When will we receive RM10 rewards? For new user for KDI invest

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Apr 4 2022, 07:23 PM Apr 4 2022, 07:23 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

590 posts Joined: Dec 2015 |

When will we receive RM10 rewards? For new user for KDI invest

|

|

|

|

|

|

May 3 2022, 06:45 AM May 3 2022, 06:45 AM

Return to original view | IPv6 | Post

#2

|

Junior Member

590 posts Joined: Dec 2015 |

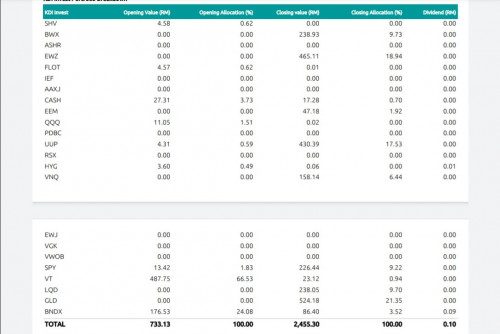

QUOTE(Yosen98 @ May 3 2022, 06:21 AM) Its kind of weird my aggresive portfolio has GLD (gold) 21% and EWZ (Brasil ETF) 19% now as at 30.4.22.Thats nt what i want. At first place they have international equity of 70++ and now become like 30%..hmmm anyone experience the same  My aggressive portfolio. Cost 2.5k. |

|

|

Jul 1 2022, 12:30 PM Jul 1 2022, 12:30 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

590 posts Joined: Dec 2015 |

Kenanga digital is very Conservative. Though I choose aggressive profile, 33% SHV, 26% IEF, 10% FLOT.

|

|

|

Jul 1 2022, 05:57 PM Jul 1 2022, 05:57 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

590 posts Joined: Dec 2015 |

|

|

|

Jul 4 2022, 09:05 PM Jul 4 2022, 09:05 PM

Return to original view | IPv6 | Post

#5

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(Samasama90 @ Jul 4 2022, 04:21 PM) FSM manage portfolio I join last year. Every month do DCA but until today still red red. Buy time already charge 1%, now -ve return but they still charge me management fee every quarter. I investedThat why I try to research and found this KDI. Not sure how it perform compare FSM manage portfolio. a) stashaway portfolio last year June - September. Now negative 13% b) KDI invest Feb - April this year, now negative 1% c) Fundsupermart Feb-May this year, now negative 5%. My own strategy : continue invest, add slowly Put more in flexible stashaway portfolio Top up a bit KDI invest and fundsupermart manage portfolio. We will not be able to know the performance for next 5-10 years. That's why invest in different company different funds. Hopefully I make correct choice. This post has been edited by engyr: Jul 4 2022, 09:07 PM preducer liked this post

|

|

|

Jul 8 2022, 06:36 PM Jul 8 2022, 06:36 PM

Return to original view | IPv6 | Post

#6

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(Samasama90 @ Jul 8 2022, 01:46 AM) Your portfolio already break rm3k? Mine still in -ve position. Kenanga digital is very Conservative. Though I choose aggressive profile, from my June statement 33% SHV, 26% IEF, 10% FLOT.Now I put around 50% in KDI save, 50% in KDI invest, slowly DCA and let see how it progress. For the KDI invest, almost all is re-invest in fixed income. Is it only my portfolio like this? Or all aggressive portfolio will be same? This explains why stashaway portfolio and fundsupermart manage portfolio -be, but KDI invest still positive. Market is down. Hope kenanga manager can buy back equity based before market up. |

|

|

Jul 8 2022, 08:45 PM Jul 8 2022, 08:45 PM

Return to original view | IPv6 | Post

#7

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(Davidtcf @ Jul 8 2022, 06:42 PM) Their AI algorithm is the one deciding it. Once market recovers will see more in the usual equity etf. That's why I try different portfolio.Good mah if not so much red. You prefer seeing more negatives? Probably their managers think market will drop further.... Capital preserved is more important... |

| Change to: |  0.0833sec 0.0833sec

0.71 0.71

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 06:41 PM |