QUOTE(cute_boboi @ Jul 8 2024, 10:38 PM)

Click on my name's "Show posts by this member only" in this HSBC thread. There are a few posts about BNM.

» Click to show Spoiler - click again to hide... «

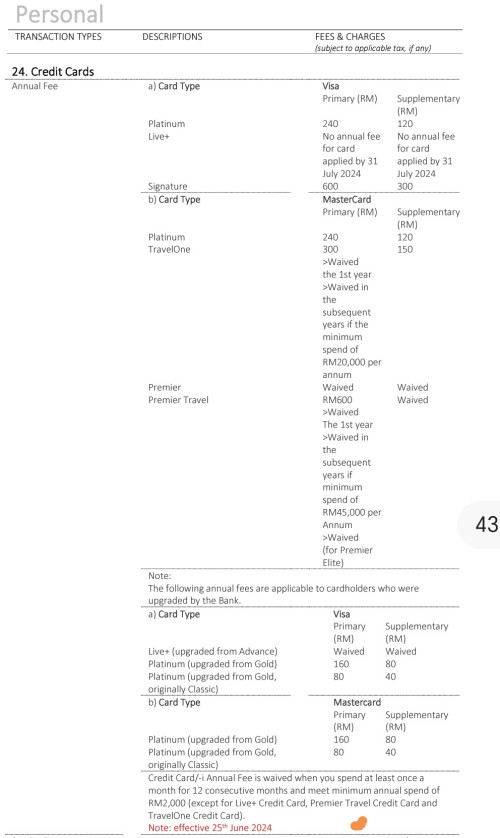

Yours is SST only. Mine is with the AF. If it’s just SST, I will probably close both eyes and settle but RM 600 for AF.

Can I use your case to include AF as well?

QUOTE(ericlaiys @ Jul 8 2024, 10:41 PM)

nothing related to BNM. it is depend on bank good will. besides, it is always a risk that bank wont waive annual fees. TNC did not say this card can waive annual fees. Some sites say use 2k or swipe 12x to waive however u wont find this info from bank tnc. That why always check bank cc tnc. U will lose if u don't have any doc tnc from bank to support it.

your best try is pay off the outstanding, cancel the card and see if retention team allow to counter offer.

You can read page 1 on this topic.

my bad experience is on Standard chartered. they revised the tnc and did not honor my welcome gift after 6 month.

Keep say new tnc does not meet requirement. Lucky I save the old tnc and showed to them. then they admit changed the tnc and give me welcome gift as they sure lost when I bring to bnm. However, I already dislike that bank as they did the same for jumpstart promo. So I 've terminated SC cc, follow by saving ACC & lastly jump start. say bye bye to that bank forever. Lesson learned, initially I plan to apply HSBC VS but found this loopholes. Therefore abort applying this card.

I’m not going to pay for RM 625 for something which I don’t use.

QUOTE(adele123 @ Jul 8 2024, 11:20 PM)

Use the chat function in the hsbc app and reach out to them again since you are overseas now. Never know whether another CS will be able to solve for you.

I will do that when I’m back using chat function now. Tomorrow busy going around and if I have time in airport I will do it.

QUOTE(wjleong15 @ Jul 8 2024, 11:32 PM)

Is the attachment useful for me to fight when I escalate to BNM?

Jun 27 2024, 08:14 PM

Jun 27 2024, 08:14 PM

Quote

Quote

0.0312sec

0.0312sec

0.44

0.44

6 queries

6 queries

GZIP Disabled

GZIP Disabled