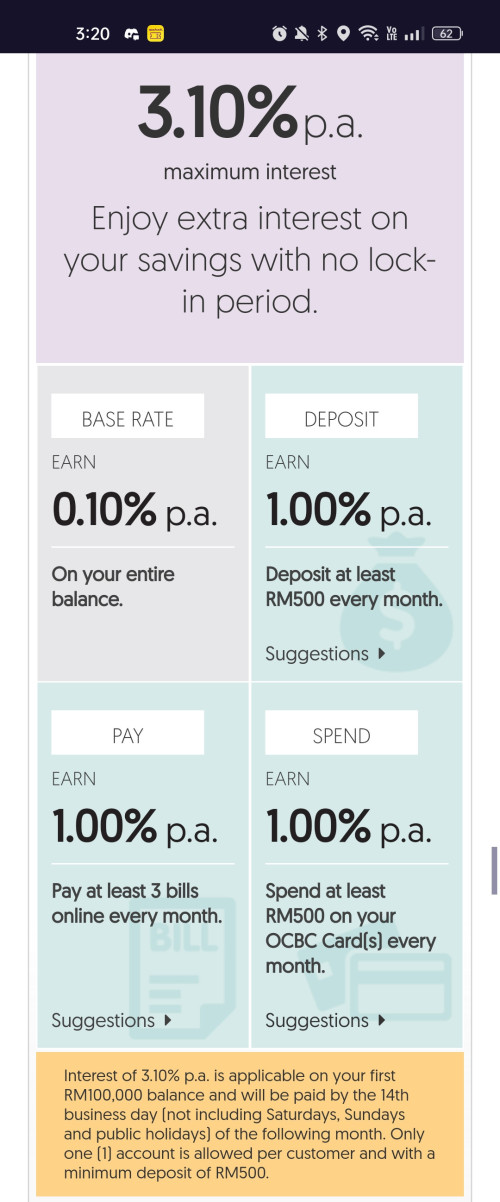

0.05% - Base Interest (based on current Board Rate for Savings)

0.70% - Deposit minimum RM500 per month

0.70% - Pay minimum 3 bills via OCBC 360 Account using OCBC Online Banking portal (includes Standing Instructions for Loan repayment and OCBC Credit Card payment)

0.70% - Spend minimum RM500 on your OCBC Credit Card

Guys I have my salary credited into OCBC Bank. Every month I get 2 bonus interests. The base interest is at the end of the month, then the two lines of bonus interest is usually at the beginning of the month.

How did I get my second bonus interest? I do not have a OCBC Credit Card. I have never used my debit card. I do not pay bills through my OCBC account either.

Usually, the only major transaction I do is "pay off" (i.e. transfer to) my Standard Chartered credit card. This amount is >RM500 every month. Other than that, just some cash withdrawals / cash transfer to other bank account.

|

|

|

|

|

|

contestchris

|

Mar 11 2021, 10:38 PM Mar 11 2021, 10:38 PM

|

|

QUOTE(myownworld @ Mar 11 2021, 10:18 PM) If you check your statement it should say 360 payment bonus. Transferring money via Duitnow (bank account transfer) counts as paying bills so doing 3 bank transfers a month qualifies you for the 360 payment bonus. I don’t think I do it three times tho. Once for credit card, another time to transfer to my other savings account. So that’s twice. Occasionally there are more transactions, but that’s not usually the case. That’s why I am curious |

|

|

|

|

|

contestchris

|

Mar 11 2021, 11:52 PM Mar 11 2021, 11:52 PM

|

|

QUOTE(myownworld @ Mar 11 2021, 10:49 PM) Just check your statement to find out the eligible transactions. The spend bonus is very specific and since you said you don't have an OCBC credit card and never used the debit card it can't be the cc spend bonus. You are right, payment bonus. Thank you! |

|

|

|

|

|

contestchris

|

Mar 12 2021, 04:37 PM Mar 12 2021, 04:37 PM

|

|

Can the RM8 annual fee for debit card be waived? If yes, how? Will I get to keep using the online naming facilities and ATM?

I have never once used my debit card. So I just rather cancel that functionality and what for pay annual fee.

|

|

|

|

|

|

contestchris

|

Mar 29 2021, 08:37 PM Mar 29 2021, 08:37 PM

|

|

QUOTE(netken @ Mar 29 2021, 02:31 PM) is the OCBC phone app down? can't access even though reinstalled ... OCBC phone app really sucks man |

|

|

|

|

|

contestchris

|

Apr 19 2021, 02:46 PM Apr 19 2021, 02:46 PM

|

|

I do not hit the 3rd pillar for debit/credit card spend of RM500.

Is it somehow possible to use my debit card to pay my credit card from other bank? Any creative way to hit this?

|

|

|

|

|

|

contestchris

|

Aug 2 2021, 09:22 AM Aug 2 2021, 09:22 AM

|

|

I only got credit for 2 bonus pillars. I spent more than rm500 on debit card, so should be getting credit for 3 bonus pillars, no?

Been always getting the save and pay bonus pillars, so no issue there I think.

This post has been edited by contestchris: Aug 2 2021, 09:23 AM

|

|

|

|

|

|

contestchris

|

Aug 2 2021, 01:44 PM Aug 2 2021, 01:44 PM

|

|

QUOTE(rojakwhacker @ Aug 2 2021, 12:55 PM) Just some highlights, 1) Are you OCBC 360 saving account a joint account? 2) Pay 3 different bills Do you use OCBC 360 saving account to pay 3 different bills/ fund transfer? I read you past comment, you paid include Standing instructions for loan repayment and OCBC Credit card payment. So it is counted as 2 payments, what are the thrid payment? (FPX not counted). 3) Deposit minimum RM500 I guess you already did deposit in July 2021. 4) Spend minimum RM500 with OCBC Credit card or Debit card. When is the posting date of your spending? Yes I consistently use the deposit and spend, and always get 2x bonus for those. This time I used Mastercard Debit on 15 July rm515, but I still get 2x bonus, not 3x bonus as I had expected. |

|

|

|

|

|

contestchris

|

Aug 2 2021, 02:01 PM Aug 2 2021, 02:01 PM

|

|

Checked with OCBC. It is because FPX not counted for the payment pillar. I used FPX to pay Syabas bill via the app. Damn

|

|

|

|

|

|

contestchris

|

Oct 6 2021, 12:44 PM Oct 6 2021, 12:44 PM

|

|

QUOTE(rojakwhacker @ Oct 6 2021, 11:53 AM) From search of this thread, for direct debit from debit card is consider as Spend category. While standing instruction is consider as Pay category. Yes correct. Pay with card = spend, pay with account balance = pay. |

|

|

|

|

|

contestchris

|

Oct 27 2021, 09:53 AM Oct 27 2021, 09:53 AM

|

|

Will OCBC 360 benefits increase more to compete better, or this is as good as it gets? Otherwise, might seriously consider going to RHB.

|

|

|

|

|

|

contestchris

|

Nov 5 2021, 05:44 PM Nov 5 2021, 05:44 PM

|

|

QUOTE(DragonReine @ Nov 5 2021, 11:35 AM) This is bullcrap and reportable for violation of conduct/ethics code to BNM. Access to savings/current account is a basic right, banks cannot enforce the need to apply credit facility/insurance scheme before opening a cash account. The only way that they can deny you is if they suspect you're involved in criminal activity. Bank can refuse to open an account for you, except for a BASIC SAVINGS ACCOUNT / BASIC CURRENT ACCOUNT which is FREE and mandated by BNM. For all other products, including the Bank's own savings/current account offerings, the bank can refuse to open accounts for any damn reason. |

|

|

|

|

|

contestchris

|

Mar 9 2022, 02:15 PM Mar 9 2022, 02:15 PM

|

|

QUOTE(jerebubu @ Mar 8 2022, 11:01 AM) I was thinking to cancel the debit card to avoid the rm8/12 charges because there's so limited OCBC atm machine around. I don't think I had withdraw from a OCBC atm machine before. Usually i will online transfer from ocbc SA to maybank/ambank SA first, then withdraw from their atm machine. Yes, call and cancel the debit card, but keep OCBC 360 active cause it might come in handy in the future. |

|

|

|

|

|

contestchris

|

Jul 21 2022, 11:31 PM Jul 21 2022, 11:31 PM

|

|

QUOTE(superahdang @ Jul 21 2022, 07:08 PM) 2.30%? I think currently they are running a 2Spend & 2 Save campaign from 1June -31 Aug which offer rate up to 2.50%p.a. for 3 months. Even higher than 3-mnths FD board rate. I thnk can open and try out 360 during this period, somemore can stand a double chances/entries to win grand prize to Italy. I think not many ppl joining the campaign hence the chances of wining prize is quite high tho.   RHB Smart still at 2.85%, most superior HY savings account. |

|

|

|

|

|

contestchris

|

Jul 23 2022, 01:11 PM Jul 23 2022, 01:11 PM

|

|

QUOTE(superahdang @ Jul 22 2022, 09:38 AM) OCBC is easier to achieve la. and now got the lucky draw campaign, i think worth to open and try out. What campaigns? |

|

|

|

|

|

contestchris

|

Sep 6 2022, 03:59 PM Sep 6 2022, 03:59 PM

|

|

QUOTE(Hinote @ Sep 5 2022, 03:29 AM) Stumbled across HLB Pay&Save recently, high interest and seems not difficult to achieve (unless I missed the catch? If any). I wonder why not much mention of it here on LYN... What do you guys think on Pay&Save vs 360? Am thinking to switch out from OCBC. Because HLB Pay&Save account still loses out to RHB Smart account. 2.65% vs RHB's 2.85%, plus RHB's tiers are much easier to hit. |

|

|

|

|

|

contestchris

|

Sep 26 2022, 10:55 PM Sep 26 2022, 10:55 PM

|

|

QUOTE(sidefulnes @ Sep 26 2022, 03:20 PM) Damn that’s getting closer to RHBs 2.85%. I wonder how long before RHB Smart revises rates… |

|

|

|

|

|

contestchris

|

Sep 30 2022, 12:31 AM Sep 30 2022, 12:31 AM

|

|

QUOTE(Hinote @ Sep 29 2022, 11:56 AM) Did you or anyone managed to get their annual fee waived? Tried twice and both got rejected... Bummer.  Feel like cancelling the card (and 360 account altogether?!) but already paying for the annual fee...  And now with the new rate looks better (succumbing to it). Cancel the card but keep the account, what so difficult. |

|

|

|

|

|

contestchris

|

Nov 16 2022, 12:06 AM Nov 16 2022, 12:06 AM

|

|

QUOTE(smartfreak @ Nov 14 2022, 11:33 PM) Damn man why RHB Smart is not revising their rate!!! |

|

|

|

|

|

contestchris

|

Dec 7 2022, 11:53 AM Dec 7 2022, 11:53 AM

|

|

QUOTE(DragonReine @ Nov 29 2022, 03:21 PM) Can do pre-approval online but still need to go to branch to officially verify and open account. The savings interest is conditional, not "passive" like MBSB wise saver, if you don't hit all 3 of the spend/save/pay monthly goals you will not get good interest rate.  RM8 yearly for ATM debit card annual fee. You can eventually cancel the card, so no AF |

|

|

|

|

Mar 11 2021, 09:10 PM

Mar 11 2021, 09:10 PM

Quote

Quote

0.9485sec

0.9485sec

0.87

0.87

7 queries

7 queries

GZIP Disabled

GZIP Disabled