QUOTE(Samasama90 @ Jul 3 2022, 03:40 PM)

it will be like watching grass grow lah, maybe check 1 time a month is goodInvestment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Jul 3 2022, 08:47 PM Jul 3 2022, 08:47 PM

Show posts by this member only | IPv6 | Post

#1281

|

Senior Member

2,337 posts Joined: Oct 2014 |

|

|

|

|

|

|

Jul 3 2022, 09:21 PM Jul 3 2022, 09:21 PM

|

Probation

25 posts Joined: Jul 2022 |

QUOTE(!@#$%^ @ Jul 3 2022, 05:24 PM) because it's a medium term investment. u will know how it performs after 2-3 years. if u wanna follow daily, then go for stocks or crypto. QUOTE(cklimm @ Jul 3 2022, 08:47 PM) Ic. Still thinking to compare KDI vs unit trust which will give better return in long run. |

|

|

Jul 3 2022, 11:16 PM Jul 3 2022, 11:16 PM

Show posts by this member only | IPv6 | Post

#1283

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(Samasama90 @ Jul 3 2022, 09:21 PM) UT charges higher especially if buy from agent or bankers. Hard to compare as there are many different UTs around with different results and past success does not guarantee future result will be the same.If u happen to know the fund manager who manage the UT very well, u may wish to stick to him or her. This post has been edited by bcombat: Jul 3 2022, 11:19 PM |

|

|

Jul 4 2022, 07:42 AM Jul 4 2022, 07:42 AM

|

Probation

25 posts Joined: Jul 2022 |

QUOTE(bcombat @ Jul 3 2022, 11:16 PM) UT charges higher especially if buy from agent or bankers. Hard to compare as there are many different UTs around with different results and past success does not guarantee future result will be the same. I think difficult to find consistent good return fund manager. some fund manager this year may perform better but next year may be not. If u happen to know the fund manager who manage the UT very well, u may wish to stick to him or her. Just in long run, not sure how good for the KDI invest perform for annual return. Can not see past performance for this KDI invest website? |

|

|

Jul 4 2022, 10:26 AM Jul 4 2022, 10:26 AM

Show posts by this member only | IPv6 | Post

#1285

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(Samasama90 @ Jul 4 2022, 07:42 AM) I think difficult to find consistent good return fund manager. some fund manager this year may perform better but next year may be not. KDI just started earlier this year. No much data available.Just in long run, not sure how good for the KDI invest perform for annual return. Can not see past performance for this KDI invest website? don’t dump in all your money in one of roboadvisor. Diversify into different type investment |

|

|

Jul 4 2022, 02:51 PM Jul 4 2022, 02:51 PM

Show posts by this member only | IPv6 | Post

#1286

|

Probation

25 posts Joined: Jul 2022 |

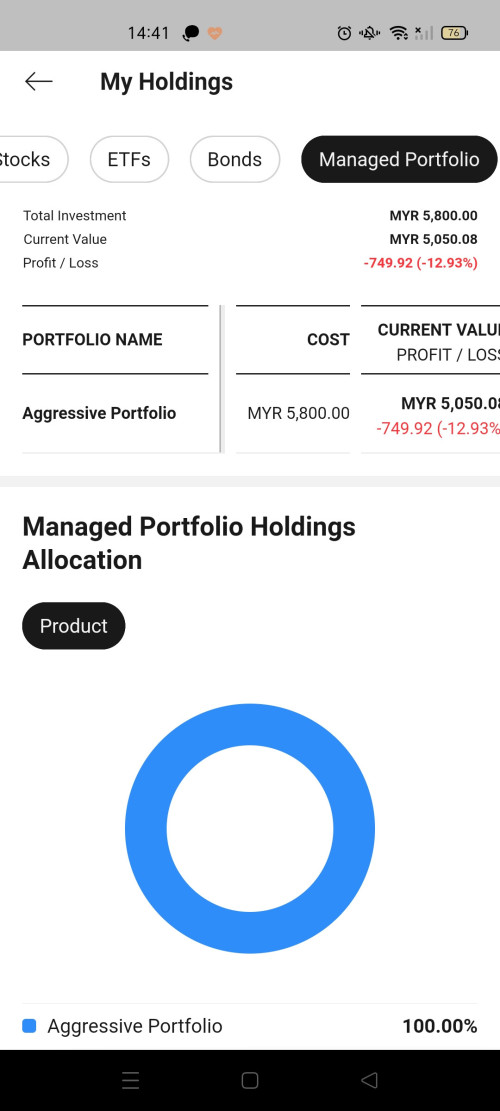

QUOTE(bcombat @ Jul 4 2022, 10:26 AM) KDI just started earlier this year. No much data available. Ic. No wonder can not find past performance.don’t dump in all your money in one of roboadvisor. Diversify into different type investment I do diverse some money into Fundsupermart manage portfolio, but so far -ve return. No idea want to continue that manage portfolio or jump ship to this KDI fund. So far invest what also -ve return.  |

|

|

|

|

|

Jul 4 2022, 03:40 PM Jul 4 2022, 03:40 PM

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(Samasama90 @ Jul 4 2022, 02:51 PM) Ic. No wonder can not find past performance. You have to understand that the fund or etf hold stocks. When majority of the stocks goes down, the etc or the fund goes down. There's no way around it I do diverse some money into Fundsupermart manage portfolio, but so far -ve return. No idea want to continue that manage portfolio or jump ship to this KDI fund. So far invest what also -ve return.  The only way around it is if they have a robot which can predict the future and sell before it drops and buy when it's near or at the bottom. But if such robot were to exist, you won't get access to it as the creators will keep it for themselves as it's basically a free gold mine for them. Btw FSM managed portfolio have reputation of being super lousy for a long time already like 5 years+. harmonics3 liked this post

|

|

|

Jul 4 2022, 04:21 PM Jul 4 2022, 04:21 PM

Show posts by this member only | IPv6 | Post

#1288

|

Probation

25 posts Joined: Jul 2022 |

QUOTE(Ramjade @ Jul 4 2022, 03:40 PM) You have to understand that the fund or etf hold stocks. When majority of the stocks goes down, the etc or the fund goes down. There's no way around it FSM manage portfolio I join last year. Every month do DCA but until today still red red. Buy time already charge 1%, now -ve return but they still charge me management fee every quarter. The only way around it is if they have a robot which can predict the future and sell before it drops and buy when it's near or at the bottom. But if such robot were to exist, you won't get access to it as the creators will keep it for themselves as it's basically a free gold mine for them. Btw FSM managed portfolio have reputation of being super lousy for a long time already like 5 years+. That why I try to research and found this KDI. Not sure how it perform compare FSM manage portfolio. |

|

|

Jul 4 2022, 04:39 PM Jul 4 2022, 04:39 PM

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Samasama90 @ Jul 4 2022, 04:21 PM) FSM manage portfolio I join last year. Every month do DCA but until today still red red. Buy time already charge 1%, now -ve return but they still charge me management fee every quarter. try yourself to see la with small amount e.g. 200-300 (below RM3k KDI manage FOC for you - no management fee). choose "aggressive" or "very aggressive" both doing well according to forummers here. That why I try to research and found this KDI. Not sure how it perform compare FSM manage portfolio. Once you confident then slowly DCA in more every month. This is the best way to know. Balanced and Conservative returns not doing too good now due to Fed raising interest rates causing Bond prices to fall. Best is DIY but need much more steps transfer here and there with Wise / CIMB SG. I'm moving fully into DIY already after consulted with my investor friends. Both can open fully online but some people don't like leceh or just scare. Money in overseas also. So some will opt for roboadvisor like KDI Invest. as for your FSM investments just leave them there till make profit only withdraw la. Else lose a lot if sell now. Also stop DCA with them liao since you hear bad feedback from others here too. This post has been edited by Davidtcf: Jul 4 2022, 04:43 PM |

|

|

Jul 4 2022, 05:23 PM Jul 4 2022, 05:23 PM

Show posts by this member only | IPv6 | Post

#1290

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Jul 4 2022, 07:32 PM Jul 4 2022, 07:32 PM

Show posts by this member only | IPv6 | Post

#1291

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(Samasama90 @ Jul 4 2022, 04:21 PM) FSM manage portfolio I join last year. Every month do DCA but until today still red red. Buy time already charge 1%, now -ve return but they still charge me management fee every quarter. Just transfer it to KDI invest. No need to think so hard.That why I try to research and found this KDI. Not sure how it perform compare FSM manage portfolio. |

|

|

Jul 4 2022, 08:05 PM Jul 4 2022, 08:05 PM

Show posts by this member only | IPv6 | Post

#1292

|

Probation

25 posts Joined: Jul 2022 |

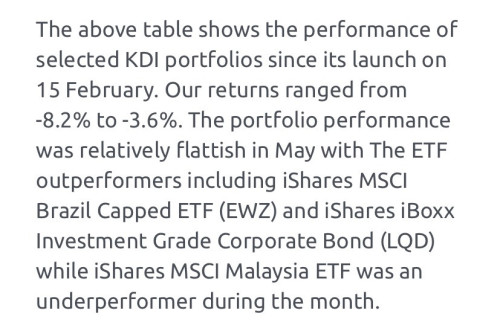

QUOTE(Davidtcf @ Jul 4 2022, 04:39 PM) try yourself to see la with small amount e.g. 200-300 (below RM3k KDI manage FOC for you - no management fee). choose "aggressive" or "very aggressive" both doing well according to forummers here. Yes.just started last month put in few hundred already.Once you confident then slowly DCA in more every month. This is the best way to know. Balanced and Conservative returns not doing too good now due to Fed raising interest rates causing Bond prices to fall. Best is DIY but need much more steps transfer here and there with Wise / CIMB SG. I'm moving fully into DIY already after consulted with my investor friends. Both can open fully online but some people don't like leceh or just scare. Money in overseas also. So some will opt for roboadvisor like KDI Invest. as for your FSM investments just leave them there till make profit only withdraw la. Else lose a lot if sell now. Also stop DCA with them liao since you hear bad feedback from others here too. Mean 6k need lock in FSM can not move. I think need 2-3year to break even if it can turn +ve 5% annually. Add on last year starting invest, total 3 year+ lock in get 0 return. QUOTE(bcombat @ Jul 4 2022, 05:23 PM) Thanks for the link. Seem KDI also in down trend for last few month QUOTE(Ramjade @ Jul 4 2022, 07:32 PM) But refer to the above past performance, KDI currently also in downtrend with -ve return. |

|

|

Jul 4 2022, 09:05 PM Jul 4 2022, 09:05 PM

Show posts by this member only | IPv6 | Post

#1293

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(Samasama90 @ Jul 4 2022, 04:21 PM) FSM manage portfolio I join last year. Every month do DCA but until today still red red. Buy time already charge 1%, now -ve return but they still charge me management fee every quarter. I investedThat why I try to research and found this KDI. Not sure how it perform compare FSM manage portfolio. a) stashaway portfolio last year June - September. Now negative 13% b) KDI invest Feb - April this year, now negative 1% c) Fundsupermart Feb-May this year, now negative 5%. My own strategy : continue invest, add slowly Put more in flexible stashaway portfolio Top up a bit KDI invest and fundsupermart manage portfolio. We will not be able to know the performance for next 5-10 years. That's why invest in different company different funds. Hopefully I make correct choice. This post has been edited by engyr: Jul 4 2022, 09:07 PM preducer liked this post

|

|

|

|

|

|

Jul 4 2022, 10:52 PM Jul 4 2022, 10:52 PM

|

Junior Member

940 posts Joined: Dec 2007 From: Shah Alam,Selangor |

» Click to show Spoiler - click again to hide... « Day 20 after switching to Growth, RM47 to breakeven, about 5.8% returns? This post has been edited by elimi8z: Jul 4 2022, 10:54 PM |

|

|

Jul 4 2022, 11:36 PM Jul 4 2022, 11:36 PM

Show posts by this member only | IPv6 | Post

#1295

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(Samasama90 @ Jul 4 2022, 08:05 PM) Like I said stocks down. So the etf holding it will go down. The question is how much down is KDI, FSM. Then when it rebound, how much higher us KDI Vs FSM. A good portfolio manager is down lesser than it's competitor and up more than it's competitor. Does FSM have have the above characteristics? So far history have proven no with FSM managed portfolio. That's why I said switch only. Don't hold on to lousy stuff. You can do a fresh comparison. Withdraw all. Put in say rm100/month into both of them. Come back to this post after 3 years and see who's the winner. 3 years is enough to judge the performance. |

|

|

Jul 5 2022, 12:31 AM Jul 5 2022, 12:31 AM

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(bcombat @ Jul 4 2022, 05:23 PM) February wasn't a good time to go in as stock prices were still quite high that time.. now they are near their support level each time hit will bounce back up a bit.But dunno if can go lower. All depends on the Ukraine War progress and Fed's decision. For me I will still DCA bit by bit once every few mths. This post has been edited by Davidtcf: Jul 5 2022, 12:32 AM |

|

|

Jul 5 2022, 07:03 PM Jul 5 2022, 07:03 PM

|

Probation

25 posts Joined: Jul 2022 |

QUOTE(engyr @ Jul 4 2022, 09:05 PM) I invested The flexible stashaway portfolio look complicated. Too many etf to mixed, that for super pro level… a) stashaway portfolio last year June - September. Now negative 13% b) KDI invest Feb - April this year, now negative 1% c) Fundsupermart Feb-May this year, now negative 5%. My own strategy : continue invest, add slowly Put more in flexible stashaway portfolio Top up a bit KDI invest and fundsupermart manage portfolio. We will not be able to know the performance for next 5-10 years. That's why invest in different company different funds. Hopefully I make correct choice. QUOTE(elimi8z @ Jul 4 2022, 10:52 PM) » Click to show Spoiler - click again to hide... « Day 20 after switching to Growth, RM47 to breakeven, about 5.8% returns? QUOTE(Ramjade @ Jul 4 2022, 11:36 PM) Like I said stocks down. So the etf holding it will go down. The question is how much down is KDI, FSM. For FSM 5 year until Jun 2022 annualised return around 4.5%. From their fact sheet.Then when it rebound, how much higher us KDI Vs FSM. A good portfolio manager is down lesser than it's competitor and up more than it's competitor. Does FSM have have the above characteristics? So far history have proven no with FSM managed portfolio. That's why I said switch only. Don't hold on to lousy stuff. You can do a fresh comparison. Withdraw all. Put in say rm100/month into both of them. Come back to this post after 3 years and see who's the winner. 3 years is enough to judge the performance. If withdraw all now rugi a lot 13%+, haven’t include the fee they charge every quarter… Actually I got do DCA last few month, otherwise the lost is over 20% for 1 year+. QUOTE(Davidtcf @ Jul 5 2022, 12:31 AM) February wasn't a good time to go in as stock prices were still quite high that time.. now they are near their support level each time hit will bounce back up a bit. Difficult to predict when is good month to enter, who knows next month may be go lower again compare July 2022.But dunno if can go lower. All depends on the Ukraine War progress and Fed's decision. For me I will still DCA bit by bit once every few mths. All can do is try to do DCA a bit every month. But must choose the correct fund to enter. Otherwise, DCA more drop more. Fund non perform but those Fund house every quarter still dare to ask performance fee… |

|

|

Jul 5 2022, 07:58 PM Jul 5 2022, 07:58 PM

Show posts by this member only | IPv6 | Post

#1298

|

Junior Member

940 posts Joined: Dec 2007 From: Shah Alam,Selangor |

|

|

|

Jul 5 2022, 08:18 PM Jul 5 2022, 08:18 PM

Show posts by this member only | IPv6 | Post

#1299

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(Samasama90 @ Jul 5 2022, 07:03 PM) The flexible stashaway portfolio look complicated. Too many etf to mixed, that for super pro level… you may want to find out more about individual assets components inside the portfolio. the weightage for each assets and its past performance etc. I do not have the details as I did not invest in the aggressive portfolio. You enter at good timing. What will happen after your portfolio exceed rm 3001? The system will auto deduct rm 21 fees become rm 2980? For FSM 5 year until Jun 2022 annualised return around 4.5%. From their fact sheet. If withdraw all now rugi a lot 13%+, haven’t include the fee they charge every quarter… Actually I got do DCA last few month, otherwise the lost is over 20% for 1 year+. Difficult to predict when is good month to enter, who knows next month may be go lower again compare July 2022. All can do is try to do DCA a bit every month. But must choose the correct fund to enter. Otherwise, DCA more drop more. Fund non perform but those Fund house every quarter still dare to ask performance fee… As for conservative portfolio as at June 22, their top assets are BNDX (28%), SHV (26%), IEF (19.3%), FLOT (9.46%). Just realised they dispose the gold ETF in my portfolio in June.  This post has been edited by bcombat: Jul 5 2022, 09:22 PM |

|

|

Jul 5 2022, 10:20 PM Jul 5 2022, 10:20 PM

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Samasama90 @ Jul 5 2022, 07:03 PM) The flexible stashaway portfolio look complicated. Too many etf to mixed, that for super pro level… If wanna avoid fee just make sure total amount don't hit 3k. Else mthly will see management fee come in. Below 3k they charge a very small amount of custodian fee just a few cents a mth. You enter at good timing. What will happen after your portfolio exceed rm 3001? The system will auto deduct rm 21 fees become rm 2980? Exceed 3k can withdraw to KDI save which is giving promotion of 3% till end of this year. Or withdraw to your bank account (can only withdraw to bank in your own name). KDI is under Kenanga ya.. A public listed investment bank in Malaysia. Hence many of us trust and use this app. ---- As for stashaway their fees higher la. I don't like flex portfolio but still charge same management fee. Padahal no auto reallocation also. ETF names easy la.. Just Google each of them see what they are. Search [ETF name] + factsheet.. Open and view their PDF every info inside there. Top etfs they let us choose is S&P500 and QQQ. KDI invest also got these 2 in their growth or high growth portfolio/aggressive. This post has been edited by Davidtcf: Jul 5 2022, 10:22 PM |

| Change to: |  0.0275sec 0.0275sec

2.47 2.47

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 03:03 PM |