QUOTE(ultimate93 @ Mar 26 2021, 10:53 AM)

Hi guys, recently found out this saving acct is quite interesting, plan to open a jointly-held acct with my wife

Anyone can let me know

1. If secondary account holder to apply the CC but not the primary holder?

2. Can OCBC pay other bank's CC and counted as one of the eligible "bill" ?

3. Can I opt to not have the atm (debit) card ?

TQTQ

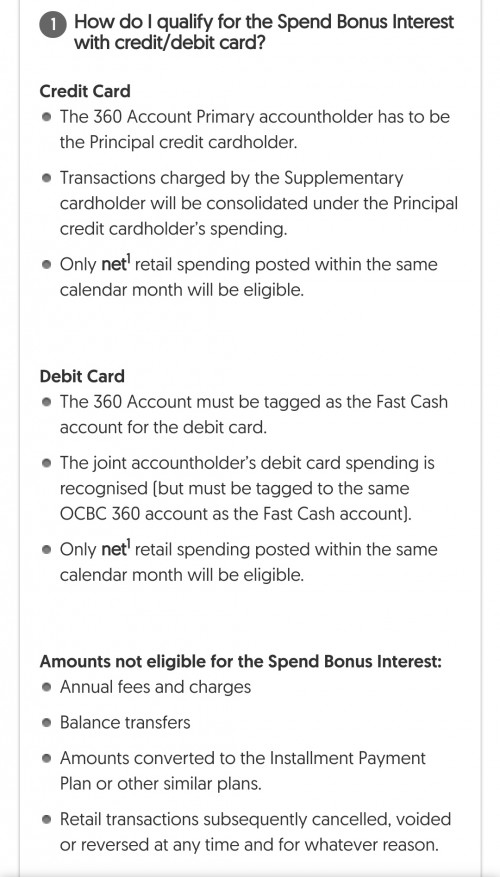

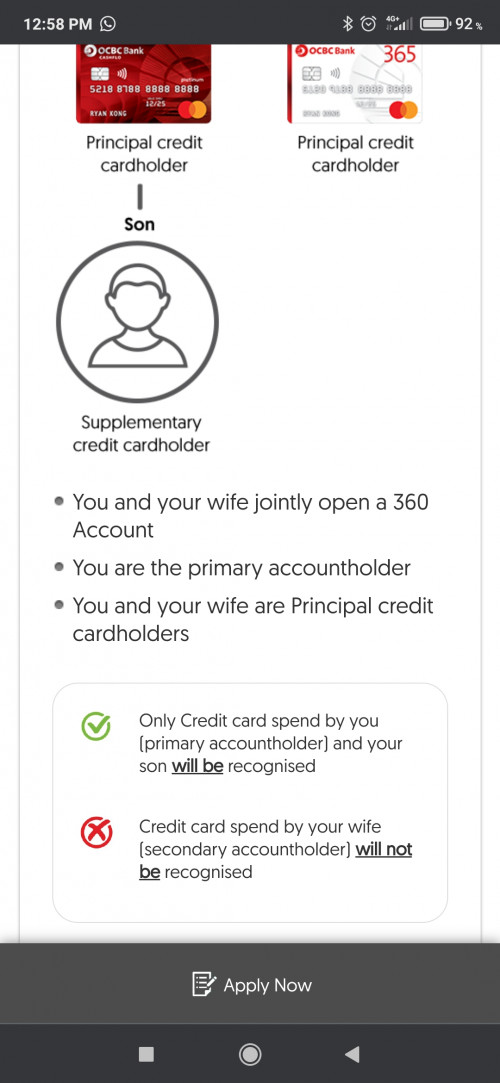

1) Secondary account holder cannot use their CC to get Spend bonus, as per OCBC 360 info page:

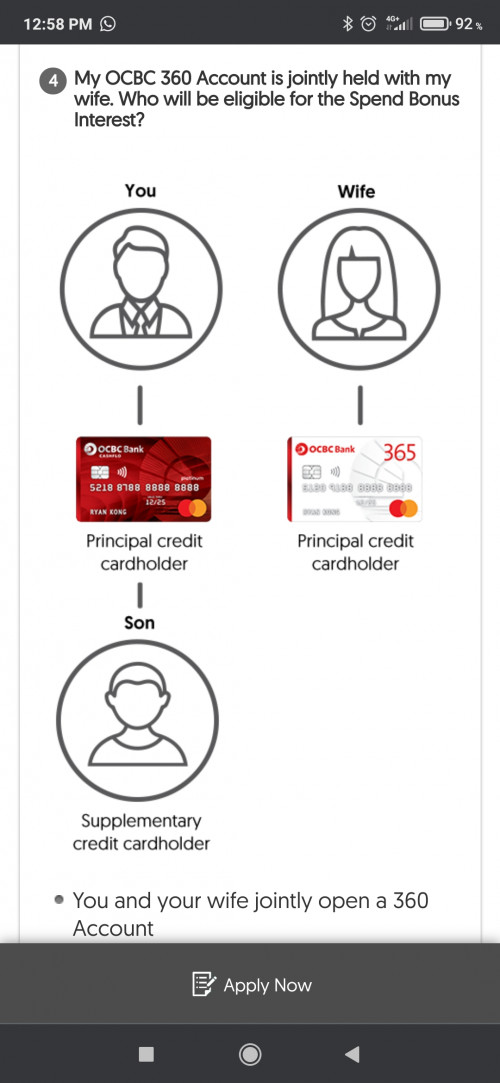

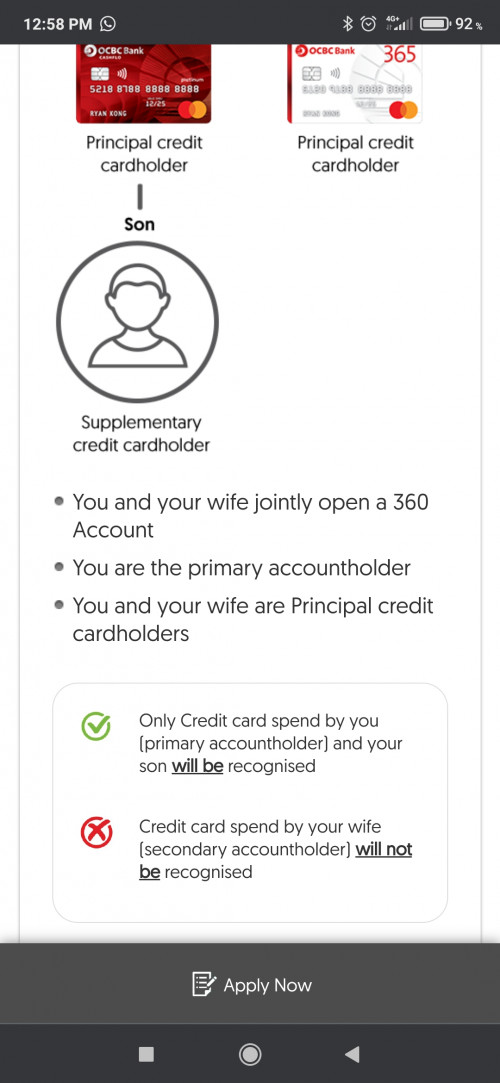

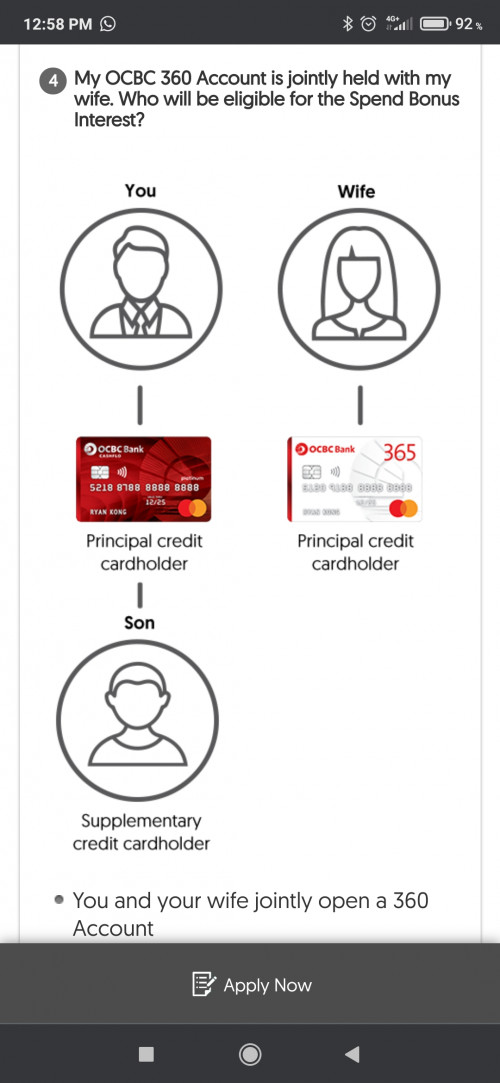

https://www.ocbc.com.my/personal-banking/accounts/360/#divd3You and your wife jointly open a 360 Account

You are the primary accountholder

You and your wife are Principal credit cardholders

✅Only Credit card spend by you (primary accountholder) and your son (supplement CC from your CC) will be recognised

❌

Credit card spend by your wife (secondary accountholder) will not be recognised

however OCBC Malaysia have not been accepting any new credit card applications from last year's MCO (see #3)

2) Yes, through Transfer Funds > Other Bank's Account > Credit Card Payment. Qualify for "Bill" bonus.

3) OCBC based in Malaysia actually not accepting new-to-bank credit card applications for now, last I checked (December 2020), so if you want the Spend bonus you need to get Debit+ATM card. They might have changed policies recently but I would note that I've received zero advertising material for credit cards, so they're most likely still not accepting new application. You may enquire their branch/hotline to check.

Jan 18 2021, 04:38 PM

Jan 18 2021, 04:38 PM

Quote

Quote

0.0919sec

0.0919sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled