Warrants - The confusion, the headaches and the frustrationContent ----------------------------------------------------------------

a) The basics of warrants

b) What is warrants?

c) What happens when warrants are issued?

d) Why are warrants issued?

e) Why buy warrants if common stocks can also increase in price?

f) What happens to warrants later on until expiry?

g) How and when to trade warrants?

-----------------------------------------------------------------------------

If you're lazy to read further and wants to know immediately what a warrant is, just think of warrant as a tool, a small knife to cut big tree (as we LYN people like to say).

Warrant is a high risk but high return investment where you can use relatively less money to get huge gains. Just don't forget that if you cut the big tree the wrong way, you can get flatten when the tree falls on you!!! Just like what can happen to the warrant price on expiry.... fall flat to a price of ZERO!

In summary, warrants means getting the maximum return with the least amount of your capital at risk

Disclaimer : I do not pretend I know about warrants. In fact, before this project, I knew NOTHING about warrants. Whatever facts below are taken from the internet with the references at the end. I just try to organize, summarize and make it as simple to understand as possible. The information is provided free without any charge. If not, I might get sued for copyright infringement/violation, plagiarism and what not!

Also, no warrant was sold or exercised during the production of this subtopic.

Update : There's an excellent website regarding warrants that recently came out, much better than my guide!!!

http://www.nagawarrants.com/home.htmlThe basics of warrantsIn order to understand warrants, we need to go back to the very basics of basics. The explanation will be thorough so that you don't miss any step.

Before reading on, here are the important terms that you need to understand when you deal with warrants:

Common stock - The normal stocks that is traded in the stock market e.g. PBBANK, MAYBANK, SIME, TM, YTLPOWER, GAMUDA, KINSTEL, etc.

- In relation to warrants, the common stock is also referred to as the "mother share" OR "underlying security"

Exercise a warrant - you exercise your right to convert the warrant to common stock

Issue price - the price of the warrant when issued

Exercise or strike price - the pre-specified price at which the holder of such warrants may exercise the warrant

Expiry date - the date in which the ability to exercise that right expires.

- All warrants have expiry date

- The expiry date is usually a minimum of 2 - 5 years from the date of issue

- After the expiry date, warrants are worth nothing. Zero.

Leverage - Intrinsic value of warrant - the difference between the share price and the warrant's exercise price. If the share price is less than the exercise price then the intrinsic value is zero.

Premium - The premium is anything paid above the intrinsic value for the warrant. Typically the premium will decrease as the price of the warrant rises and the time to expiration decreases.

The lower the premium, the more attractive the warrant@ The amount of share price increase required to equal the combined price of warrant and exercise.

Example

Current YTLPOWER common stock price : RM 2.17

Current YTPOWER-WB price : RM1.10

Exercise price : RM1.25

Exercise ratio : 1

Warrant intrinsic value = Stock price - exercise price = RM 2.17 - RM1.25 = RM0.92

Premium = Current price of warrant - intrinsic value = RM1.10 - RM0.92 = RM0.18

Premium in % = Premium / stock market price x 100% = 8.29%

To understand premium better, it just means how much more you are paying to buy the warrant and then immediately convert it to common stock.

Buy YTLPOWER-WB : RM1.10

Exercise your right and convert the warrant to common stock : YTLPOWER-WB + exercise price = RM 1.10 + RM 1.25 = RM 2.35

YTLPOWER price : RM 2.17

So, you're paying RM2.35 rather than RM2.17 to get the common stock. The extra amount you paid is (2.35-2.17) / 2.17 x 100% = 8.29%

Before you crack your head calculating the premium, you can:

1) Use a warrant calculator :

http://www.bursawave.com/warrant-calculator/2) Use the premium formula

Important : The above calculation assumed that the exercise ratio is 1. For every warrant, there is a specific exercise ratio, which needs to be factored in. Example as below.

Exercise ratio

Exercise ratio - Number of warrants in exchange for one (1) mother share

@ Indicates the number of X warrant related to one share and specifies the amount of the underlying that the owner of a single warrant is entitled to buy or sell.

Each warrant has an exercise ratio. The most common ratio is 1.0. However, there are other ratios that can be any number, but usually below 1.0 e.g. 0.5, 0.25, 0.02, 0.000067, etc.

E.g.

Conversion ratio of 0.5 - each warrant confers the right to buy 0.5 shares or 2 warrants to buy 1 share

Conversion ratio of 0.5567 - 1.7963 warrants to buy 1 share

Example 1

TM-CI warrant price : RM 0.11

TM (mother share) price : RM3.80

Exercise ratio : 0.17 (6 warrants to 1 mother share OR 1 warrant to buy 0.17 mother share)

Exercise price : RM 3.62

If you exercise the warrant immediately, you will pay a high premium.

Warrant price for 1 mother share = RM 0.11 x 6 = RM 0.66

Convert to mother share = RM 0.66 + RM 3.62 = RM 4.28

TM's price is only RM3.80 while you paid RM4.28 when you exercise the warrant to become the mother share. To break even, you need the mother share to be RM4.28 before you exercise the warrant.

Example 2

Tenaga-CL warrant price : RM 0.13

Tenaga (mother share) price : RM 6.30

Exercise ratio : 0.07 (15 warrants per 1 Tenaga shares OR 1 warrant to buy 0.07 mother share)

Exercise price : RM 6.00

If you exercise the warrant immediately, you will pay:

Warrant price for 1 mother share = RM 0.13 x 15 = RM 1.95

Convert to mother share = RM 1.95 + RM 6.00 = RM 7.95

Tenaga's price is only RM6.30 while you paid RM 7.95 when you exercise the warrant to become the mother share. To break even, you need the mother share to be RM 7.95 before you exercise the warrant.

When using the premium formula, the correct formula should be:

As for Tenaga-CL, the warrant has an exercise ratio of 15 warrants per Tenaga share, and an

exercise price of RM6. With the warrants closing at 11 sen last Friday, the break even price for

the mother share, after considering the warrants’ exercise ratio and price, comes up to RM7.65.

Calculations reveal that Tenaga-CL was last traded at a 21.4% premium to the mother share

price of RM6.30 on March 20.

What are warrants?Warrants are certificates or financial instrument that entitle the holder (the investor who bought the warrant) the right, but not the obligation, to buy a specific amount of common stock at a fixed price in the future.

ExampleCompany's common stock :

YTLPOWERCompany's warrant :

YTLPOWER-WB (Warrant B)

If you hold some YTLPOWER-WB, you have the right to buy YTLPOWER common stocks at an agreed-upon price in the future

Warrants are usually denoted by additional wordings at the back:

YTLPOWER-WB

TGOFF-WA

TGOFF-WB

OSK-WB

Types of warrantsWarrants can be divided into many categories:

1)

Company warrants or

Covered (Structured) warrants2)

Call warrant or

Put warrant3)

American or

European warrantCompany or covered warrantsThe typical differences between company warrant and a covered (structured) warrants are as below:

QUOTE

Additional infoCompany warrants normally have a lower liquidity, and there is no way to compare their prices. This is because the price of a company warrant is mainly determined by the board of directors. Therefore, the warrant price is very likely to deviate from the underlying price. Put another way, company warrants are less transparent and, sometimes, more speculative. In contrast, covered warrants have a good liquidity due to the market making system. Besides, their pricing mechanism is more transparent (statistics such as effective gearing is readily available). Hence, it is possible to track changes in the theoretical prices of covered warrants.

Although the concepts behind company warrants and covered warrants are similar, the two are subject to different levels of risks. Investors should study the relevant information carefully and bear in mind their own risk tolerance in making the decision whether to invest in company warrants or covered warrants.

Source :

http://neaven-seo.blogspot.com/2008/01/dif...f-warrants.html For more regarding Covered (structured) warrants, take a look at OSK's Issued Structured Warrants :

http://www.osk188.com/pageW.jsp?name=SW_OSKIssuedCall or put warrantCall warrant - gives the holder the option to buy

Put warrant - gives the option to sell

Investors buy call warrants when they expect the underlying share prices to increase in the future. On the other hand, investors buy put warrants when they expect the underlying share prices to drop in the future.

Previously, in Malaysia, only "Call Warrants" were allowed to be traded. "Put Warrants" were not allowed, just like short selling. However, KLSE recently

has allow for "Put warrants" to be traded.

American or European warrantWarrants or call warrants can also be subdivided into two categories based on their exercise style - either American or European.

An American warrant - can be exercised at any time up to its maturity date

European warrant - can only be exercised at its maturity date.

What happens when warrants are issued?Warrants are usually issued by the company itself and sometimes by 3rd party issuers. After they are issued, warrants trade similarly to stocks. However, warrants aren't usually as liquid to trade as the stock itself.

When warrants are issued, there are a lot of information released, which includes these very important info:

1) Issue price

2) Exercise/strike price

3) Premium

4) Expiry date

ExampleYTLPOWER common stock price at the time of warrant issue :

RM 1.10YTLPOWER-WB was then issued with the following details

1) Issue price :

RM 0.102) Exercise price:

RM 1.253) Premium :

22.7% -------- calculated by [(RM1.25 + RM0.10) - RM1.10] / 1.10 x 100%

4) Expiry date :

11/06/2018From the above example, when YTLPOWER-WB is issue, you can buy it at RM0.10 per unit. However, remember that warrants are traded similar to stocks. As such, its price can go up on down with time.

If you bought 1000 units and were to immediately exercise the warrant to convert it to become common stocks, you will have to pay a premium of 22.7%, which is definitely not a good idea right?

Which leads us to the next question.

Why are warrants issued?Warrants are usually issued along a new bond or stock offering to increase the attractiveness of the offering. Warrants also help reduce the financing cost. Bundled bonds and warrants or bundled stock and warrants are call units.

They are "sweeteners" because they're something that the issuer throws into the new offering to make the deal more appealing; however, warrants can also be sold separately on the market. Also frequently referred to as an "equity kicker", i.e. an additional incentive for the buyer of the common stock to invest in the company.

When warrants are originally issued, the warrant's exercise price is set well above the underlying stock's market price. In the above case, YTLPOWER's exercise price was RM1.25 while the underlying stock price (YTLPOWER) was only RM1.10.

Now, why would investors buy an instrument whose price is above the current price of shares of stock that effectively underlie the instrument? Investors who buy a warrant basically believe that the price of the stocks of the company will rise above the warrant price at that specified point in time in the future. If this happens, the warrant-holder then can exercise his/her claim as specified in the warrant.

For any given warrant, the higher the premium, the more expensive the warrant becomes. If an investor pays a premium to buy a warrant, the underlying share must rise by a percentage equal to the premium before the maturity date to break even.

As such, warrants are, in actual fact, a long-term call on the

potential price increase of the common stock. You will lose money if you exercise the warrants immediately after you bought them.

Warrant holders have no voting rights and receive no dividends.

Which leads us to the next question.

Why buy warrants if common stocks can also increase in price?2 main reasons:

1) Cheaper

2) Leverage

CheaperWarrants are cheaper as compared to the price of the mothershare

Say you have 10k and consider buying the shares of the company PBBANK. It also has a warrant PBBANK-CH.

PBBANK :

RM9.90PBBANK-CH :

RM0.03With 10k, you could only buy around

1000 shares of PBBANK (RM9.90 x 1000 = RM 9,900) but can buy around

330,000 warrants of PBBANK-CH! (RM0.03 x 330,000 = RM9,900)

Alternatively, you could also buy 1,000 warrants of PBBANK-CH for RM0.03 x 1,000 = RM30 (which leaves you RM9,970 to buy other shares)

Important : It is not as simple as that when making decisions to buy warrants as you have to take into consideration the exercise price and conversion ratio. The above example is to depict the meaning of "cheap" in warrants.

LeverageWarrants are all about leverage. Leverage measures how much more a warrant will move in percentage against its underlying stock. When you invest in a warrant, you stand to gain from the exposure of the share price movement at only a fraction of its cost. In terms of percentage, a warrant is more sensitive to the market movement compared to its underlying assets. Therefore, by investing in a warrant, it allows you to benefit from unlimited upside at a lower cost. Apart from that, you can free up your capital to invest in other investments. The downside risk of not being able to exercise the warrant is only the loss of the warrant premium.

Leverage is why an investor should be interested in warrants. Warrants provide the investor the potential for incredible upside leverage versus the underlying common stock. As the price of the underlying common stock rises (i.e. in a bull market), the warrant will (in most cases) greatly outperform the common stock.

In many cases, the warrants will reflect the potential of a 2:1 leverage over the common stock, meaning simply, if the common stock increases 100%, the warrant will increase by 200%, thus a leverage of 2:1.

In short, leverage means getting the maximum return with the least amount of your capital at risk.

It is important to note that leverage diminishes as the common stock rises father above the warrant's exercise price. At some high price for the common, the warrant will lose most of its leverage and advance at a rate barely higher than the common.

ExampleYou have these shares/warrants in hand:

PBBANK = 1,000 shares at RM9.90

PBBANK-CH = 1,000 shares at RM0.03

The price of PBBANK increases by

RM2.00 and PBBANK-CH also increases by

RM0.03 as it follows the mother share.

PBBANK RM9.90 increase RM2.00 = RM11.90 (increase by around

20%)

PBBANK-CH RM0.03 increase RM0.03 = RM0.06 (increase by around

100%!!!)

From the example, you can see that even though PBBANK-CH only increase by 3 cents, it is 100% gain from it's original price. As compared to PBBANK which increase RM2 but only gain 20% from it's original price.

Now, imagine if you had 33,000 shares of PBBANK-CH!!!

What happens to warrants later on until expiry?In progress

What happens to warrants later on until expiry?In progressRemember that warrants have an expiry date.

Warrant prices usually start to decline when the expiry date is near.

If the underlying stock is trading below the exercise price on the expiration date, the warrant will be worthless which is why it is recommended that investors focus on warrants that have a remainnig life of at least 2 years.

______

Of course, if the stock price in the future does not go higher than the warrant's price, the right of claim provided by the warrant is not exercised by the investor and is left to expire. In this case, the investor loses by the amount it cost to buy the warrant. The company issuing stock rights or warrants is really not directly affected by the profits or losses made by investors. As far as they are concerned, these instruments provide a means to raise funds for the use of the company. The profits and losses that accrue to the investor refer to investment gains and losses of theinvestor in managing the instruments and do not reflect gains and losses of the company itself.

____

The value of a warrant is determined by two main factors, its intrinsic value and time value. Its intrinsic value is the difference between the current price of the underlying asset and the warrant's exercise price.

A warrant has a limited life span and as such, when you are looking at the time value, as time passes the value will decrease accordingly until it turns zero on expiration. The factors that will positively affect a warrant's time value are the expected volatility of the underlying stock and the warrant's time to maturity.

Where to get information on warrants?There are various sources where you can find further details about a particular warrant:

1) Bursa Malaysia website

2) Your own trading portal

3) The Edge weekly magazine

4) Your local newspaper (stock section)

Bursa Malaysia websiteFor bursa Malaysia, you need to go to the website :

http://www.bursamalaysia.com/website/bm/index.jspFrom the top menu, select "Market information" > "Market statistics" > "Warrants"

From there, you can either select "Top 20 active warrants", "Call warrants" or "Summary or warrants". After that, download the PDF file.

Your own trading portal

Your own trading portalFor example, if you use Maybank2u, go to the trading portal. Select the drop-down menu >"Search by sector" > "Warrants" > "All sectors".

The Edge (Weekly) Magazine

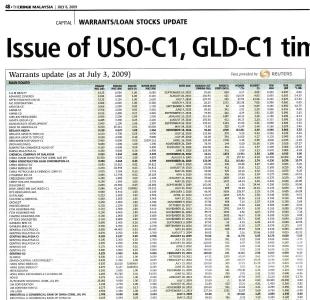

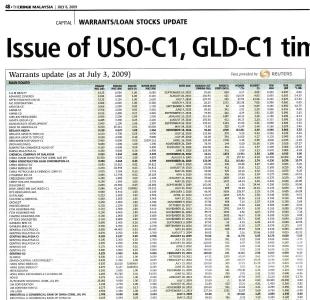

The Edge (Weekly) MagazineThe Edge Magazine will list out ALL the warrants on KLSE with lots of information in every weekly issue. Here's an example :

References:

http://books.google.com.my/books?id=Zf_uMf...result&resnum=4http://www.safehaven.com/article-4613.htmhttp://books.google.com.my/books?id=wLE4vo...esult&resnum=10http://www.hotstockmarket.com/forums/showthread.php?t=44281http://www.preciousmetalswarrants.com/whywarrants.htmlhttp://business.inquirer.net/money/advice/...stock_rights%3Fhttp://www.hashemian.com/financial-markets...arrants-183.htmhttp://www.sc.com.my/eng/html/resources/gu...ants_090508.pdfhttp://www.numa.com/derivs/ref/calculat/warrant/calc-wtb.htmhttp://www.investment-analytics.com/files/...es/Warrants.pdfhttp://www.asiaone.com/Business/My%2BMoney...1205-39670.htmlhttps://www.warrants.standardbank.co.za/war...ful_Trading.pdfhttp://biz.thestar.com.my/news/story.asp?f...94&sec=businesshttp://www.investopedia.com/articles/04/021704.asphttp://warrants.cimb.com/WRT/callWarrants.jsp#a7http://media.dbwarrants.com.hk/EN/binaer_view.asp?BinaerNr=8QUOTE

Without mentioning any specific names, let’s illustrate why warrants can be very profitable. One large gold company trading on the TSX and the American Exchange has two warrants which trade on the TSX. The most recent warrant issued has an exercise price of C$12.10 and expires on 7-January-2008.

Closing price of the common stock (23-Sep-2005) C$9.30

Closing price of the warrant (23-Sep-2005) C$1.55

Say you were interested in buying 1,000 shares of the common stock which would cost you C$9,300. You could instead purchase 1,000 warrants at C$1.55 for a total cost of C$1,550.

Cost of the common stock (1,000 shares) C$9,300

Cost of the warrants (1,000) (C$1,550)

Your savings C$7,750

Now you control 1,000 shares and have saved a lot of money.

Not only do you save money, if the common stock goes to say C$20 (a return of 115%), the warrant will be worth at least C$7.90 or a total of C$7,900 on your investment of C$1,550, reflecting an incredible return of 410%.

What if, instead of buying 1,000 shares of the common stock you invested the entire amount in the warrants, you could actually purchase 6,000 warrants for the same total cost of C$9,300. Again, if we get a move in the common stock to C$20 (a 115% return), the warrants will be worth at least C$7.90 or a total of C$47,400 (6,000 wts @ C$7.90), for a return of 410%.

This post has been edited by kmarc: Feb 9 2010, 05:13 PM

May 23 2009, 09:14 PM, updated 15y ago

May 23 2009, 09:14 PM, updated 15y ago Quote

Quote

0.0326sec

0.0326sec

1.26

1.26

6 queries

6 queries

GZIP Disabled

GZIP Disabled