QUOTE(wongmunkeong @ Apr 16 2019, 10:01 AM)

yup, looks like a loophole. i'm aiming to do like that too when 55 and if the SOP is still the same

ie.

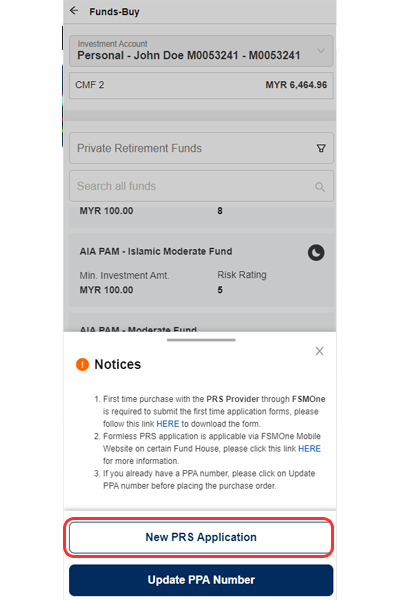

a. place $3K into PRS fixed income type thus low/no fluctuations Nov

b. take back out coming Feb

repeat (a.) & (b.)

hi, PRS cannot withdraw until retirement age right? Unless you are willing to pay the penalty 8%?ie.

a. place $3K into PRS fixed income type thus low/no fluctuations Nov

b. take back out coming Feb

repeat (a.) & (b.)

Apr 20 2019, 11:04 PM

Apr 20 2019, 11:04 PM

Quote

Quote

0.1209sec

0.1209sec

0.98

0.98

7 queries

7 queries

GZIP Disabled

GZIP Disabled