Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

poweredbydiscuz

|

Feb 22 2023, 04:33 PM Feb 22 2023, 04:33 PM

|

|

QUOTE(gooroojee @ Feb 21 2023, 03:26 PM) sorted in Excel for your easy reference: honsiong 7.20% wongmunkeong 6.15% HonMun 6.15% oks911 6.05% netcrawler 6.00% HolyCooler 5.90% lembu goreng 5.85% tbgreen 5.85% optional1988 5.80% Aaron212 5.80% Just 5.80% N9484640 5.80% prophetjul 5.75% Kip21 5.75% akhito 5.70% romuluz777 5.65% Contestchris 5.65% Capt Marble 5.60% fuzzy 5.60% vanan78 5.60% Human Nature 5.55% ikanbilis 5.50% roarus 5.50% Asali 5.50% nexona88 5.50% BboyDora 5.50% Ankle 5.45% kechung 5.40% Justhistime 5.35% CommodoreAmiga 5.30% Mroys@lyn 5.25% Xander2k8 5.25% Wolves 5.25% popice2u 5.25% sunami 5.23% ronnie 5.20% emilyngsc 5.14% jutamind 5.00% Imbi Plaza Lot 1.28 5.00% doremon 4.90% dani 4.25% Harfan (Syariah) 4.10% Unkerpanjang 1.00% No one tikam tiered dividend eh?  |

|

|

|

|

|

poweredbydiscuz

|

Feb 22 2023, 04:52 PM Feb 22 2023, 04:52 PM

|

|

QUOTE(Wedchar2912 @ Feb 22 2023, 04:44 PM) why don't you tikam that then? so easy to create tiering meh? remember that Rafizi and Zafrul both are T20 and has quite a bit of Epf balance. Maybe test water first with a more "gender" tier structure. Where the top tier still get a respectable percentage to prevent mass withdrawal. Something like <100k - 6.5% 100k-200k - 6.2% 200k-300k - 6.0% 300k-400k - 5.8% 400k-500k - 5.5% >500k - 5.2% |

|

|

|

|

|

poweredbydiscuz

|

Feb 22 2023, 05:01 PM Feb 22 2023, 05:01 PM

|

|

QUOTE(Chrono-Trigger @ Feb 22 2023, 04:58 PM) Won’t work. If you do like that , T20 will just withdraw the money until the level they can get the highest dividend. For example , first 500,000 full dividend , those with millions will empty their epf until 500000 It’s going to trigger an EPF run 5.2% not good enough? Why withdraw? If there's no tiered dividend and announcement is 5.2% for everyone, will they withdraw? This post has been edited by poweredbydiscuz: Feb 22 2023, 05:03 PM |

|

|

|

|

|

poweredbydiscuz

|

Feb 22 2023, 05:12 PM Feb 22 2023, 05:12 PM

|

|

QUOTE(Chrono-Trigger @ Feb 22 2023, 05:07 PM) He has already stated 20% of members contribute huge portion of EPF money. It does not make any economic sense to have a policy to target them. Anyway all barking at wrong tree. EPF is not the problem. They function as collector and investors. Problem is LOW WAGES —-> LOW EPF ——> low saving. Solve LOW WAGES —-> LOW EPF SOLVED —-> Low saving solved. Singapore CPF can be near 40% a month employee and employer combined. It’s about time EPF follow Well your analysis is from economy POV, while my tikam is from political POV. I'm not talking this is the better way but I think is the more possible case. I hope you understand what tikam means. My wild guess is the priority of the gomen is to do something to please the B40. I hope I was wrong tho. This post has been edited by poweredbydiscuz: Feb 22 2023, 05:15 PM |

|

|

|

|

|

poweredbydiscuz

|

Feb 22 2023, 05:48 PM Feb 22 2023, 05:48 PM

|

|

QUOTE(Wolves @ Feb 22 2023, 05:25 PM) Then i will withdraw until 100k or shortly below put into house loan. 😂 Wow. Amazing decision. |

|

|

|

|

|

poweredbydiscuz

|

Feb 22 2023, 06:18 PM Feb 22 2023, 06:18 PM

|

|

QUOTE(Wolves @ Feb 22 2023, 06:15 PM) Please elaborate. It seems like it's sarcastic. Yes it's sarcastic, because you choose to let go 5-6% of interest and put into house loan. |

|

|

|

|

|

poweredbydiscuz

|

Feb 22 2023, 06:59 PM Feb 22 2023, 06:59 PM

|

|

QUOTE(Wolves @ Feb 22 2023, 06:37 PM) » Click to show Spoiler - click again to hide... « If they don't do the tiered dividen then yes you are right. If they do then my money will grow less. So i rather take out until i get the highest tier or as much as possible (artificially inflated coz it's rob from above) and move it to house loan (coz it's one of the allowed withdrawal) and move the money originally for that purpose (flexi loan so money park there consider earning 4% coz i don't get charged that 4% interest when i have excess money) and use that excess money to get other stuff. Even if they don't allow a second withdrawal on the same home i will go buy another house or apartment to take it out and earn rental. Rather do that than give donation by force. The yield might be more or less (a lot higher potential to be higher) but at least now i own more assets and if they can do this tier dividends then chances are they can do a lot more so your kwsp money is not really your money in this case so i rather move it out than putting more in it. Money that you do not control is not your money. The only reason i put minimum amount (plus a bit more) when i actually don't need to is coz of tax benefit and forcing myself to save some extra per month as a gift for myself when i hit 50/55. But if they doing tiered dividend then it is no longer the case as they are now officially moving goal post and able to dictate the money direction and have intention to do it. Once they start they can do more. Hence it's a good decision for me to move it. Got it?  Thanks for taking the time to explain. I tot you just put it in house loan coz that's all the info I got from that post. Cheers. |

|

|

|

|

|

poweredbydiscuz

|

Feb 23 2023, 09:10 PM Feb 23 2023, 09:10 PM

|

|

|

|

|

|

|

|

poweredbydiscuz

|

Mar 24 2023, 09:06 AM Mar 24 2023, 09:06 AM

|

|

QUOTE(ronnie @ Mar 24 2023, 08:42 AM) I notice my wife's i-Akaun has no mobile number registered but can receive TAC when reset password. How to add the mobile number for TAC verification ? I think need to use kiosk. |

|

|

|

|

|

poweredbydiscuz

|

Apr 13 2023, 11:23 AM Apr 13 2023, 11:23 AM

|

|

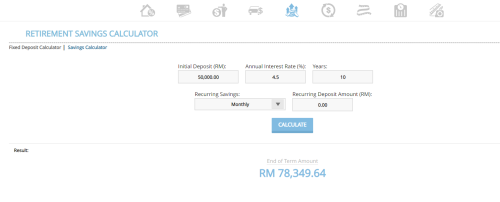

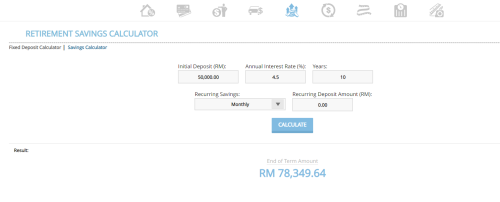

QUOTE(Rinth @ Apr 13 2023, 10:48 AM) I've found something interesting......  Borrow RM 50k put in EPF assume interest 4.5%(same rate as you loan), end of 10 years = RM 78,349.64 Based on MBSB repayment table for 10 years, 1st 12 months repayment RM 187.50 13th onwards RM 564.00 = RM 63,162.00 Different RM 15k over the span of 10 years, same interest rates..... is my calculation correct ah????? or somewhere wrong??? If correct means the timing differences of 1 shoot RM 50k deposit to EPF actually is worth while, even if the interest rate is same... If you don't take the loan, you self-contribute the same amount (rm187.50 for first 12 months, then rm564.00/m for 9 years) into your epf, at the end your epf will have around rm78356.45 also. So why bother to take the loan? |

|

|

|

|

|

poweredbydiscuz

|

Apr 13 2023, 11:44 AM Apr 13 2023, 11:44 AM

|

|

QUOTE(Cubalagi @ Apr 13 2023, 11:35 AM) Say, if govt increase Kwsp contribution to RM100k, but you only have RM50k spare cash this year. Worth it to take the loan to max 100k? No difference. If you got money to pay loan monthly, just use the money to self contribute monthly. |

|

|

|

|

|

poweredbydiscuz

|

Jul 6 2023, 09:05 AM Jul 6 2023, 09:05 AM

|

|

QUOTE(prophetjul @ Jul 6 2023, 08:50 AM) https://www.msn.com/en-my/news/national/epf...ddaf312ee&ei=17UALA LUMPUR - The Employees' Provident Fund (EPF) is considering making regular or monthly withdrawals mandatory for contributors reaching the retirement age of 55. » Click to show Spoiler - click again to hide... « EPF CEO Datuk Seri Amir Hamzah Azizan said the regular or monthly withdrawals were currently done voluntarily.

He said it was due to it being seen as providing individuals a better chance at managing their retirement funds.

At the same time, he said the withdrawals also gave the opportunity for the contributors to receive yearly dividends with the remaining savings they had.

“We do provide a choice of withdrawals for all EPF members who reached the age of retirement be it in full or partial.

“However, not many opted for monthly withdrawal and this provides space for us to promote it more,” he told reporters during the 2023 International Social Welfare Conference, today.

However, Amir said more reserach and discussions are needed with the government.

“For the time being our focus is to encourage members to have a savings account with the schemes available,” he said.

Up to March 2023, EPF recorded 116,423 new registrations bringing the total EPF members to 15.8 million.

Of the total 8.45 million were active, representing 50 per cent of the 16.81 million Malaysian labour force.  Here it comes... First don't allow fully withdraw at age 55, then increase retirement age to 65. |

|

|

|

|

|

poweredbydiscuz

|

Jul 6 2023, 09:40 AM Jul 6 2023, 09:40 AM

|

|

QUOTE(126126 @ Jul 6 2023, 09:35 AM) Where does it say you cannot fully withdraw at 55? What do you think he was trying to say? |

|

|

|

|

|

poweredbydiscuz

|

Jul 6 2023, 10:12 AM Jul 6 2023, 10:12 AM

|

|

QUOTE(MUM @ Jul 6 2023, 10:01 AM) If it was so easy to be able to "lock" the age 55 epf funds, ....they would not hv implemented the EMAS accounts. It's not easy, but EPF is considering it now. |

|

|

|

|

|

poweredbydiscuz

|

Jul 6 2023, 10:27 AM Jul 6 2023, 10:27 AM

|

|

QUOTE(MUM @ Jul 6 2023, 10:17 AM) They had not considered it previously before implementing EMAS account?The political climates at that time are more conducive than now. They may say "consider" or "Study", but in reality... I don't know. Did they publicly say that they were considering it before implementing EMAS account previously? QUOTE(N9484640 @ Jul 6 2023, 10:21 AM) I think he is saying retirees are not taking out their money in regular monthly intervals. Suka-suka take out any amount and any time they wish. They want to promote to them to take out on a regular basis. But why I dont know. Why bother what people do or how they do it. "The Employees' Provident Fund (EPF) is considering making regular or monthly withdrawals mandatory for contributors reaching the retirement age of 55." |

|

|

|

|

|

poweredbydiscuz

|

Jul 6 2023, 10:37 AM Jul 6 2023, 10:37 AM

|

|

QUOTE(MUM @ Jul 6 2023, 10:31 AM) You really think they will do that implementation of EMAS account, without first studying it? My question was did they tell the public that they are considering it like now? QUOTE(N9484640 @ Jul 6 2023, 10:31 AM) yalah means they want to force you to take out on a montly basis. I dont think they are saying you cant take out in one lump sum. but why? anyway, our news reporter listen and write only. They got no brains to ask questions and this is they type of reporting we get Oh, your understanding is that they want to force people to take out the money. Ok. |

|

|

|

|

|

poweredbydiscuz

|

Jul 6 2023, 10:54 AM Jul 6 2023, 10:54 AM

|

|

QUOTE(126126 @ Jul 6 2023, 10:49 AM) https://www.nst.com.my/business/2023/07/927...stment-strategyMy interpretation of what he is trying to say is well articulated here. They want ppl to withdraw regularly instead of lumpsum. Not sure why there is so mich fear mongering on epf. If scared take it out immediately Yup, that's what they want. One way or another. |

|

|

|

|

|

poweredbydiscuz

|

Jul 6 2023, 02:17 PM Jul 6 2023, 02:17 PM

|

|

QUOTE(batman1172 @ Jul 6 2023, 01:35 PM) maybe they t20 people to be scared and take out immediately now so in in future pay less dividend to them. No need to implement tier-dividend. also will implement basic income drawdown. how much a month? https://theedgemalaysia.com/node/673791KUALA LUMPUR (July 6): Prime Minister Datuk Sri Anwar Ibrahim said any decision on the basic income drawdown plans for members' savings will be decided by the Employment Provident Fund (EPF). EPF say will discuss with gomen, and PM say will be decided by EPF. Topkek. |

|

|

|

|

|

poweredbydiscuz

|

Jul 6 2023, 02:25 PM Jul 6 2023, 02:25 PM

|

|

QUOTE(HolyCooler @ Jul 6 2023, 02:19 PM) Nothing wrong, after EPF discussed with gomen, then EPF makes the decision. It is quite normal in many organizations / companies, collect info and discuss, but only one will make the decision. Sure. EPF is the one making the decision.  |

|

|

|

|

|

poweredbydiscuz

|

Jul 7 2023, 10:11 AM Jul 7 2023, 10:11 AM

|

|

QUOTE(batman1172 @ Jul 7 2023, 08:10 AM) If there's a cap, then yes. |

|

|

|

|

Feb 22 2023, 04:33 PM

Feb 22 2023, 04:33 PM

Quote

Quote

0.0463sec

0.0463sec

0.25

0.25

7 queries

7 queries

GZIP Disabled

GZIP Disabled