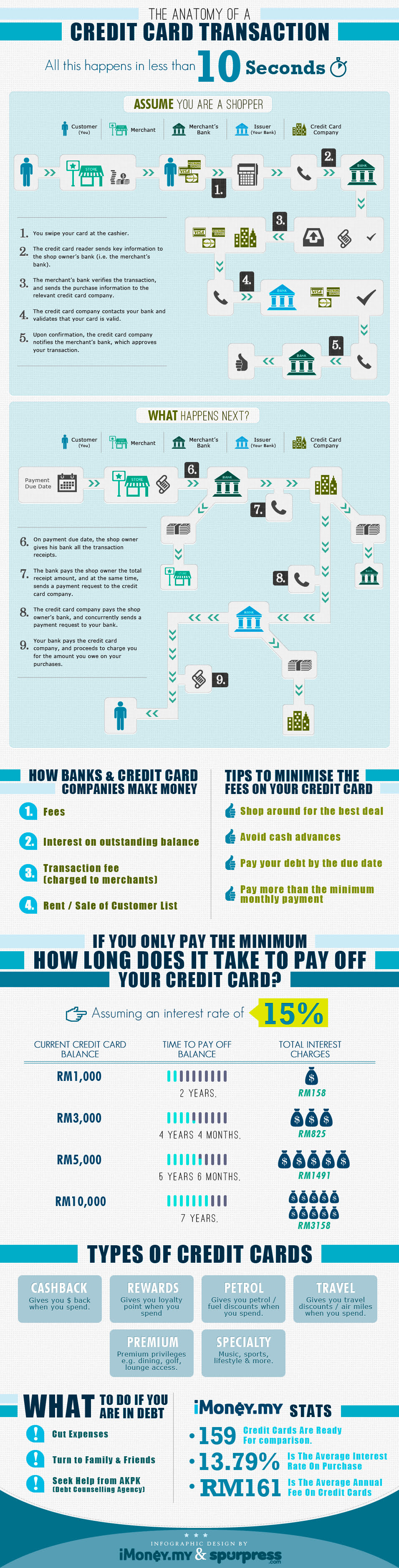

Courtesy of iMoney.com

Credit Cards Credit Card v17, Ask general questions here, Please read the 1st post before posting!

|

|

Jul 29 2013, 12:00 AM Jul 29 2013, 12:00 AM

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

|

|

|

Jul 29 2013, 01:32 AM Jul 29 2013, 01:32 AM

|

Junior Member

353 posts Joined: Jan 2003 From: kuala lumpur |

QUOTE(ronnie @ Jul 29 2013, 12:00 AM) |

|

|

Jul 29 2013, 12:08 PM Jul 29 2013, 12:08 PM

|

Junior Member

111 posts Joined: Nov 2005 |

Hope someone can help me here. I work in Macau and trying to apply for a credit card in Malaysia. Not sure why is it so difficult. Citibank do not accept application if you work abroad in any countries except Singapore and Brunei.

Does this rule apply to all banks? |

|

|

Jul 29 2013, 01:55 PM Jul 29 2013, 01:55 PM

|

Senior Member

4,404 posts Joined: Jun 2012 |

QUOTE(kytan @ Jul 29 2013, 12:08 PM) Hope someone can help me here. I work in Macau and trying to apply for a credit card in Malaysia. Not sure why is it so difficult. Citibank do not accept application if you work abroad in any countries except Singapore and Brunei. I Afraid so... Does this rule apply to all banks? All the Bank will Decline Your Apps due to the Reason of Your Stability, Reputation & Duration of Your Employment/ Business furthermore without Malaysian Income Proof Document (e.g EPF) coz Working in Overseas... This post has been edited by fly126: Jul 29 2013, 02:01 PM |

|

|

Jul 29 2013, 03:02 PM Jul 29 2013, 03:02 PM

|

Junior Member

111 posts Joined: Nov 2005 |

QUOTE(fly126 @ Jul 29 2013, 01:55 PM) I Afraid so... Crap. Really don't know how these things work.All the Bank will Decline Your Apps due to the Reason of Your Stability, Reputation & Duration of Your Employment/ Business furthermore without Malaysian Income Proof Document (e.g EPF) coz Working in Overseas... House loan can get, card application kena decline. |

|

|

Jul 29 2013, 03:40 PM Jul 29 2013, 03:40 PM

|

Senior Member

4,404 posts Joined: Jun 2012 |

QUOTE(kytan @ Jul 29 2013, 03:02 PM) Coz Credit Card or Personal Loan is an Unsecured Short Term (3-10 Years) Loan Facility.... that is issued and supported only by the borrower's creditworthiness, rather than by a type of collateral. An unsecured loan is one that is obtained without the use of property as collateral for the loan. Borrowers generally must have high credit ratings to be approved for an unsecured loan.& It is Different with Housing Loan Repay Tenure can be up to 30 Years or until the borrower reaches age 65... This post has been edited by fly126: Jul 29 2013, 03:50 PM |

|

|

|

|

|

Jul 29 2013, 06:34 PM Jul 29 2013, 06:34 PM

|

Junior Member

36 posts Joined: Aug 2011 |

Had anyone did some research on Citibank Reward Platinum?

Any different between Citibank Platinum and Citibank Reward Platinum? I just read thru their benifit finds out Citibank Reward Platinum cover petro but Citibank Platinum dont. |

|

|

Jul 29 2013, 09:45 PM Jul 29 2013, 09:45 PM

|

Senior Member

4,098 posts Joined: Jan 2003 From: USJ |

|

|

|

Jul 29 2013, 10:28 PM Jul 29 2013, 10:28 PM

|

Senior Member

4,404 posts Joined: Jun 2012 |

QUOTE(kentwei @ Jul 29 2013, 06:34 PM) Had anyone did some research on Citibank Reward Platinum? But, U need to pay $100 Subscription Fee Annually on Citi Rewards Platinum to Enjoy the 5x Reward Points Benefit on Petrol or Others Reward Categories ($100 per Category)Any different between Citibank Platinum and Citibank Reward Platinum? I just read thru their benefit finds out Citibank Reward Platinum cover petro but Citibank Platinum dont. FAQ on Rewards Platinum: http://www.citibank.com.my/english/credit-...rdsplat/faq.htm Benefits on Citibank Platinum Card: http://www.citibank.com.my/english/credit-...Code=MYCCWAB3LM FYI, Most of the Credit Card X Earn Points on Petrol Purchase.... & also Some of the CC like HLB Wise Card, will Need some Subscription Fee... to Get more Benefit e.g Cash Back from the Card This post has been edited by fly126: Jul 30 2013, 12:02 PM |

|

|

Jul 30 2013, 09:22 AM Jul 30 2013, 09:22 AM

|

Senior Member

914 posts Joined: Mar 2011 From: Infinity & Beyond |

hi guys,

Groupon has this Standchart Platinum CC thing going on - is it legit? Standchart Platinum MasterCard StandChart Platinum VISA cc if it is(legit), is it worth applying for? |

|

|

Jul 30 2013, 11:18 AM Jul 30 2013, 11:18 AM

|

Senior Member

1,206 posts Joined: Jan 2008 |

QUOTE(kytan @ Jul 29 2013, 12:08 PM) Hope someone can help me here. I work in Macau and trying to apply for a credit card in Malaysia. Not sure why is it so difficult. Citibank do not accept application if you work abroad in any countries except Singapore and Brunei. in your case Malaysian working overseas. in other case, Malaysian work in Malaysia want to apply overseas card. also hard.Does this rule apply to all banks? |

|

|

Jul 30 2013, 06:09 PM Jul 30 2013, 06:09 PM

|

Senior Member

1,191 posts Joined: Sep 2004 |

QUOTE(kytan @ Jul 29 2013, 12:08 PM) Hope someone can help me here. I work in Macau and trying to apply for a credit card in Malaysia. Not sure why is it so difficult. Citibank do not accept application if you work abroad in any countries except Singapore and Brunei. honestly u can forget bout it....cause u in the high risk, giving CC to malaysian consider risky already , but to those work oversea riskier....u can hilang anytime....Does this rule apply to all banks? vice versa same to u apply macau CC , they will scare u run back to malaysia anytime.... so the best find ur family to supp 1 card for u |

|

|

Jul 30 2013, 06:10 PM Jul 30 2013, 06:10 PM

|

Senior Member

1,191 posts Joined: Sep 2004 |

QUOTE(GravityFi3ld @ Jul 30 2013, 09:22 AM) hi guys, yup legitGroupon has this Standchart Platinum CC thing going on - is it legit? Standchart Platinum MasterCard StandChart Platinum VISA cc if it is(legit), is it worth applying for? if u apply on9 from SC itself, they give u rm300 , groupon somehow managed to squeeze some deal from SC |

|

|

|

|

|

Jul 30 2013, 06:13 PM Jul 30 2013, 06:13 PM

|

Senior Member

1,191 posts Joined: Sep 2004 |

QUOTE(WhiteFlag @ Jul 28 2013, 10:15 PM) Hi all sifus i got a question about using mbb mastercard for online purchase. wrong otp ? Do i need to activate or do any steps to allow online transaction? So far all the online transaction i tried to do all kena rejected. But i can buy MAS ticket online, so it really confuse me... anyone know why? no procedure....just purchase anytime u like , no activation nothing |

|

|

Jul 30 2013, 06:22 PM Jul 30 2013, 06:22 PM

|

Junior Member

11 posts Joined: Apr 2009 |

Hi all

if i am blacklisted , can i still apply for a citibank corporate credit card will they reject the applications |

|

|

Jul 31 2013, 09:36 AM Jul 31 2013, 09:36 AM

|

Senior Member

1,191 posts Joined: Sep 2004 |

|

|

|

Jul 31 2013, 11:52 AM Jul 31 2013, 11:52 AM

|

Senior Member

6,267 posts Joined: Jul 2005 From: UEP Subang Jaya |

If you're blacklisted solve your problems first wei, still wanna apply credit card?

|

|

|

Jul 31 2013, 12:25 PM Jul 31 2013, 12:25 PM

|

Junior Member

111 posts Joined: Nov 2005 |

QUOTE(maru @ Jul 30 2013, 06:09 PM) honestly u can forget bout it....cause u in the high risk, giving CC to malaysian consider risky already , but to those work oversea riskier....u can hilang anytime.... Uhhh...on the contrary, I have 2 cards issued by Macau banks.vice versa same to u apply macau CC , they will scare u run back to malaysia anytime.... so the best find ur family to supp 1 card for u |

|

|

Jul 31 2013, 04:19 PM Jul 31 2013, 04:19 PM

|

Senior Member

1,206 posts Joined: Jan 2008 |

QUOTE(kytan @ Jul 31 2013, 12:25 PM) yup, if you work in Macau they could give you&that's why you got 2 cards. different bank have different policy. some banks might need at least permanent resident with min income to give card. some banks could give someone with valid visa holder with certain income to give credit card. different countries also have different policy. In Australia even international or local student can get credit card with lower limit (https://www.commbank.com.au/personal/credit-cards/low-fee/student.html)This post has been edited by cenkudu: Jul 31 2013, 04:20 PM |

|

|

Jul 31 2013, 11:42 PM Jul 31 2013, 11:42 PM

|

Junior Member

808 posts Joined: May 2008 |

Hi, I was wondering if anyone new why the annual fee for the "Citibank AirAsia Platinum Visa Credit Card" is so high. For gold its RM180, and for platinum its RM380.

I feel the card does not have many benefits, but its appealing because of all the other credit cards, AirAsia benefits is something I would like to get compared to cashback, umbrellas, etc. Also, if anyone have opinion about the "Citibank AirAsia Platinum Visa Credit Card", please share here. |

|

Topic ClosedOptions

|

| Change to: |  0.0347sec 0.0347sec

0.34 0.34

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 21st December 2025 - 06:50 AM |