QUOTE(x3Kai @ Mar 3 2022, 03:49 PM)

any referrals? pm thanks

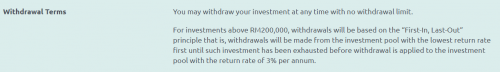

looking to enjoy that 3% since even my trusty SC PSA doesn't give that much interest anymore lol.

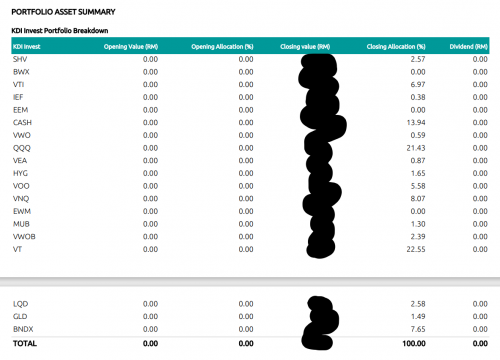

so far what are the thoughts on their offerings? i saw many here complained about transparency, but i'm still thinking of taking advantage of the first RM3k managed for free if the portfolios offered looks reasonable and such.

Sent looking to enjoy that 3% since even my trusty SC PSA doesn't give that much interest anymore lol.

so far what are the thoughts on their offerings? i saw many here complained about transparency, but i'm still thinking of taking advantage of the first RM3k managed for free if the portfolios offered looks reasonable and such.

Mar 3 2022, 03:51 PM

Mar 3 2022, 03:51 PM

Quote

Quote

0.0199sec

0.0199sec

0.72

0.72

6 queries

6 queries

GZIP Disabled

GZIP Disabled