QUOTE(bcombat @ Jul 5 2022, 11:18 PM)

how many time I need to repeat this?

no management fees for StashAway flexible portfolio until next year as part of their promotion. Only for Fresh funds.

If one don’t have fresh funds available, that’s too bad and it is the investor side issue. Some of the bank FD required fresh fund as well to enjoy special rate.

and please don’t say SA impose management fees for flexible portfolio. Shaking head

okok forgot la.. I not using Stashaway flex mah.

Ok foc management fee till next year. Then after that got. Most people won't invest in such short term though at least 2-3 years to see some gains.

QUOTE(download88 @ Jul 6 2022, 02:31 PM)

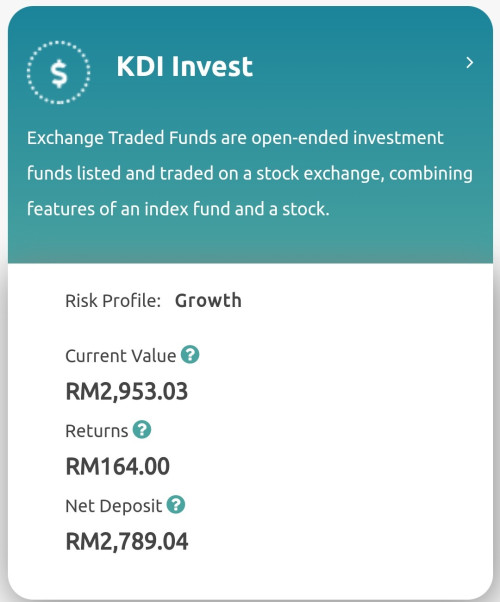

want to know how to reduce the holdings in KDI Invest? withdraw it then the system will reallocate the amount invest in each etfs?

p/s not yet try in Invest, now only put in Save account.

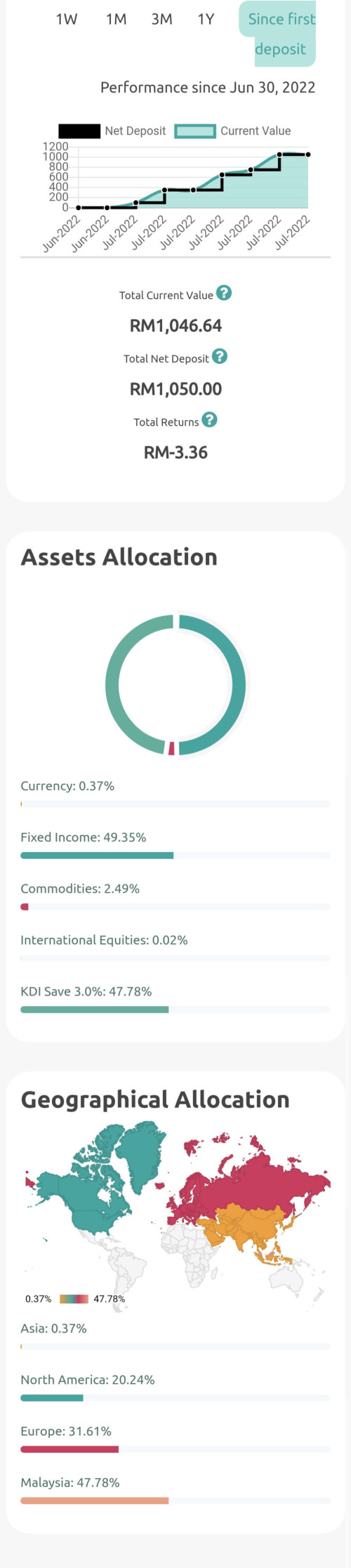

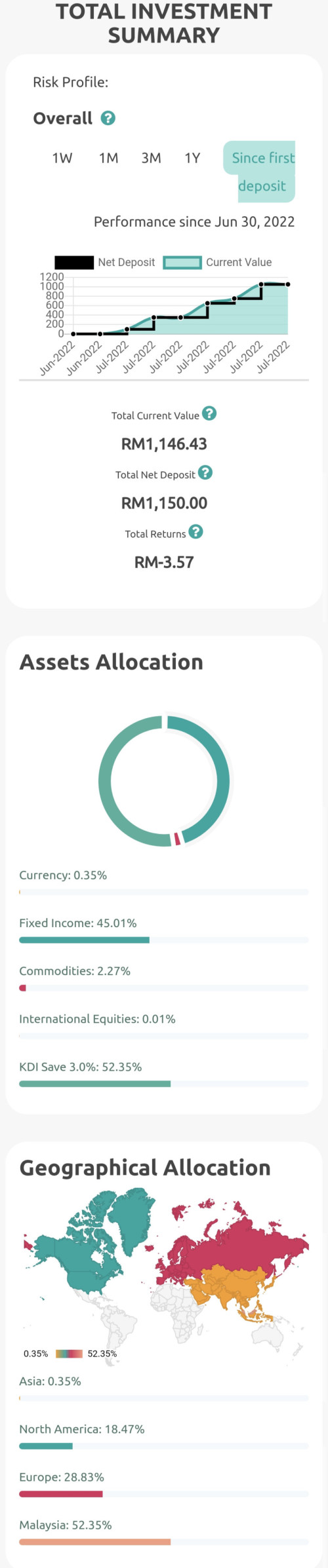

KDI Invest manage by AI. just choose your risk and it will allocate ETF based on that.

More aggressive focuses more on Equity side such as QQQ, SPY etf etc.

Conservative and Balance portfolio will focus more on bonds etf.

Those who invested in KDI Invest here mention Aggresive and Very Aggresive so far doing well for them.

Balance and conservative affected by huge bond price swings.. many of their price dropping in value that's why see much red. Due to Fed keep increasing interest rates causing bond prices to fall.

This post has been edited by Davidtcf: Jul 6 2022, 03:16 PM

Jul 5 2022, 11:18 PM

Jul 5 2022, 11:18 PM

Quote

Quote

0.0230sec

0.0230sec

0.51

0.51

6 queries

6 queries

GZIP Disabled

GZIP Disabled