QUOTE(contestchris @ May 2 2025, 08:40 AM)

Hafiz, you're a smart guy and you're very correct in whatever you're saying.

But I don't understand your issue with building lapse supportable products and pricing them cheaper than they otherwise would be, by designing them such that there is no surrender value.

If this was wrong, BNM and other insurance regulators around the world would outlaw it...but it is perfectly legal and even the "Big 3" design some products like this.

As for single premium products...actually I would for all intents and purposes be happy to buy such a product without a surrender value, if it means the single premium is 20% to 30% cheaper and if it is disclosed upfront.

You can feel however you feel, that is your right as a consumer. But I don't understand your issue with building lapse supportable products and pricing them cheaper than they otherwise would be, by designing them such that there is no surrender value.

If this was wrong, BNM and other insurance regulators around the world would outlaw it...but it is perfectly legal and even the "Big 3" design some products like this.

As for single premium products...actually I would for all intents and purposes be happy to buy such a product without a surrender value, if it means the single premium is 20% to 30% cheaper and if it is disclosed upfront.

But, this product is being sold to the masses, to others than yourself, and who themselves have very different appetites, very different life circumstances/financial situations.

Anything can happen in future, 20 - 30 years is a very long time period. Consumers deserve the right to pivot according to their changing circumstances and shouldn't be penalized for it.

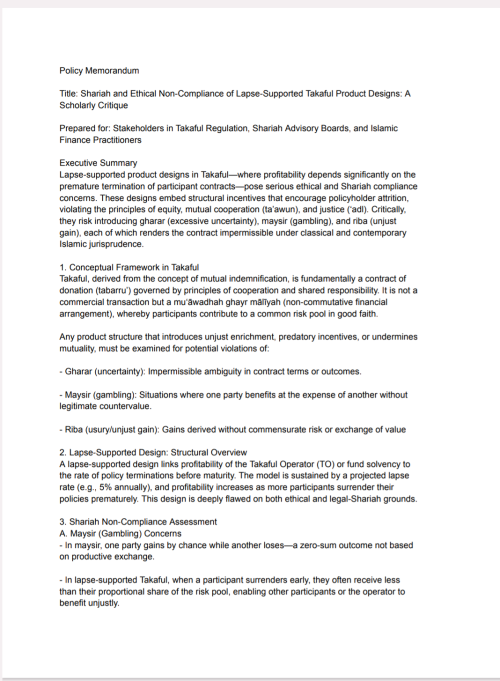

It is unethical, unfair and very predatory to have a product design where ITOs are incentivised to target vulnerable consumers. The ITO's financial position or standing is directly linked to the number of surrendering policies.

Another way to look at it, the ITO requires for a proportion of the insurance/takaful pool to surrender every year so that the tabarru fund (risk fund) or the non-participating fund does not have a deficit. If they have less than the expected proportion of policies surrendering, say 5% per annum, they are in trouble and would have to pump money into the tabarru or non-participating fund.

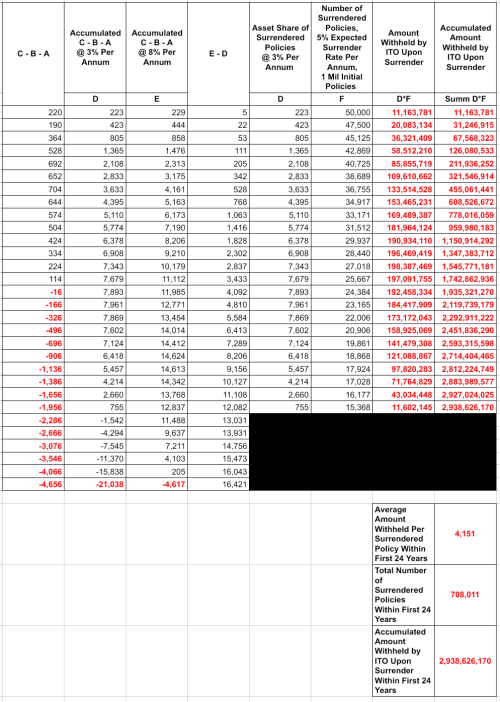

Do you know what a 5% surrender rate per annum means? It means that if an ITO had a million policies at the beginning of a 30 year policy term, they would only have around 600k policies by the 10th year, 463k by the 15th year, 359k by the 20th year, 277k by the 25th year, and 215k by the 30th year.

So, the ITO needs to go out there and find a million policies, out of whom 401k need to leave by the 10th year, 537k by the 15th year, 642k by the 20th year, 723k by the 25th year and 785k by the 30th year.

That is the number of people we are telling to go fly kite. It's just a disaster waiting to happen.

It's even better for the ITO if more than the expected number of policies surrender. They would then be in surplus position and they get to keep all the profits from it. A horrendous incentive structure.

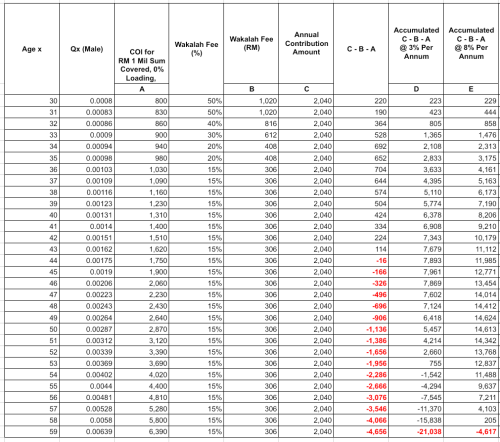

This is the impact. For the Kaotim product, assuming 1 million 30 yr old males signed on for the RM 1 million coverage, 30 year plan @ RM 2040 per annum, a 5% expected surrender rate per annum yields over 700k surrenders within the first 24 years of the plan and an average withheld amount per surrendered policy of RM 4151 and an accumulated withheld amount of RM 2.94 billion.

Edit: I should add that this lapse supported design and pricing model is also a death supported design and pricing model, as the Asset Shares of policies terminated due to death events are also unfairly withheld by the ITO within the tabarru fund or non-participating fund (conventional). Whether a policy is terminated due to a surrender or an insured/takaful event, in this case 'death', it's unfair to withhold any remaining Asset Share amount. A surrendered policy should by right receive the policy's remaining Asset Share amount upon surrender while a death event policy should receive both the sum assured amount as well as the Asset Share amount.

So, while the above projections on the number of expected surrendered policies do not include death, it should have. Within the first 24 years, there are expected to be around 20k deaths after accounting for the surrendered policies. It would not add much to the surrendered policy numbers, but the point remains. Both the death event and surrendered policies have the same level of withheld Asset Share amounts, per policy, within the tabarru fund.

Interesting thought experiment. Most takaful models and investment-linked policies operate on a drip model, where regular deductions are made from the savings account (unitised fund account) to finance the insurance/takaful coverage component. The only difference being the frequency of drips, with some done on a monthly basis, while others weekly.

When a policy is surrendered during the period between two drips, it would only be fair for a portion of the insurance/takaful coverage charges to be returned to the policyholder. The amount returned should commensurate with the charges that would have been levied for the period between the surrender date and the end of the drip coverage period. E.g., if RM 200 was deducted at the beginning of the month for a monthly coverage, and the policyholder decided to surrender the policy on the 10th day of a 30 day month period, then the amount returned to the policyholder should be two-thirds of the RM 200 insurance/takaful charge or RM 133.3.

The question is, should this also be done for a policy terminated due to an insurance/takaful event such as death? If no, why not? I would argue that the same principles should apply.

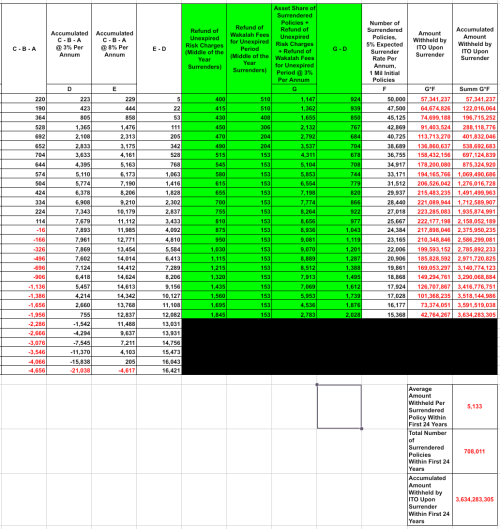

Btw, the projections in the earlier example don't provide for a return to policyholders of the unexpired risk amounts, so that's another thing to look out for.

The following table has accounted for the refund or return of both the unexpired risk charges and wakalah fees. Yes, the same principle should also apply for wakalah fees covering the unexpired period.

The average amount withheld per surrendered policy jumps from RM 4151 to RM 5133 once the unexpired risk charges and wakalah fees are accounted for. And the accumulated withheld amount grows to RM 3.6 billion from RM 2.94 billion.

For anyone who challenges the need to refund the risk charges and wakalah fees for the unexpired period, ask them to play out the various scenarios where policyholders are allowed to pay premiums based on various payment modes (monthly, quarterly, annually). Compare the financial outcomes under various decrement events (death, surrender etc.) happening on a specific date for the various payment modes, and then compare those financial outcomes with the financial outcomes under various decrement events of a theoretical policy having a daily premium payment mode and daily deductions for wakalah fees and other charges (incl. risk charges).

This post has been edited by hafizmamak85: May 3 2025, 03:49 PM

May 2 2025, 10:49 AM

May 2 2025, 10:49 AM

Quote

Quote

0.0218sec

0.0218sec

0.41

0.41

6 queries

6 queries

GZIP Disabled

GZIP Disabled