Anyone still have missing one Bonus profit for March 2021?

OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

|

|

Apr 6 2021, 12:22 PM Apr 6 2021, 12:22 PM

Show posts by this member only | IPv6 | Post

#2701

|

Senior Member

1,628 posts Joined: May 2013 |

Anyone still have missing one Bonus profit for March 2021?

|

|

|

|

|

|

Apr 6 2021, 12:54 PM Apr 6 2021, 12:54 PM

Show posts by this member only | IPv6 | Post

#2702

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(rocketm @ Apr 6 2021, 12:22 PM) Still processing kot, they say they'll be manually crediting in to affected accounts by 15 Apr rocketm liked this post

|

|

|

Apr 6 2021, 06:08 PM Apr 6 2021, 06:08 PM

|

Senior Member

1,509 posts Joined: Sep 2019 |

QUOTE(rocketm @ Apr 6 2021, 12:22 PM) Yes, still waiting for the manual credit. rocketm liked this post

|

|

|

Apr 6 2021, 07:18 PM Apr 6 2021, 07:18 PM

|

Senior Member

2,175 posts Joined: May 2019 |

QUOTE(rocketm @ Apr 6 2021, 12:22 PM) Mine all in on 2nd April. rocketm liked this post

|

|

|

Apr 6 2021, 09:23 PM Apr 6 2021, 09:23 PM

|

Senior Member

889 posts Joined: Jun 2008 |

QUOTE(rocketm @ Apr 6 2021, 12:22 PM) Yeah, still missing bonus profit and waiting for it. rocketm liked this post

|

|

|

Apr 9 2021, 07:53 AM Apr 9 2021, 07:53 AM

|

Senior Member

889 posts Joined: Jun 2008 |

Just check acc, my missing bonus profit is in this morning

|

|

|

|

|

|

Apr 9 2021, 09:36 AM Apr 9 2021, 09:36 AM

|

Senior Member

2,965 posts Joined: Jul 2014 |

The send sms said credit the miss out bonus.

|

|

|

Apr 9 2021, 09:48 AM Apr 9 2021, 09:48 AM

Show posts by this member only | IPv6 | Post

#2708

|

Senior Member

1,628 posts Joined: May 2013 |

I got mine too.

Just to confirm the base interest of 0.05% pa is for maintaining balance at least RM500? I got another sub-account, I got the profit amount for something. |

|

|

Apr 9 2021, 10:02 AM Apr 9 2021, 10:02 AM

|

Senior Member

1,509 posts Joined: Sep 2019 |

Got mine as well.

QUOTE 09/04/2021 09/04/2021 BULK CREDIT XX.XX QUOTE RM0.00 OCBC: We have credited the Pay Bonus for your OCBC 360 Account-i on 9/4/2021. We apologise for the delay. Please call 03 8314 9310 for more information. |

|

|

Apr 9 2021, 10:43 AM Apr 9 2021, 10:43 AM

Show posts by this member only | IPv6 | Post

#2710

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(rocketm @ Apr 9 2021, 09:48 AM) I got mine too. Base interest is constant irregardless of minimum balance, calculated based on monthly average balance.Just to confirm the base interest of 0.05% pa is for maintaining balance at least RM500? I got another sub-account, I got the profit amount for something. rocketm liked this post

|

|

|

Apr 19 2021, 01:53 PM Apr 19 2021, 01:53 PM

Show posts by this member only | IPv6 | Post

#2711

|

Senior Member

1,744 posts Joined: Nov 2007 |

in terms of interest rate,is saving money here better or putting my money in stashaway simple ..say i got a lumpsum of RM15k?

|

|

|

Apr 19 2021, 02:04 PM Apr 19 2021, 02:04 PM

Show posts by this member only | IPv6 | Post

#2712

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(~Curious~ @ Apr 19 2021, 01:53 PM) in terms of interest rate,is saving money here better or putting my money in stashaway simple ..say i got a lumpsum of RM15k? 1) Are you going to use OCBC 360 actively as a regular savings account? Then OCBC 360 is, for the moment, the better cboice.If your goal is to save and forget about it, you don't want to touch the account at all, then use StashAway Simple/Versa. OCBC 360 is better only if you're able to hit the bonus interest rate, which means you must actively spend minimum RM500 per month using the debit card, deposit minimum RM500 per month, and pay 3 bills per month. The moment you miss one of these bonus tiers, your interest rate for that calendar month will be affected. 2) Is liquidity important (i.e. how quick you want to withdraw money in case of emergencies)? OCBC is instant assess since you can assess the money via any MEPS ATM/online banking/DuitNow/MasterCard function on debit card. StashAway Simple takes at least 3 business days to withdraw from StashAway to your banking account, while money is sitting in StashAway Simple you cannot use the money at all to pay bills etc. |

|

|

Apr 19 2021, 02:46 PM Apr 19 2021, 02:46 PM

Show posts by this member only | IPv6 | Post

#2713

|

Senior Member

5,559 posts Joined: Aug 2011 |

I do not hit the 3rd pillar for debit/credit card spend of RM500.

Is it somehow possible to use my debit card to pay my credit card from other bank? Any creative way to hit this? |

|

|

|

|

|

Apr 19 2021, 03:00 PM Apr 19 2021, 03:00 PM

|

Senior Member

2,175 posts Joined: May 2019 |

QUOTE(contestchris @ Apr 19 2021, 02:46 PM) I do not hit the 3rd pillar for debit/credit card spend of RM500. You can hit RM500 mark, if you use Ewallet to pay for daily expense (petrols, meals, utility bills, phone bills, etc).Is it somehow possible to use my debit card to pay my credit card from other bank? Any creative way to hit this? |

|

|

Apr 19 2021, 03:09 PM Apr 19 2021, 03:09 PM

Show posts by this member only | IPv6 | Post

#2715

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(contestchris @ Apr 19 2021, 02:46 PM) I do not hit the 3rd pillar for debit/credit card spend of RM500. No, must make use of the 16 digit number on card (i.e. the MasterCard function) of debit card.Is it somehow possible to use my debit card to pay my credit card from other bank? Any creative way to hit this? Easiest way is to use it to reload RM500 in one go to your ewallet like Grab, Touch-n-Go, ShopeePay etc. and use ewallet for daily expenses, and/or use credit/debit card standing instruction for monthly insurance premium payment. This post has been edited by DragonReine: Apr 19 2021, 03:11 PM |

|

|

Apr 19 2021, 03:30 PM Apr 19 2021, 03:30 PM

|

Senior Member

6,266 posts Joined: Jul 2005 From: UEP Subang Jaya |

QUOTE(contestchris @ Apr 19 2021, 02:46 PM) I do not hit the 3rd pillar for debit/credit card spend of RM500. Some (I think all) of the ewallets can reload unlimited from debit cards.Is it somehow possible to use my debit card to pay my credit card from other bank? Any creative way to hit this? Some ewallets can withdraw to bank. Some are even free for that. Check the respective threads. |

|

|

Apr 20 2021, 02:21 PM Apr 20 2021, 02:21 PM

Show posts by this member only | IPv6 | Post

#2717

|

Junior Member

205 posts Joined: Aug 2013 |

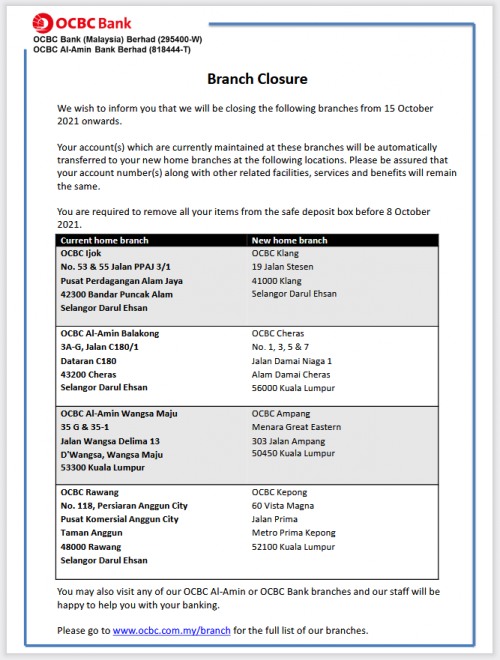

Some branches will be closing

https://www.ocbc.com.my/assets/pdf/notices/...ice_15Oct21.pdf  This post has been edited by ckh6003: Apr 20 2021, 02:23 PM |

|

|

Apr 22 2021, 01:51 PM Apr 22 2021, 01:51 PM

Show posts by this member only | IPv6 | Post

#2718

|

Senior Member

1,744 posts Joined: Nov 2007 |

QUOTE(DragonReine @ Apr 19 2021, 02:04 PM) 1) Are you going to use OCBC 360 actively as a regular savings account? Then OCBC 360 is, for the moment, the better cboice. hrmm u brought up a point i overlooked..about liquidity thanksIf your goal is to save and forget about it, you don't want to touch the account at all, then use StashAway Simple/Versa. OCBC 360 is better only if you're able to hit the bonus interest rate, which means you must actively spend minimum RM500 per month using the debit card, deposit minimum RM500 per month, and pay 3 bills per month. The moment you miss one of these bonus tiers, your interest rate for that calendar month will be affected. 2) Is liquidity important (i.e. how quick you want to withdraw money in case of emergencies)? OCBC is instant assess since you can assess the money via any MEPS ATM/online banking/DuitNow/MasterCard function on debit card. StashAway Simple takes at least 3 business days to withdraw from StashAway to your banking account, while money is sitting in StashAway Simple you cannot use the money at all to pay bills etc. |

|

|

Apr 25 2021, 03:20 PM Apr 25 2021, 03:20 PM

|

Senior Member

1,744 posts Joined: Nov 2007 |

1. Whats the cut-off date for interest accumulation?

2. and how do I know which date every month is the beginning of a new cycle? e.g. I have RM1000 which I deposited on 23rd April which is the only transaction I've made for this cycle. Hence assuming the cycle ends on 30th Aprl, my total interest would be about 0.9/365*7*1000 izzit? |

|

|

Apr 25 2021, 04:01 PM Apr 25 2021, 04:01 PM

Show posts by this member only | IPv6 | Post

#2720

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(~Curious~ @ Apr 25 2021, 03:20 PM) 1. Whats the cut-off date for interest accumulation? Interest are calculated based on monthly average balance, so the cycle starts every 1st day of the month and ends every last day of the month. 2. and how do I know which date every month is the beginning of a new cycle? e.g. I have RM1000 which I deposited on 23rd April which is the only transaction I've made for this cycle. Hence assuming the cycle ends on 30th Aprl, my total interest would be about 0.9/365*7*1000 izzit? All bonuses are applicable to the WHOLE MONTH as long as your eligible transactions are posted (i.e. reflected in your balance and statement) within that month to fulfill the criteria. You may check the illustrated examples in the OCBC 360 product information document (attached PDF) to see how it's calculated. This post has been edited by DragonReine: Apr 25 2021, 04:03 PM Attached File(s)  360_Account_PIS_ENG.pdf ( 488.37k )

Number of downloads: 7

360_Account_PIS_ENG.pdf ( 488.37k )

Number of downloads: 7 |

| Change to: |  0.0391sec 0.0391sec

0.53 0.53

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 06:46 PM |