QUOTE(Wedchar2912 @ May 1 2025, 08:18 PM)

these are the highest per disease rite? cos the average payout remains below 10K rm.

in some sense, 200K annual limit does serve its purpose for most people... definitely most people.

of course, higher limit is better but comes with higher cost rite?

Not really.

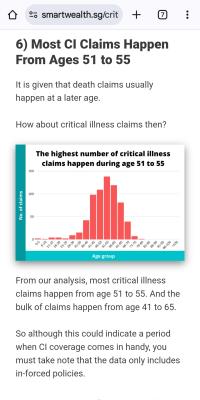

Higher claim sizes, above RM 500k, have very low frequency (number of claims), and very low volatility in claims size.

So, generally, even if you were to increase the annual limit, say from 1 mil to 5 mil, there theoretically shouldn't be a significant difference in the premium amount.

It's the small claims that exhibit inflation or volatility both in terms of frequency and claims size.

The bigger and more pressing issue is that even if you were to purchase a modest 200k annual limit product, you may not be getting your money's worth due to claim delay and deny tactics.

Even if the premium is around RM 1.6k per annum, maybe only RM 1k or less goes towards paying medical claims. Which, in turn, would reasonably mean that most of the medical claims are below RM 30k in size.

So, an ITO that doesn't practice delay and deny tactics and genuinely pays for all claims below RM 200k may have a premium amount of RM 2.2k per annum, with around RM 2k per policyholder going towards paying claims.

QUOTE(hafizmamak85 @ Apr 23 2025, 12:59 PM)

You don't have to take my word for it. You can read this write up by one Dr Gunalan Palari Arumugam in CodeBlue

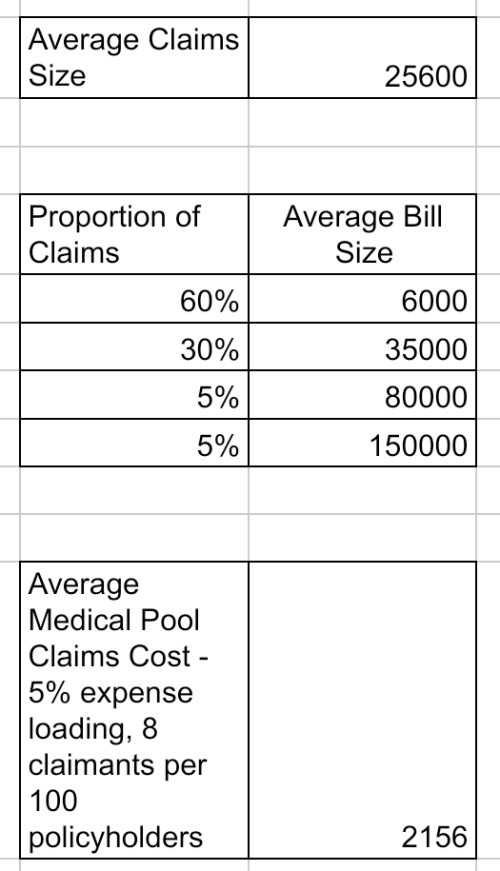

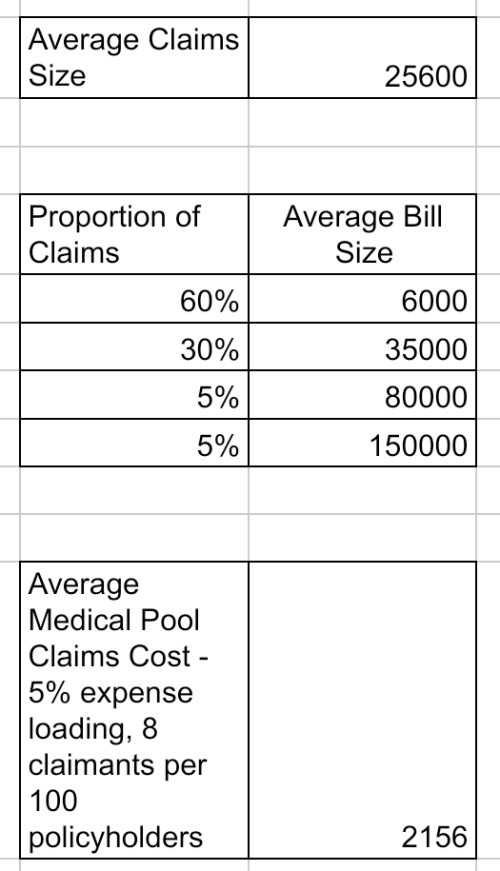

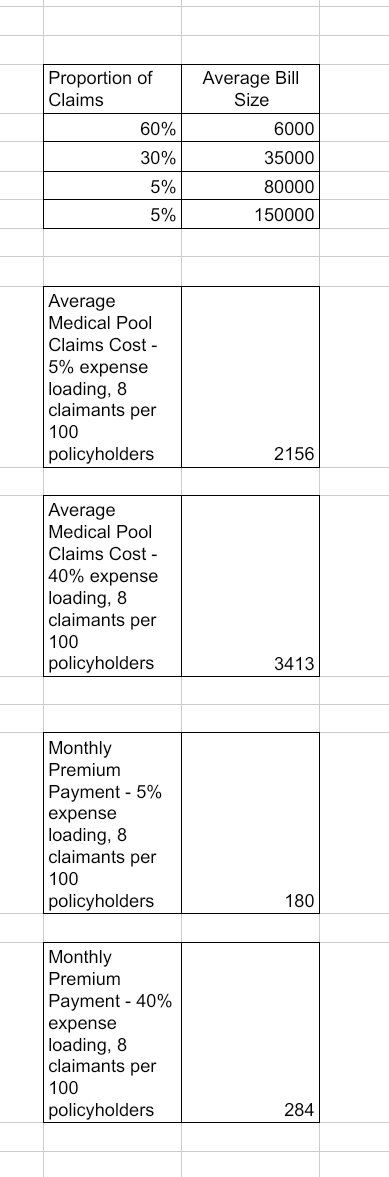

The Private Medical Insurance And Hospital Charges Conundrum: Part 2 — Dr Gunalan Palari Arumugam The misconception is that our fees are bankrupting patients. Just an example of range of fees, about 60 per cent of hospital bill sizes fall below RM10,000 (mainly medical admissions), 30 per cent between RM10,000 and 50,000 (simple surgeries), and 5 per cent RM50,000 and RM100,000 (complex surgeries),

Only about 3 to 5 per cent of cases actually exceeded RM100,000, and this is when a patient presents with a complicated problem (cardiovascular or neurology) and multi-organ failure that needs end organ support via ventilation, dialysis, interventional radiology (coronary or neuro). These are the bills that generally depletes the savings of our patients, if the insurance is not able to cover the costs.Using the above bill size distribution and assuming 8 per 100 policyholders make claims (8%) every year,

the monthly premium comes up to RM 180 with a 5% loading and RM 280 with a 40% loading (loading for expenses/profit etc.).It's still going to be somewhat pricy.

» Click to show Spoiler - click again to hide... «

QUOTE(hafizmamak85 @ Apr 21 2025, 08:17 PM)

This has been explained before. It's not the big claims that are an issue, it's the more frequent small claims that are causing premium prices to increase. The difference in annual limits at the higher end don't make much of a difference. It all depends on the types of treatments, procedures available. It is not the case, to my mind, that there is a RM 500k treatment option under the 1 million annual limit and another RM 1.5mil treatment option under the 2 million annual limit for the same type of disease/disability burden - and even if that was the case, the frequency of such a disease/disability burden would be minimal enough to not make much of a difference for the purpose of pricing premiums. It would be more impactful from a premium pricing perspective if there were two treatment options, with one being RM 2k and another RM 5k, both covered under the 1 mil and 2 mil annual limit options for the same disease/disability burden, as the smaller claims tend to have a much higher claims frequency and variations in claims severity for the same type of disease/disability burden.

QUOTE(hafizmamak85 @ Apr 23 2025, 05:06 PM)

And I'm telling you those champions are probably denying or delaying claims. Just because Generali and others like Etiqa priced those products below or around RM 1.5k doesn't means that you're getting your money's worth.

Assuming a 40% margin means a RM 1.6k product is only paying less than RM 1k in average medical pool claims cost. Probably most of their claims are below 30k. You're buying it at your own peril. So please be aware. Do ask on their average claims payout, average medical pool claims cost and other key statistics.

May 8 2025, 11:36 AM

May 8 2025, 11:36 AM

Quote

Quote

0.0207sec

0.0207sec

0.66

0.66

6 queries

6 queries

GZIP Disabled

GZIP Disabled