so much allocation to "cash" for my very conservative portfolio in March. Prefer if put it into ETFs instead.

I had changed it to "conservative", and will check again next mth. Don't dare to put in more till I'm happy with my choice:

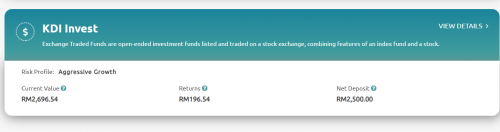

so nice those who put in very aggresive recently.. you guy bought during the lowest dip so now see all shoot up..

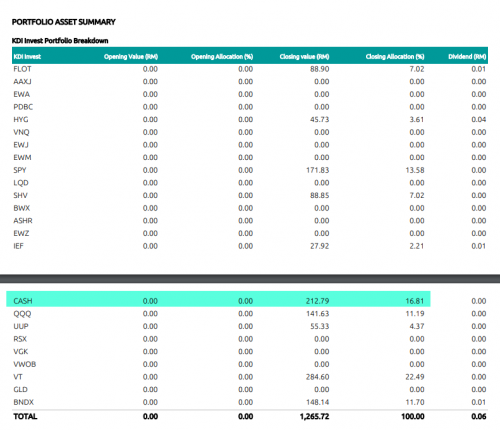

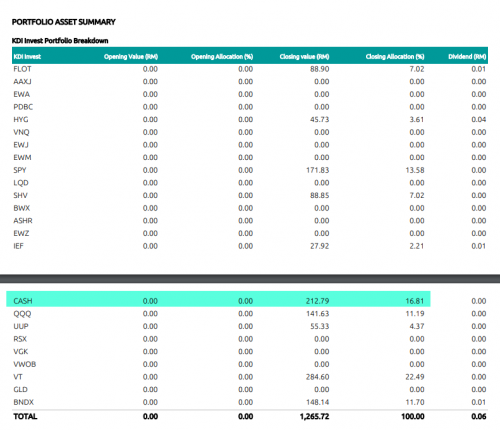

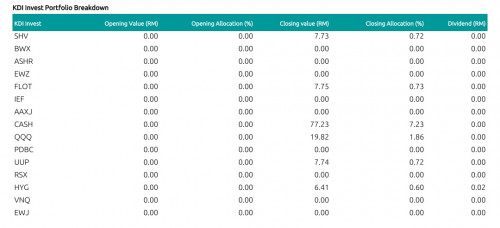

told you all d their aggressive portfolio has some nice ETFs there like QQQ and SPY.

These won't go wrong. Not sure why Stashaway avoid such US etfs.

My aggressive ETFs I self manage in IBKR. Using these robos more for bonds, commodities and conservative investing.

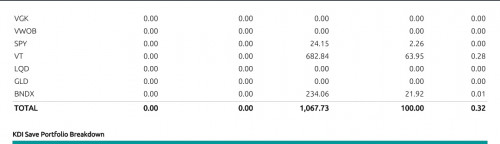

Invest below 3k in KDI Invest is worth it for its zero fees. If lazy DIY wanna invest more, KDI Invest should be a safe bet. Their lower fees and nice portfolio is good. MYTHEO is good also but higher fees. Stashaway has some weird choices for their ETFs like recent KWEB.

This post has been edited by Davidtcf: Apr 1 2022, 12:59 PM

Mar 31 2022, 06:01 PM

Mar 31 2022, 06:01 PM

Quote

Quote

0.0212sec

0.0212sec

0.59

0.59

6 queries

6 queries

GZIP Disabled

GZIP Disabled