QUOTE(ironman16 @ Dec 1 2020, 02:47 PM)

yes , my timing very accurate for AmPRS - Asia Pacific REITs - Class D this year except for the first shot

30 Nov 2020 MYR 0.6574

finally finish my 3k for PRS this year......start prepare for next year....

Next year buy either one of this:30 Nov 2020 MYR 0.6574

finally finish my 3k for PRS this year......start prepare for next year....

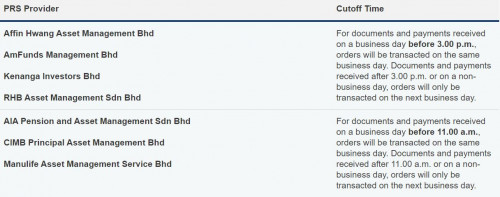

1. Manulife PRS Asia-Pacific REIT - Class C

2. Manulife Shariah PRS - Global REIT - Class C

Dec 1 2020, 02:50 PM

Dec 1 2020, 02:50 PM

Quote

Quote

0.0256sec

0.0256sec

0.69

0.69

6 queries

6 queries

GZIP Disabled

GZIP Disabled