I invested in manulife PRS which is quite bad

2017 3,539.40

2018 2,991.52

2019 2,992.00

2020 2,492.00

Total 12,014.92

Fund level 12,879.98

Can i invest additional PRS from FSM ?

Private Retirement Fund, What the hell is that??

Private Retirement Fund, What the hell is that??

|

|

Oct 21 2020, 09:05 AM Oct 21 2020, 09:05 AM

Return to original view | Post

#1

|

Senior Member

1,733 posts Joined: Jan 2003 From: Penang |

I invested in manulife PRS which is quite bad

2017 3,539.40 2018 2,991.52 2019 2,992.00 2020 2,492.00 Total 12,014.92 Fund level 12,879.98 Can i invest additional PRS from FSM ? |

|

|

|

|

|

Oct 21 2020, 09:09 AM Oct 21 2020, 09:09 AM

Return to original view | Post

#2

|

Senior Member

1,733 posts Joined: Jan 2003 From: Penang |

|

|

|

Oct 21 2020, 09:23 AM Oct 21 2020, 09:23 AM

Return to original view | Post

#3

|

Senior Member

1,733 posts Joined: Jan 2003 From: Penang |

Nope, not shariah.

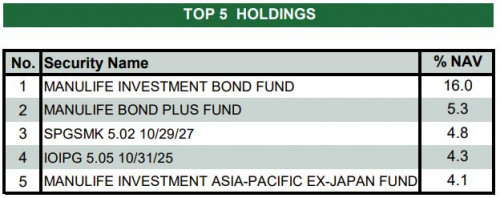

In fact, at the same time we have also invested quite a lot with this manulife agent in UT. 4 yrs + i have never seen a profit P&L . and he now parking all our fund in Money Market.... I'll wait for Oct dividend from Manulife money market, and just dump and switch to FSM managed profile. About PRS, i was told by him... If we sell and withdraw the PRS, we can longer buy .. bullshit or what. QUOTE(GrumpyNooby @ Oct 21 2020, 09:13 AM) Not the Shariah version right? If so, this is a little strange. Since it's Growth Fund, it is weird to see the top 4 holdings are into bond/fixed income securities.  https://www.fundsupermart.com.my/fsmone/adm...eetMYMLPRS3.pdf |

|

|

Oct 21 2020, 12:23 PM Oct 21 2020, 12:23 PM

Return to original view | Post

#4

|

Senior Member

1,733 posts Joined: Jan 2003 From: Penang |

Any recommendation of good performing PRS?

QUOTE(GrumpyNooby @ Oct 21 2020, 09:26 AM) |

|

|

Nov 27 2020, 08:05 AM Nov 27 2020, 08:05 AM

Return to original view | Post

#5

|

Senior Member

1,733 posts Joined: Jan 2003 From: Penang |

PRS @ fsm, if u want to bypass the paperwork.

Dont use pc web browser By using a webbrowser on mobile phone, go to their website and purchase the PRS. You can sign on the web page and there is no need to print out etc. |

|

|

Nov 27 2020, 08:09 AM Nov 27 2020, 08:09 AM

Return to original view | Post

#6

|

Senior Member

1,733 posts Joined: Jan 2003 From: Penang |

|

|

|

|

|

|

Dec 1 2020, 03:03 PM Dec 1 2020, 03:03 PM

Return to original view | Post

#7

|

Senior Member

1,733 posts Joined: Jan 2003 From: Penang |

If PRS extend to 2025, and after that people will start dumping their PRS.

Will the price of PRS collapse? |

|

|

Dec 22 2020, 05:39 PM Dec 22 2020, 05:39 PM

Return to original view | Post

#8

|

Senior Member

1,733 posts Joined: Jan 2003 From: Penang |

|

|

|

Jan 4 2021, 03:40 PM Jan 4 2021, 03:40 PM

Return to original view | Post

#9

|

Senior Member

1,733 posts Joined: Jan 2003 From: Penang |

Generally fund house would require 2-3 weeks from the fund’s ex-date (18 December 2020) to furnish

QUOTE(TaiGoh @ Jan 3 2021, 10:50 PM) |

|

|

Sep 29 2022, 10:12 AM Sep 29 2022, 10:12 AM

Return to original view | Post

#10

|

Senior Member

1,733 posts Joined: Jan 2003 From: Penang |

Principal PRS Class C Asia Pacific

-MYR 519.33 -14.84 -MYR 222.69 -14.85 Heh.. pengsan |

| Change to: |  0.0253sec 0.0253sec

0.86 0.86

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 07:56 PM |