as per latest Budget proposal as at

06/11/2020

16:43

The maximum tax relief for individual, spouse and children's medical expenses for serious medical ailments raised to RM8,000 from RM6,000

16:45

Tax relief

The government will raise the tax relief limit on personal, spouse and child medical treatment for serious illnesses from RM6,000 to RM8,000. In addition, the tax relief for a full health screening will be increased from RM500 to RM1,000.

The tax relief on expenses for medical treatment, special needs and parental care has also been raised from RM5,000 to RM8,000.

16:48

the government will expand the scope of tax exemption for the medical treatment covering vaccination expenses such as pneumococcal, influenza and Covid-19.

Tax exemption will be given for the vaccination costs for self, spouses and children limited to RM1,000.

17:08

LOWER TAXES … for some

The income tax of those earning between RM50,001 and RM70,000 will be lowered by one percentage point, expected to benefit 1.4 million taxpayers.

For a period of two assessment years, the income tax exemption limit for compensation paid upon job loss will be increased from RM10,000 to RM20,000 for every year of service completed.

17:31

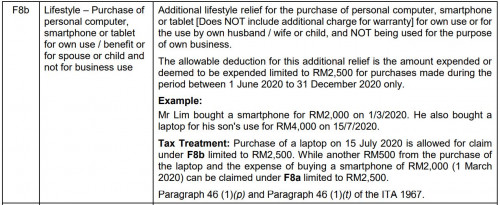

Higher lifestyle tax relief

The limit of the ‘lifestyle tax relief’ has been raised from RM2,500 to RM3,000, which is an increase of RM500 specifically for sports-related expenditure, including entrance participation fees for sports competitions. The scope of the relief has also been expanded to include subscription to electronic newspapers.

https://www.thestar.com.my/news/nation/2020...t-2021-liveblogNew budget never benefit m40 much... Useless

Nov 1 2020, 11:14 PM

Nov 1 2020, 11:14 PM

Quote

Quote

0.2631sec

0.2631sec

0.26

0.26

7 queries

7 queries

GZIP Disabled

GZIP Disabled