QUOTE(iloveusms @ Apr 7 2011, 11:07 PM)

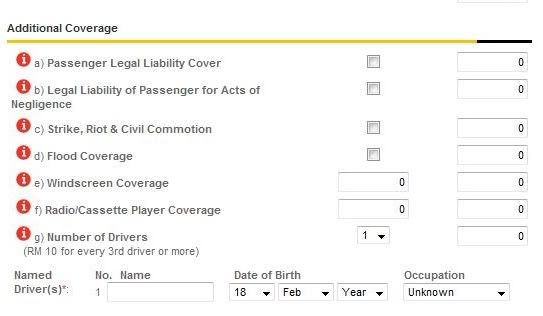

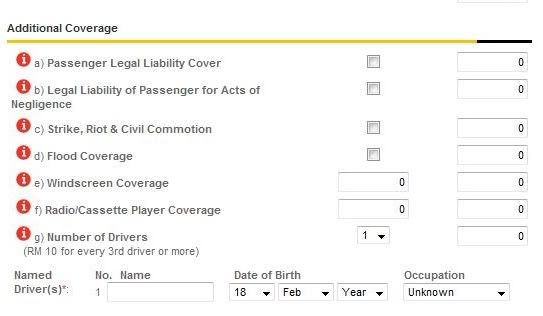

hi all,i plan to renew my car insurance online at motortakaful,but i am not sure the additional coverage,can anybody here have experience share with me,which one should add,and which one can just ignore it..mostly what you all add? thank you!

A bit late response, but as stated, it is all extra coverage (optional)

(a) in case your passengers sue you. e.g. accident, they lose their limbs

(b) same as (a), but due to negligence. e.g. you driving and talking on h/p, then bang and turn turtle. Your passenger lose limbs and want to sue.

© strike, riot... e.g. if they throw stones/molotov cocktail at your car park at roadside, you can't claim, unless you bought this extra item.

(d) flood - If you didn't buy this extra item, if your car flooded half/full, cannot claim from the general car insurance.

I think there is another add-on, called natural disaster, like earthquake, volcano, act-of-God, etc. Same applies to landslide or fallen trees. You can't claim from insurance, unless you buy extra. Otherwise, sue and claim from DBKL.

Another lesson on not to park under old trees, flood prone area and possible land slide area. Just to add, if park under coconut tree and coconut fall, cannot claim also, unless you can make it look like car accident.

(e) Windscreen - quite useful, if you travel frequent and long distance.

(f) radio/cassette - unless you have several thousand RM player, get it insured. Check if it covers the amp & speakers or not.

(g) Number of drivers - i.e. named drivers. If you don't name a driver, e.g. you husband/wife/son/daughter who use your car frequently, if accident and claim, there is loading charges (around RM400-2000, depending on car model). E.g. if you son drive your car (not named driver) and bang the fender, workshop quote RM1000 to fix and paint, minus the loading charges of let's say RM400, insurance will only pay you RM600 for the RM1000 bill.

Apr 8 2011, 10:48 AM

Apr 8 2011, 10:48 AM

Quote

Quote

0.0205sec

0.0205sec

0.58

0.58

6 queries

6 queries

GZIP Disabled

GZIP Disabled