QUOTE(okuribito @ Nov 20 2014, 09:44 AM)

good question brother. my guess is they won't even if ocbc tells them 200 oredi. why? RP probably gets some sort of commission per registration & probably bonus for successful sign-ups. And if u were OCBC would you tell them to say "200 reached oredi"?

whether u'll get the thing or not, heaven knows. hope u do

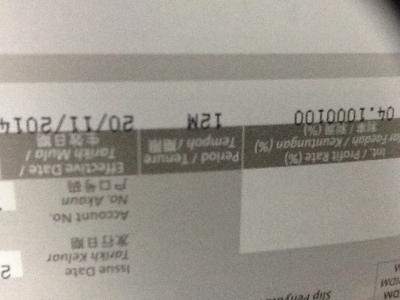

First ocbc placement through ringitplus. The gold coin is from Ocbc. Only 10 gold coin. Promote end of Nov.whether u'll get the thing or not, heaven knows. hope u do

I think it is not sold out coz I can place FD just now. The gift is from Ringgitplus.

I emailed to ringgitplus and the reply (see below) said it is compounded daily on interest. But Ocbc said it s not. I think Ringgitplus is playing a trick on wording. Interest compounded daily but paid out at maturity date. Since the interest will be paid on maturity, from now till maturity no interest is earn and hence nothing is being compounded?

The reply from Ringgitplus, Diana...

Thank you for reaching out to us.

Yes, your interest earnings will be compounded daily, but will only be paid out at the date of maturity.

If you have any more questions please just reply to this email, we'd love to help you.

Thank you.

--

Diana from RinggitPlus

can@ringgitplus.com

Nov 20 2014, 11:53 AM

Nov 20 2014, 11:53 AM

Quote

Quote

0.0364sec

0.0364sec

0.70

0.70

6 queries

6 queries

GZIP Disabled

GZIP Disabled