https://forum.lowyat.net/topic/609001/+3760

Why Invest In Stocks?

Investing is making your money work for you by getting your money to generate more money. Investing in stocks has consistently proven to be one of the most profitable forms of investment available.

The benefits include:

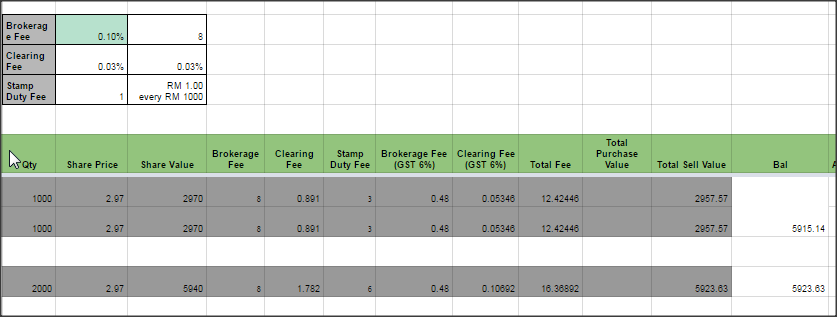

Immediate Buy/Sell so you can sell part of your investment any time. Very low transaction cost.

The freedom to work at your own place, at your pace in your own time.

Easy monitoring - log in to the market from anywhere in the world.

Being able to maximise returns whilst spreading your risk.

A predictable form of investment if you know what you're doing.

Putting you in control and freeing you of fund management fees.

Considerable tax advantages.

Things to watch out for:

The market can be a volatile place.

You must acquire knowledge of what you are doing.

You must monitor your investments.

You must learn the discipline to enter and exit the market on entry and exit signals.

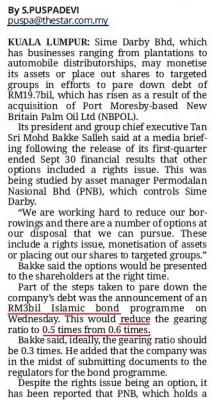

Buying and Selling Stocks

The thought of buying and selling stocks can seem daunting for a beginner but it is quite simple and will grow on you quite quickly once you have some practice. One essential thing to know is that you must go through a broker to buy and sell stocks, only a licensed broker can deal directly with the stock market.

» Click to show Spoiler - click again to hide... «

Investing Basics

Contra Trading

Contra is the buying or selling of stocks without having to pay for the cost of the stocks. Once you buy the stocks on contra, you will have to sell the stocks within T+3. At the end of that period, you will have to pay for the difference between your initial buying price and selling price.

If you accidentally hold your shares to T+4, but you do not have $$$ to settle the total value in the shares bought, the broker will force sell your holding at any price, and you will be liable for the difference (Bad case, the losses).

This post has been edited by nexona88: May 19 2015, 12:23 PM

Sep 19 2014, 06:47 PM, updated 11y ago

Sep 19 2014, 06:47 PM, updated 11y ago

Quote

Quote

0.3128sec

0.3128sec

0.55

0.55

6 queries

6 queries

GZIP Disabled

GZIP Disabled