Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

poweredbydiscuz

|

Jul 6 2023, 10:37 AM Jul 6 2023, 10:37 AM

|

|

QUOTE(MUM @ Jul 6 2023, 10:31 AM) You really think they will do that implementation of EMAS account, without first studying it? My question was did they tell the public that they are considering it like now? QUOTE(N9484640 @ Jul 6 2023, 10:31 AM) yalah means they want to force you to take out on a montly basis. I dont think they are saying you cant take out in one lump sum. but why? anyway, our news reporter listen and write only. They got no brains to ask questions and this is they type of reporting we get Oh, your understanding is that they want to force people to take out the money. Ok. |

|

|

|

|

|

N9484640

|

Jul 6 2023, 10:40 AM Jul 6 2023, 10:40 AM

|

|

For my case, I would prefer to leave my EPF money in there and withdraw only the interest. Not even all the interest, just part of it. I would prefer to withdraw only what I need and when I need it.

But frankly I am getting sick of all these uncertainties. Maybe I will just take out everything and earn a couple of percent less interest to avoid any future headaches.

|

|

|

|

|

|

MUM

|

Jul 6 2023, 10:41 AM Jul 6 2023, 10:41 AM

|

|

QUOTE(poweredbydiscuz @ Jul 6 2023, 10:37 AM) My question was did they tell the public that they are considering it like now? ..... You need to check back fior that info you need yourself... It had been years they implemented that EMAS account |

|

|

|

|

|

126126

|

Jul 6 2023, 10:49 AM Jul 6 2023, 10:49 AM

|

Getting Started

|

QUOTE(poweredbydiscuz @ Jul 6 2023, 09:40 AM) What do you think he was trying to say? My interpretation of what he is trying to say is well articulated here. They want ppl to withdraw regularly instead of lumpsum. Not sure why there is so mich fear mongering on epf. If scared take it out immediately |

|

|

|

|

|

poweredbydiscuz

|

Jul 6 2023, 10:54 AM Jul 6 2023, 10:54 AM

|

|

QUOTE(126126 @ Jul 6 2023, 10:49 AM) https://www.nst.com.my/business/2023/07/927...stment-strategyMy interpretation of what he is trying to say is well articulated here. They want ppl to withdraw regularly instead of lumpsum. Not sure why there is so mich fear mongering on epf. If scared take it out immediately Yup, that's what they want. One way or another. |

|

|

|

|

|

N9484640

|

Jul 6 2023, 10:56 AM Jul 6 2023, 10:56 AM

|

|

QUOTE(poweredbydiscuz @ Jul 6 2023, 10:54 AM) Yup, that's what they want. One way or another. if this happens, it will only be for new members after the implementation |

|

|

|

|

|

faizfizy39

|

Jul 6 2023, 11:03 AM Jul 6 2023, 11:03 AM

|

|

QUOTE(poweredbydiscuz @ Jul 6 2023, 09:05 AM) Here it comes... First don't allow fully withdraw at age 55, then increase retirement age to 65. Sounds like it will be against with what they meant if they increase the full withdrawal age to 65. Even now they already allow partial withdrawal at 50. I believe they just want the members to able to sustain their life after retirement hence locking up certain amount and become pension-like withdrawal. |

|

|

|

|

|

faizfizy39

|

Jul 6 2023, 11:11 AM Jul 6 2023, 11:11 AM

|

|

QUOTE(N9484640 @ Jul 6 2023, 10:40 AM) For my case, I would prefer to leave my EPF money in there and withdraw only the interest. Not even all the interest, just part of it. I would prefer to withdraw only what I need and when I need it. But frankly I am getting sick of all these uncertainties. Maybe I will just take out everything and earn a couple of percent less interest to avoid any future headaches. They do have these scheme in place called Annual Dividend Withdrawal... For the lock up 55 amount - it's only for a certain minimum amount. I believe if your money is more than the minimum amount you are free to do lump sum except for the minimum amount to be use for monthly retirement withdrawal. |

|

|

|

|

|

MUM

|

Jul 6 2023, 11:12 AM Jul 6 2023, 11:12 AM

|

|

QUOTE(126126 @ Jul 6 2023, 10:49 AM) https://www.nst.com.my/business/2023/07/927...stment-strategyMy interpretation of what he is trying to say is well articulated here. They want ppl to withdraw regularly instead of lumpsum. Not sure why there is so mich fear mongering on epf. If scared take it out immediately Just a note, Just not too long ago, there had been many pages of postings about fear of "tiered" dividends too. BTW, not all that are scared can qualified / eligible to withdraw immediatrly if their fear materialised. |

|

|

|

|

|

MUM

|

Jul 6 2023, 11:18 AM Jul 6 2023, 11:18 AM

|

|

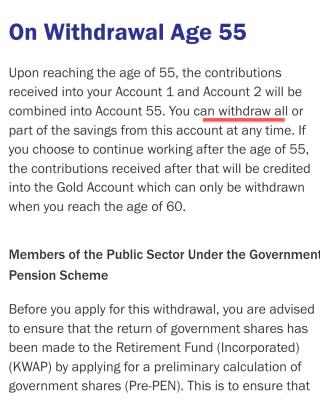

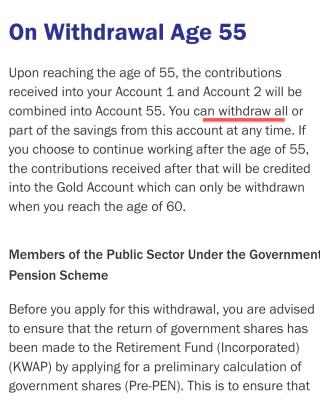

QUOTE(faizfizy39 @ Jul 6 2023, 11:11 AM) They do have these scheme in place called Annual Dividend Withdrawal... For the lock up 55 amount - it's only for a certain minimum amount. I believe if your money is more than the minimum amount you are free to do lump sum except for the minimum amount to be use for monthly retirement withdrawal. I got this from kwsp site Attached thumbnail(s)

|

|

|

|

|

|

faizfizy39

|

Jul 6 2023, 11:38 AM Jul 6 2023, 11:38 AM

|

|

QUOTE(MUM @ Jul 6 2023, 11:18 AM) I got this from kwsp site I was saying 2 different things. The annual dividend scheme is currently in place to only withdraw dividend annually.. The lock up amount is for the new scheme they are studying. |

|

|

|

|

|

batman1172

|

Jul 6 2023, 01:35 PM Jul 6 2023, 01:35 PM

|

|

QUOTE(126126 @ Jul 6 2023, 10:49 AM) https://www.nst.com.my/business/2023/07/927...stment-strategyMy interpretation of what he is trying to say is well articulated here. They want ppl to withdraw regularly instead of lumpsum. Not sure why there is so mich fear mongering on epf. If scared take it out immediately maybe they t20 people to be scared and take out immediately now so in in future pay less dividend to them. No need to implement tier-dividend. also will implement basic income drawdown. how much a month? https://theedgemalaysia.com/node/673791KUALA LUMPUR (July 6): Prime Minister Datuk Sri Anwar Ibrahim said any decision on the basic income drawdown plans for members' savings will be decided by the Employment Provident Fund (EPF). This post has been edited by batman1172: Jul 6 2023, 01:48 PM |

|

|

|

|

|

prophetjul

|

Jul 6 2023, 01:57 PM Jul 6 2023, 01:57 PM

|

|

QUOTE(batman1172 @ Jul 6 2023, 01:35 PM) maybe they t20 people to be scared and take out immediately now so in in future pay less dividend to them. No need to implement tier-dividend. also will implement basic income drawdown. how much a month? https://theedgemalaysia.com/node/673791KUALA LUMPUR (July 6): Prime Minister Datuk Sri Anwar Ibrahim said any decision on the basic income drawdown plans for members' savings will be decided by the Employment Provident Fund (EPF). Wondering what is "basic income drawdown"? |

|

|

|

|

|

Wedchar2912

|

Jul 6 2023, 01:58 PM Jul 6 2023, 01:58 PM

|

|

QUOTE(batman1172 @ Jul 6 2023, 01:35 PM) maybe they t20 people to be scared and take out immediately now so in in future pay less dividend to them. No need to implement tier-dividend. also will implement basic income drawdown. how much a month? https://theedgemalaysia.com/node/673791KUALA LUMPUR (July 6): Prime Minister Datuk Sri Anwar Ibrahim said any decision on the basic income drawdown plans for members' savings will be decided by the Employment Provident Fund (EPF). Assuming 240K rm at start of 56 years old, EPF div rate stable at 5% pa, achieve 0 balance by age 76 (ie 20 years drawdown), can spend 1.6K pm. worth it? |

|

|

|

|

|

batman1172

|

Jul 6 2023, 02:08 PM Jul 6 2023, 02:08 PM

|

|

QUOTE(Wedchar2912 @ Jul 6 2023, 01:58 PM) Assuming 240K rm at start of 56 years old, EPF div rate stable at 5% pa, achieve 0 balance by age 76 (ie 20 years drawdown), can spend 1.6K pm. worth it? I think they gonna cap withdrawl at RM1k monthly from 56 since only 18% of members have enough money. And then later extend retirement age to say 65. https://www.nst.com.my/business/2023/07/927...post-retirement |

|

|

|

|

|

batman1172

|

Jul 6 2023, 02:09 PM Jul 6 2023, 02:09 PM

|

|

QUOTE(prophetjul @ Jul 6 2023, 01:57 PM) Wondering what is "basic income drawdown"? RM240k/20 years = 1k monthly? This post has been edited by batman1172: Jul 6 2023, 02:09 PM |

|

|

|

|

|

Wedchar2912

|

Jul 6 2023, 02:11 PM Jul 6 2023, 02:11 PM

|

|

QUOTE(batman1172 @ Jul 6 2023, 02:08 PM) I think they gonna cap withdrawl at RM1k monthly from 56 since only 18% of members have enough money. And then later extend retirement age to say 65. https://www.nst.com.my/business/2023/07/927...post-retirementproblem is if the starting amount is 240K rm, and cap withdrawal at 1K pm, it becomes a perpetual annuity...cos 5% div means 12K rm dividend already. Then this will be even more draconian than SG's CPF version.... EPF want to keep our funeral and burial funds and more!!!!!!! Any worse is everyone can only take out max 1K pm regardless of balance. haha  EPF and gov really need to be better in communicating this to the public... |

|

|

|

|

|

HolyCooler

|

Jul 6 2023, 02:13 PM Jul 6 2023, 02:13 PM

|

|

I feel like i am back to 30+ years ago when so much rumours about EPF flying around.

|

|

|

|

|

|

poweredbydiscuz

|

Jul 6 2023, 02:17 PM Jul 6 2023, 02:17 PM

|

|

QUOTE(batman1172 @ Jul 6 2023, 01:35 PM) maybe they t20 people to be scared and take out immediately now so in in future pay less dividend to them. No need to implement tier-dividend. also will implement basic income drawdown. how much a month? https://theedgemalaysia.com/node/673791KUALA LUMPUR (July 6): Prime Minister Datuk Sri Anwar Ibrahim said any decision on the basic income drawdown plans for members' savings will be decided by the Employment Provident Fund (EPF). EPF say will discuss with gomen, and PM say will be decided by EPF. Topkek. |

|

|

|

|

|

HolyCooler

|

Jul 6 2023, 02:19 PM Jul 6 2023, 02:19 PM

|

|

QUOTE(poweredbydiscuz @ Jul 6 2023, 02:17 PM) EPF say will discuss with gomen, and PM say will be decided by EPF. Topkek. Nothing wrong, after EPF discussed with gomen, then EPF makes the decision. It is quite normal in many organizations / companies, collect info and discuss, but only one will make the decision. |

|

|

|

|

Jul 6 2023, 10:37 AM

Jul 6 2023, 10:37 AM

Quote

Quote

0.0214sec

0.0214sec

0.57

0.57

6 queries

6 queries

GZIP Disabled

GZIP Disabled