QUOTE(cybpsych @ Mar 7 2023, 12:20 PM)

no idea. i assume no further requests = no further action

not like I want to keep digging lhdn for answers

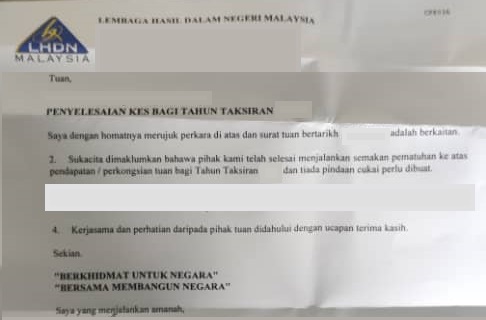

when they sent you a letter for audit

they will also send you a letter when it has been completed

» Click to show Spoiler - click again to hide... «

QUOTE(Jack&Guild @ Mar 7 2023, 12:40 PM)

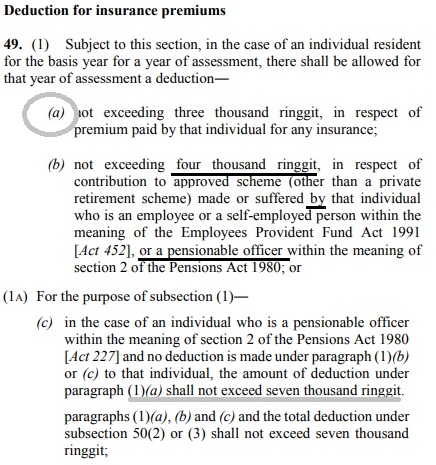

Yep I am officer under pension scheme. For me to enjoy tax relief YA2023, maybe I should self contribute RM7k to the max limit for epf this time.

while you may claim life insurance up to RM 7k as a pensionable officer but

EPF relief is still being restricted to RM 4,000 for voluntary contribution

» Click to show Spoiler - click again to hide... «

QUOTE(Xitox @ Mar 7 2023, 01:21 PM)

Hello guys, my wife's former employer has refused to provide an EA form and EPF contributions were only made during the last 2 months of her employment. What is the appropriate way for my wife to declare her income?

while i agree to MUM's proposal -

QUOTE

you can still file your taxes for income (and other relevant contributions) received during your previous job. You’ll need to manually combine all details via salary slips and other statements (EPF, SOCSO, MTD) to complete the full year’s assessment

the problem is, during LHDN audit, they will still request for EA form as supporting document

Mar 7 2023, 01:21 PM

Mar 7 2023, 01:21 PM

Quote

Quote

0.0258sec

0.0258sec

0.92

0.92

6 queries

6 queries

GZIP Disabled

GZIP Disabled