QUOTE(126126 @ Jul 6 2023, 09:35 AM)

What do you think he was trying to say?EPF DIVIDEND, EPF

EPF DIVIDEND, EPF

|

|

Jul 6 2023, 09:40 AM Jul 6 2023, 09:40 AM

|

Senior Member

3,833 posts Joined: Oct 2011 |

|

|

|

|

|

|

Jul 6 2023, 10:01 AM Jul 6 2023, 10:01 AM

Show posts by this member only | IPv6 | Post

#14002

|

All Stars

14,888 posts Joined: Mar 2015 |

If it was so easy to be able to "lock" the age 55 epf funds, ....they would not hv implemented the EMAS accounts.

|

|

|

Jul 6 2023, 10:12 AM Jul 6 2023, 10:12 AM

|

Senior Member

3,833 posts Joined: Oct 2011 |

|

|

|

Jul 6 2023, 10:17 AM Jul 6 2023, 10:17 AM

Show posts by this member only | IPv6 | Post

#14004

|

All Stars

14,888 posts Joined: Mar 2015 |

|

|

|

Jul 6 2023, 10:21 AM Jul 6 2023, 10:21 AM

|

Senior Member

1,282 posts Joined: Aug 2014 |

QUOTE(poweredbydiscuz @ Jul 6 2023, 09:40 AM) I think he is saying retirees are not taking out their money in regular monthly intervals. Suka-suka take out any amount and any time they wish. They want to promote to them to take out on a regular basis. But why I dont know. Why bother what people do or how they do it. |

|

|

Jul 6 2023, 10:27 AM Jul 6 2023, 10:27 AM

|

Senior Member

3,833 posts Joined: Oct 2011 |

QUOTE(MUM @ Jul 6 2023, 10:17 AM) They had not considered it previously before implementing EMAS account? I don't know. Did they publicly say that they were considering it before implementing EMAS account previously? The political climates at that time are more conducive than now. They may say "consider" or "Study", but in reality... QUOTE(N9484640 @ Jul 6 2023, 10:21 AM) I think he is saying retirees are not taking out their money in regular monthly intervals. Suka-suka take out any amount and any time they wish. They want to promote to them to take out on a regular basis. But why I dont know. Why bother what people do or how they do it. "The Employees' Provident Fund (EPF) is considering making regular or monthly withdrawals mandatory for contributors reaching the retirement age of 55." |

|

|

|

|

|

Jul 6 2023, 10:31 AM Jul 6 2023, 10:31 AM

Show posts by this member only | IPv6 | Post

#14007

|

All Stars

14,888 posts Joined: Mar 2015 |

QUOTE(poweredbydiscuz @ Jul 6 2023, 10:27 AM) I don't know. Did they publicly say that they were considering it before implementing EMAS account previously? You really think they will do that implementation of EMAS account, without first studying it?"The Employees' Provident Fund (EPF) is considering making regular or monthly withdrawals mandatory for contributors reaching the retirement age of 55." This post has been edited by MUM: Jul 6 2023, 10:31 AM |

|

|

Jul 6 2023, 10:31 AM Jul 6 2023, 10:31 AM

|

Senior Member

1,282 posts Joined: Aug 2014 |

QUOTE(poweredbydiscuz @ Jul 6 2023, 10:27 AM) I don't know. Did they publicly say that they were considering it before implementing EMAS account previously? yalah means they want to force you to take out on a montly basis. I dont think they are saying you cant take out in one lump sum. but why?"The Employees' Provident Fund (EPF) is considering making regular or monthly withdrawals mandatory for contributors reaching the retirement age of 55." anyway, our news reporter listen and write only. They got no brains to ask questions and this is they type of reporting we get |

|

|

Jul 6 2023, 10:37 AM Jul 6 2023, 10:37 AM

|

Senior Member

3,833 posts Joined: Oct 2011 |

QUOTE(MUM @ Jul 6 2023, 10:31 AM) My question was did they tell the public that they are considering it like now? QUOTE(N9484640 @ Jul 6 2023, 10:31 AM) yalah means they want to force you to take out on a montly basis. I dont think they are saying you cant take out in one lump sum. but why? Oh, your understanding is that they want to force people to take out the money. anyway, our news reporter listen and write only. They got no brains to ask questions and this is they type of reporting we get Ok. |

|

|

Jul 6 2023, 10:40 AM Jul 6 2023, 10:40 AM

|

Senior Member

1,282 posts Joined: Aug 2014 |

For my case, I would prefer to leave my EPF money in there and withdraw only the interest. Not even all the interest, just part of it. I would prefer to withdraw only what I need and when I need it.

But frankly I am getting sick of all these uncertainties. Maybe I will just take out everything and earn a couple of percent less interest to avoid any future headaches. |

|

|

Jul 6 2023, 10:41 AM Jul 6 2023, 10:41 AM

Show posts by this member only | IPv6 | Post

#14011

|

All Stars

14,888 posts Joined: Mar 2015 |

QUOTE(poweredbydiscuz @ Jul 6 2023, 10:37 AM) You need to check back fior that info you need yourself...It had been years they implemented that EMAS account HolyCooler liked this post

|

|

|

Jul 6 2023, 10:49 AM Jul 6 2023, 10:49 AM

Show posts by this member only | IPv6 | Post

#14012

|

Junior Member

76 posts Joined: Jan 2011 |

QUOTE(poweredbydiscuz @ Jul 6 2023, 09:40 AM) https://www.nst.com.my/business/2023/07/927...stment-strategyMy interpretation of what he is trying to say is well articulated here. They want ppl to withdraw regularly instead of lumpsum. Not sure why there is so mich fear mongering on epf. If scared take it out immediately |

|

|

Jul 6 2023, 10:54 AM Jul 6 2023, 10:54 AM

|

Senior Member

3,833 posts Joined: Oct 2011 |

QUOTE(126126 @ Jul 6 2023, 10:49 AM) https://www.nst.com.my/business/2023/07/927...stment-strategy Yup, that's what they want. One way or another.My interpretation of what he is trying to say is well articulated here. They want ppl to withdraw regularly instead of lumpsum. Not sure why there is so mich fear mongering on epf. If scared take it out immediately |

|

|

|

|

|

Jul 6 2023, 10:56 AM Jul 6 2023, 10:56 AM

|

Senior Member

1,282 posts Joined: Aug 2014 |

|

|

|

Jul 6 2023, 11:03 AM Jul 6 2023, 11:03 AM

|

Junior Member

681 posts Joined: Apr 2011 |

QUOTE(poweredbydiscuz @ Jul 6 2023, 09:05 AM) Sounds like it will be against with what they meant if they increase the full withdrawal age to 65. Even now they already allow partial withdrawal at 50.I believe they just want the members to able to sustain their life after retirement hence locking up certain amount and become pension-like withdrawal. |

|

|

Jul 6 2023, 11:11 AM Jul 6 2023, 11:11 AM

|

Junior Member

681 posts Joined: Apr 2011 |

QUOTE(N9484640 @ Jul 6 2023, 10:40 AM) For my case, I would prefer to leave my EPF money in there and withdraw only the interest. Not even all the interest, just part of it. I would prefer to withdraw only what I need and when I need it. They do have these scheme in place called Annual Dividend Withdrawal...But frankly I am getting sick of all these uncertainties. Maybe I will just take out everything and earn a couple of percent less interest to avoid any future headaches. For the lock up 55 amount - it's only for a certain minimum amount. I believe if your money is more than the minimum amount you are free to do lump sum except for the minimum amount to be use for monthly retirement withdrawal. |

|

|

Jul 6 2023, 11:12 AM Jul 6 2023, 11:12 AM

Show posts by this member only | IPv6 | Post

#14017

|

All Stars

14,888 posts Joined: Mar 2015 |

QUOTE(126126 @ Jul 6 2023, 10:49 AM) https://www.nst.com.my/business/2023/07/927...stment-strategy Just a note,My interpretation of what he is trying to say is well articulated here. They want ppl to withdraw regularly instead of lumpsum. Not sure why there is so mich fear mongering on epf. If scared take it out immediately Just not too long ago, there had been many pages of postings about fear of "tiered" dividends too. BTW, not all that are scared can qualified / eligible to withdraw immediatrly if their fear materialised. |

|

|

Jul 6 2023, 11:18 AM Jul 6 2023, 11:18 AM

Show posts by this member only | IPv6 | Post

#14018

|

All Stars

14,888 posts Joined: Mar 2015 |

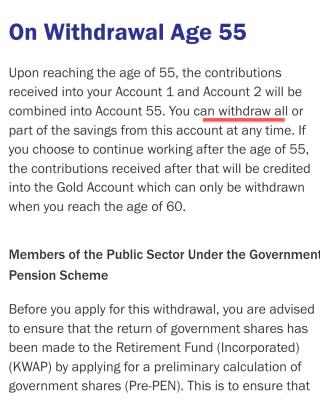

QUOTE(faizfizy39 @ Jul 6 2023, 11:11 AM) They do have these scheme in place called Annual Dividend Withdrawal... I got this from kwsp siteFor the lock up 55 amount - it's only for a certain minimum amount. I believe if your money is more than the minimum amount you are free to do lump sum except for the minimum amount to be use for monthly retirement withdrawal. Attached thumbnail(s)

|

|

|

Jul 6 2023, 11:38 AM Jul 6 2023, 11:38 AM

|

Junior Member

681 posts Joined: Apr 2011 |

QUOTE(MUM @ Jul 6 2023, 11:18 AM) I was saying 2 different things.The annual dividend scheme is currently in place to only withdraw dividend annually.. The lock up amount is for the new scheme they are studying. MUM liked this post

|

|

|

Jul 6 2023, 01:35 PM Jul 6 2023, 01:35 PM

|

Senior Member

1,362 posts Joined: Sep 2013 |

QUOTE(126126 @ Jul 6 2023, 10:49 AM) https://www.nst.com.my/business/2023/07/927...stment-strategy maybe they t20 people to be scared and take out immediately now so in in future pay less dividend to them. No need to implement tier-dividend.My interpretation of what he is trying to say is well articulated here. They want ppl to withdraw regularly instead of lumpsum. Not sure why there is so mich fear mongering on epf. If scared take it out immediately also will implement basic income drawdown. how much a month? https://theedgemalaysia.com/node/673791 KUALA LUMPUR (July 6): Prime Minister Datuk Sri Anwar Ibrahim said any decision on the basic income drawdown plans for members' savings will be decided by the Employment Provident Fund (EPF). This post has been edited by batman1172: Jul 6 2023, 01:48 PM poweredbydiscuz liked this post

|

| Change to: |  0.0238sec 0.0238sec

0.46 0.46

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 09:16 AM |