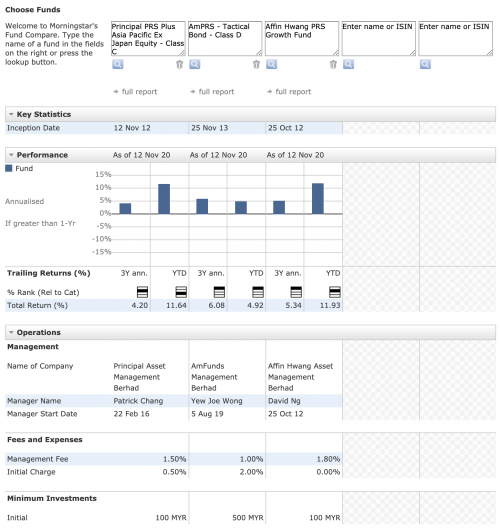

Currently I'm considering only the three, i.e. 2 equity funds and 1 bond (refer the morningstar screenshot).

Totally agree with Equity for long term.

But not any equity fund. Definitely not active equity funds.

As stated, 50%+ of my current networth is directly with Vanguard Van1579AU (100% equity passive fund).

How many 30+ years company you know not yet disrupted by younger companies?

Those in my mind, Apple, maybe Berkshire, IBM, ... even IBM had been disrupted.

All the old car manufacturers are incomparable to Tesla now, a relatively very young company....

That is totally possible that you will forget about Tencent or Alibaba in years, without WW3 or Alien invasion.

Tech disruption is too common nowadays, especially in China or emerging markets.

For example, if Xi wants Alibaba (Jiang's line) disappeared, Alimama (from Xi's line) can easily replace it, no worry for that.

That said, it is also possible Alibaba will be the 100-year-old undisrupted company as they visioned.

Think statistically.

PRS is only the pure bond I'm watching, as of now.

Another bond I found in my asset is in Akru robo advisor (only 2%), which I don't have a choice for it :-P

That's fine since totally negligible in my whole asset.

Actually, I always recommend 100% equity fund, not any any equity fund, but a passive world broad-base equity fund.

People parking their liquidity in FD or Stashaway Simple.

I parking at akru portfolio 10 (highest risk).

Leaving only +-10k cash in bank for short-term liquidity.

As long as you have cashflow come in, nothing to worry.

Worst case scenario, like WW3, I can withdraw from equity fund, selling property, .... at lose.

As you observed, in some sense, I'm totally ok with risk.

But, I'm still quite risk-averse, try to avoid active funds.

I know I will lose many opportunities, but that's fine.

I focus more on opportunities in business that I directly own or control.

The business is actually riskier, but it is something I can control.

The one year return from business or any active income can be more than 10 years return from an investment.

Worse if your capital is small.

For example with RM 100k capital, with 100% ROI, it is only another RM 100k.

Most retail investors have less than that, 100% ROI is quite hard...

Those I couldn't control, I will default to world index fund, high likely to continue annual return of 8% without wasting my brain power and peace of mind.

So, I actually think young people (less or no capital) should start businesses, not focus on investment return.

Different case if you're a fund manager, your return is from mainly fee, before investment return.

Just a sharing la ;-)

People's different opinion mah.

World index might also be negative in 30 years time also. If think like that nothing is impossible.

Apple gone orange will come. Tesla gone Edison will replace.

Yesterday Covid 19, tomorrow Covid 21, who knows right.

Yes I agreed that young people should start business instead of spending time on investment if their target is to do big thing and get rich. But one need to know the risk la, majority people lost money in business and investment.

Jul 24 2020, 07:11 PM

Jul 24 2020, 07:11 PM

Quote

Quote

0.1351sec

0.1351sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled