QUOTE(contestchris @ May 1 2025, 07:14 PM)

I think you are jumping to the wrong conclusions here. Yes, the product is lapse supportable because it contains no surrender value.

But insurers CAN design such products.

If too many policyholders buy long-term cover and the lapse just 2 or 3 years into the policy, the insurers make bank. Why is this wrong though?

Cause on the flip side, by buying such a product, you pay significantly lesser.

In pricing the product, the insurer will make certain lapse assumptions, possibly by drawing from the experience of similar products.

By pricing the product such that there is no surrender value, we customers get to buy "cheaper" term cover. This is proven by the fact that Kaotim Legasi is cheaper than almost every other term insurance covering death and TPD.

There is nothing shady here. It is written clearly in the PDS and policy contract that there is no surrender value.

As a customer looking for the absolute cheapest insurance coverage, I am OKAY with this. I don't need any surrender value from my pure protection policies.

Regarding the company's ability to reprice, I believe it is a standard wording for "non-guaranteed" products. Most term cover products have this clause. Those with guaranteed rates, are generally more expensive. However, given the trend of Malaysians living longer, this should not be a concern. It is fairly unlikely, probably unheard of, for an insurer to reprice pure death+TPD products, and if they do, they will come under significant scrutiny from BNM. If they intentionally underpriced the product, they will not get the approval from BNM to reprice the product. BNM has access to all the assumptions used in pricing the product.

As to the question of the use of estate, I am not sure if STMB has any estate, and if they do, is it even significant? Do takaful operators even have an estate? Is a estate even applicable to non-participating policies such as this? In any case, that's not an issue and BNM has got stringent policies on the management of estates and not a relevant consideration as to whether one should buy this product or not.

Edit: My man, you do know that for pure protection non-participating product from conventional insurance, the customer gets nothing as well right, if ultimately the fund has excess monies due to high lapses, or better-than-expected claims experience.

Seriously, who in the world is feeding you these talking points????? Whatever the case may be, let's go through it.

Can insurers and takaful operators (ITOs) design and price such lapse supported products? Short answer, no. As ITOs are required to treat consumers fairly, which would not be possible in a lapse supported scenario. If ITOs are legally allowed to treat consumers unfairly, then yes, all is good.

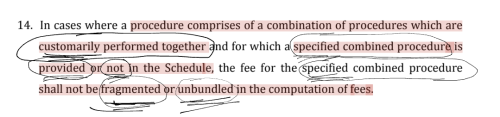

The question is, in constructing the terms of the insurance and takaful (IT) contract, what are the implied terms of a fair and just IT contract and why is a lapse supported design inherently unfair, regardless of disclosure?

For one, disclosure is not a carte blanche to treat consumers unfairly. One can't disclose unfair term X to consumers and consider such disclosure sufficient to turn unfair term X to fair term X. Especially in a consumer insurance/takaful contract where consumers have no say in shaping the terms of the contract.

So, what is it about term X (lapse supported design and pricing) that makes it an inherently unfair term in the construction of IT contract terms?

One of the implied terms in any long term IT contract which has a pre-funding element is that there must be a fair surrender value which would pass back to consumers the unused pre-funded amount. Why? Because fairness is linked to equity and equity does not allow for 'Robbing Peter to pay Paul' scenarios.

So, the points about policyholders, as a group, getting cheaper premiums or shareholders getting a bigger share of profits from surrendered policies don't count.

Equity requires a 'proper' balancing of the rights and interests between each individual within a group (between each policyholder within a pooled fund/group of policyholders), and between different groups or parties within the contract (policyholders vs shareholders) over various contemporaneous and non-contemporaneous risk sharing time periods.

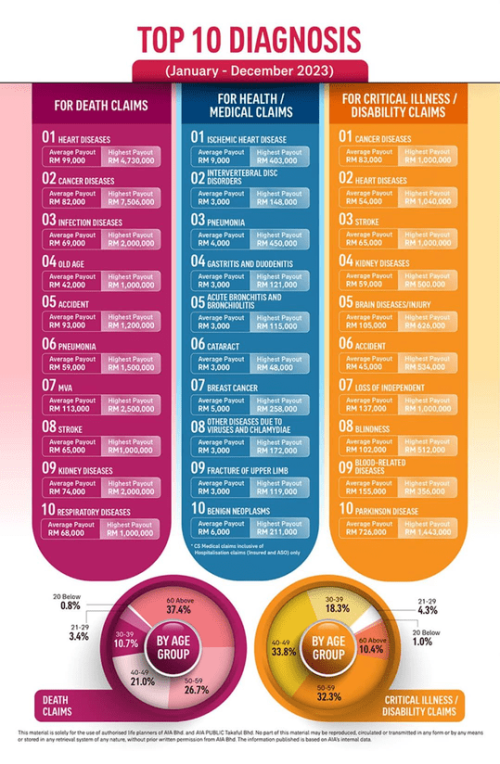

Policyholders in a risk pool/fund typically have their cost of insurance/takaful charges calculated based on their individual or group risk exposure levels and duration of exposure.

For a leaving policyholder, their risk exposure is limited to the duration they were in the fund - up until the policy's termination. Therefore, the amounts deducted for insurance/takaful coverage should commensurate with the level of risk exposure for the duration the leaving policyholders were at risk. Not more, not less.

Insurance/takaful is mostly a form of risk sharing within contemporaneous time periods. There is no risk sharing within non-contemporaneous time periods, such as the smoothing of investment returns in a participating fund setting, which would allow for deductions from the policy's asset share. The fact that it is pre-funded means the amount is required for future risk sharing, not present risk sharing.

The excuse that insurance/takaful may involve risk sharing within non-contemporaneous time periods as surpluses may be retained and built up for future generations is misapplied in this scenario. Mortality risk is much less volatile compared to investment returns. And any deductions from the policy's Asset Share for the build-up of surpluses should be done incrementally, applied across the board throughout the term of the policy and shouldn't just target surrendering policies. It is not an excuse to not provide a fair surrender value.

Shareholders also deserve their fair share of profits from a long term contact and the level of profits is tied to the level of service/risk protection provided within the period the leaving policyholder was serviced/at risk. Not more, but can be less. And the amount shareholders may take as profits has nothing to do with the pre-funded amount.

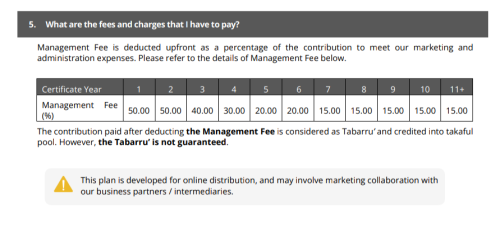

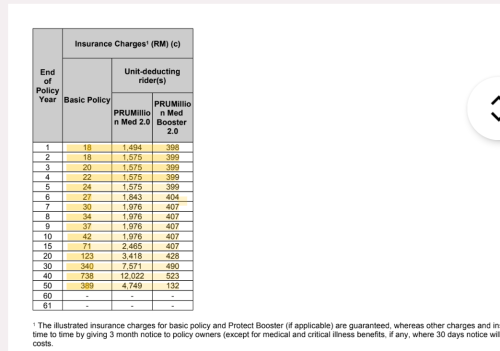

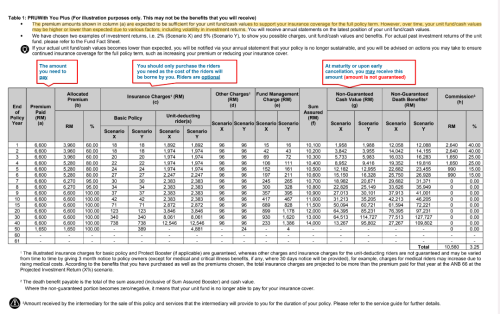

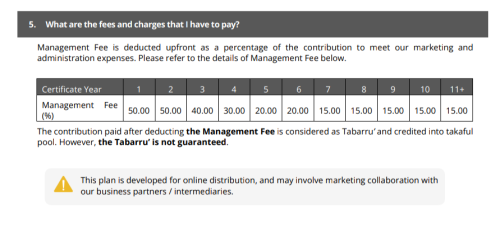

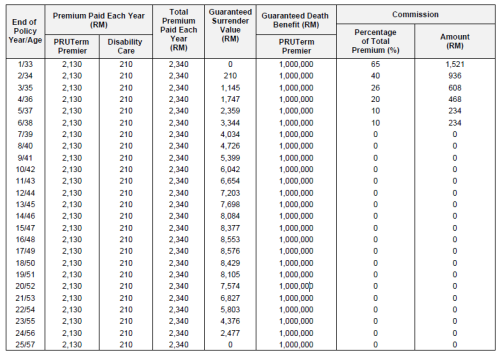

In the case of STMB's Kaotim, there are no profits to be made by STMB from the tabarru fund (risk charges). What they have are only wakalah fees. Very, very high wakalah fees which are charged to the premium (contribution) amount, prior to the remainder being allocated to the tabarru fund.

Sidenote:

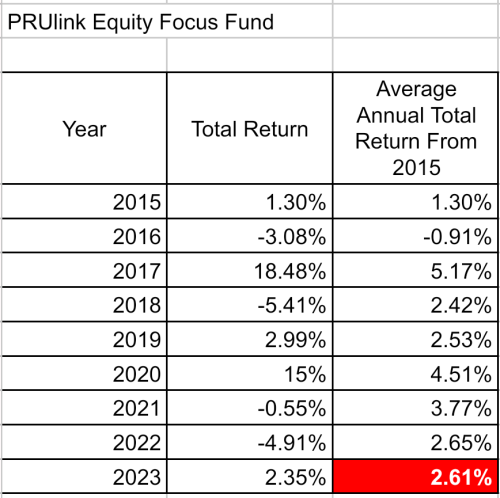

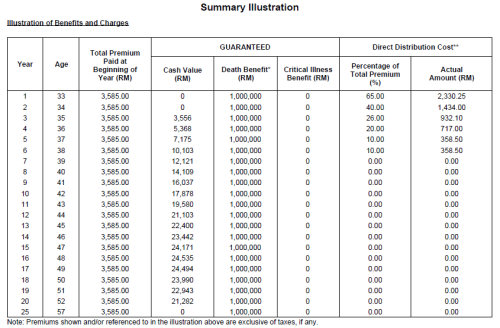

The more one looks at the pricing of the premium amounts, the more suspicious it gets. They are either expecting very high lapse rates, perhaps even as high as 5% per annum or above, during the initial 10 - 20 years of the policy, or are relying on the investment returns generated by the Estate within the tabarru fund, or both, or worse, just downright expecting some Estate or other surplus resource within the fund to finance any deficit - I'm pretty confident they may even be praying for mortality to be low. I just don't see how the Kaotim policy can be sustainable with such high wakalah fees and low premium amounts.

Even with a projected 8% return per annum, a 30 year term Kaotim policy for RM 1 million in coverage for a 30 yr old, under a 0% lapse scenario and RM 2040 in annual premiums, still yields a tabarru fund deficit of RM 4.6k at end of the policy's term.

Btw, can you imagine, spending RM 50,000 or RM 60,000 on a single premium 30 yr mortgage reducing term assurance product, only to be told that your policy doesn't have any surrender value as the product was designed to be lapse supported, and you are in the midst of settling the loan during the 5th year.

Also, takaful is a participating type policy by its very nature (not non-participating). The tabarru funds (risk funds) are 'owned' by policyholders.

As for BNM, just as what they keep conveying to the media, they do not 'approve' of a product's pricing/re-pricing or design.

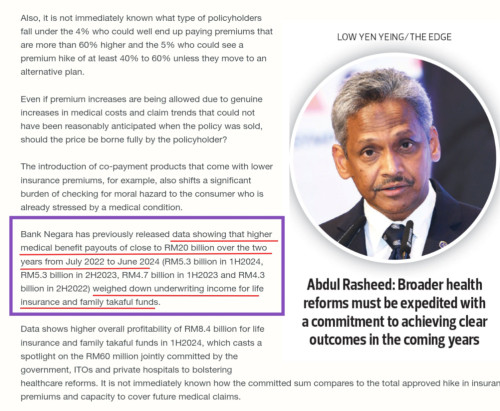

Having said that, BNM does have the authority to issue any direction to the lTO, as they deem fit and pursuant to the objectives of the Financial Services Act. These directions may include putting a stop to any re-pricing efforts or the launch of any product, if they deem such efforts may lead to policyholders being treated unfairly or adversely affected. Why didn't BNM issue such directions to put a stop to so many unfair/unlawful practices????

BNM as an institution has failed many a time in protecting the rights and interests of policyholders. We have to stand up to them. They are only human. They have been lulled by the very power they have wielded for so long that they have forgotten their duties or failed to carry them out properly.

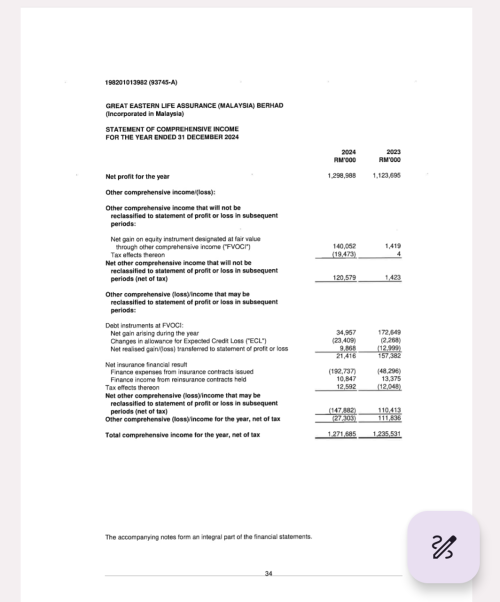

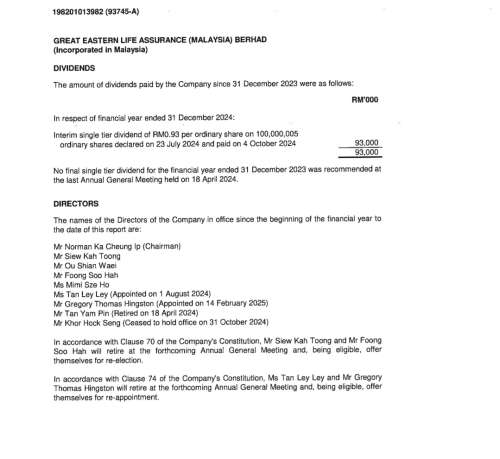

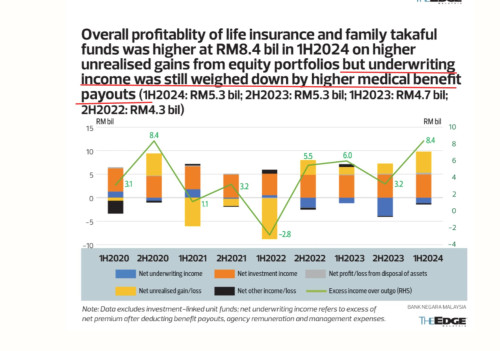

Case in point, how did Great Eastern's Estate grow from RM 1.8 billion in 2001 to + RM 10 billion in 2018????? If BNM and Great Embarrassment were so competent and fair to consumers, this wouldn't have happened in the first place.

Why and how did it come to be that BNM ended up conspiring with MOF, Great Eastern in misappropriating RM 2.37 billion from their participating policyholders????

Why haven't any of the other foreign insurers complied with the in-lieu-of-divesting condition: contribution to the mySalam trust fund???

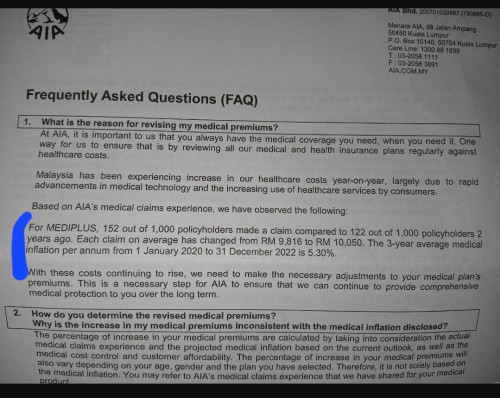

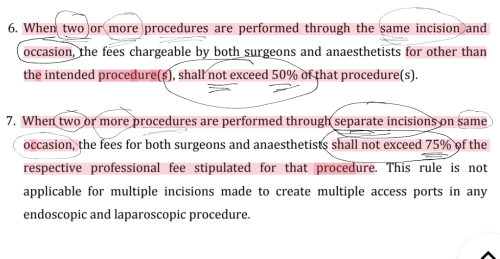

How is it that long term level premium IL policies with medical coverage still face the risk of re-pricing year in, year out??? Why were these policies allowed to be priced without accounting for the long term effects of medical inflation, and with such high expenses and profit margins???? Why have claim delay and denial tactics been allowed to fester?????

Why were are all these unfair/unlawful practices allowed to run rampant????

This post has been edited by hafizmamak85: May 3 2025, 05:00 PM

Apr 26 2025, 06:44 PM

Apr 26 2025, 06:44 PM

Quote

Quote

0.0238sec

0.0238sec

0.84

0.84

6 queries

6 queries

GZIP Disabled

GZIP Disabled