Does anyone have Lonpac medical insurance? In particular, Medisecure Plus 2015. Does it come with a medical card for cashless admission to panel hospitals?

Insurance Talk V7!, Your one stop Insurance Discussion

Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Apr 23 2025, 04:22 PM Apr 23 2025, 04:22 PM

Show posts by this member only | IPv6 | Post

#7141

|

Senior Member

5,558 posts Joined: Aug 2011 |

Does anyone have Lonpac medical insurance? In particular, Medisecure Plus 2015. Does it come with a medical card for cashless admission to panel hospitals?

|

|

|

|

|

|

Apr 23 2025, 04:45 PM Apr 23 2025, 04:45 PM

|

Senior Member

4,482 posts Joined: Jul 2005 |

QUOTE(hafizmamak85 @ Apr 23 2025, 02:03 PM) The point was that even the 30/40 year olds may have to pay above RM 250 a month so that people of your mother's age and above can get a not so pricy premium of below RM 6k again please experience before sharing wrong info. at age 40 the term insurance i bought for smartcare optimum from generalli only cost me rm1.6k per annum. from etiqa and other with lower coverage its as low as rm800 - 1300. it's not that expensive. its a good start for anyone who wants extra protection. |

|

|

Apr 23 2025, 04:47 PM Apr 23 2025, 04:47 PM

|

Senior Member

4,482 posts Joined: Jul 2005 |

QUOTE(Wedchar2912 @ Apr 22 2025, 08:42 PM) I'm not really sure if it is worth while to so called get a "future proof" card as in having medical coverage with high limits... i always tell ppl you need anything above rm1m for insurance.. you would rather die than hanging on..as you said, many stories about providers rejecting certain "exotic" treatment and now them hiking medical premium exorbitantly... essentially pricing the policyholder out of his medical coverage when he needed it most. And this is despite him paying from start while under-utilizing the insurance all this while. And that is also assuming if one can survive even one incident that cost 1.5 million ringgit treatment! plus how many exotic illness would need a treatment of say 2 million ringgit? these are like super rare events. (but providers greed is a lot more common and infinite) But if one can afford the coverage, sure... |

|

|

Apr 23 2025, 05:04 PM Apr 23 2025, 05:04 PM

Show posts by this member only | IPv6 | Post

#7144

|

Junior Member

400 posts Joined: Jan 2003 |

QUOTE(Ramjade @ Apr 21 2025, 07:13 AM) If you want to buy those 200k-1m coverage without agent, not possible. For those 100k coverage can buy fully online. kaotim by takaful malaysia also can be bought online up to 1.1 millionGenerali can be bought online via fi.life This post has been edited by bryon: Apr 23 2025, 05:04 PM |

|

|

Apr 23 2025, 05:06 PM Apr 23 2025, 05:06 PM

|

Junior Member

463 posts Joined: Nov 2009 |

QUOTE(kidmad @ Apr 23 2025, 04:45 PM) again please experience before sharing wrong info. at age 40 the term insurance i bought for smartcare optimum from generalli only cost me rm1.6k per annum. from etiqa and other with lower coverage its as low as rm800 - 1300. it's not that expensive. its a good start for anyone who wants extra protection. And I'm telling you those champions are probably denying or delaying claims. Just because Generali and others like Etiqa priced those products below or around RM 1.5k doesn't means that you're getting your money's worth. Assuming a 40% margin means a RM 1.6k product is only paying less than RM 1k in average medical pool claims cost. Probably most of their claims are below 30k. You're buying it at your own peril. So please be aware. Do ask on their average claims payout, average medical pool claims cost and other key statistics.QUOTE(hafizmamak85 @ Apr 23 2025, 12:59 PM) I'm sorry for what your family has had to go through. Yes, you are right, a significant number of treatments/procedures can be covered within a 150k coverage. But what makes you think RM 100 per month is sufficient to cover sub RM 150k treatments/procedures??? This post has been edited by hafizmamak85: Apr 23 2025, 05:26 PMIf an ITO did price it as such, without high deductibles like RM 5000, it's my view that they might likely be denying/delaying claims. You don't have to take my word for it. You can read this write up by one Dr Gunalan Palari Arumugam in CodeBlue The Private Medical Insurance And Hospital Charges Conundrum: Part 2 — Dr Gunalan Palari Arumugam The misconception is that our fees are bankrupting patients. Just an example of range of fees, about 60 per cent of hospital bill sizes fall below RM10,000 (mainly medical admissions), 30 per cent between RM10,000 and 50,000 (simple surgeries), and 5 per cent RM50,000 and RM100,000 (complex surgeries), Only about 3 to 5 per cent of cases actually exceeded RM100,000, and this is when a patient presents with a complicated problem (cardiovascular or neurology) and multi-organ failure that needs end organ support via ventilation, dialysis, interventional radiology (coronary or neuro). These are the bills that generally depletes the savings of our patients, if the insurance is not able to cover the costs. Using the above bill size distribution and assuming 8 per 100 policyholders make claims (8%) every year, the monthly premium comes up to RM 180 with a 5% loading and RM 280 with a 40% loading (loading for expenses/profit etc.). It's still going to be somewhat pricy. » Click to show Spoiler - click again to hide... « |

|

|

Apr 23 2025, 05:11 PM Apr 23 2025, 05:11 PM

Show posts by this member only | IPv6 | Post

#7146

|

All Stars

24,358 posts Joined: Feb 2011 |

|

|

|

|

|

|

Apr 23 2025, 05:15 PM Apr 23 2025, 05:15 PM

|

Junior Member

463 posts Joined: Nov 2009 |

|

|

|

Apr 24 2025, 02:44 AM Apr 24 2025, 02:44 AM

Show posts by this member only | IPv6 | Post

#7148

|

Junior Member

463 posts Joined: Nov 2009 |

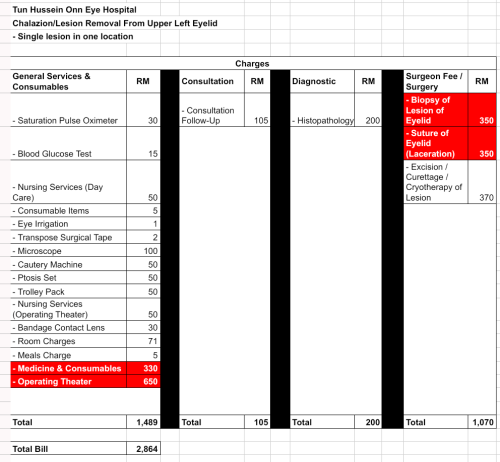

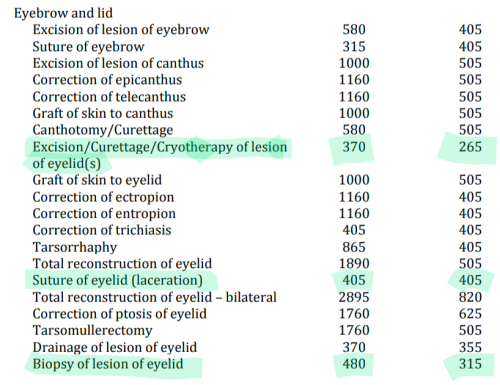

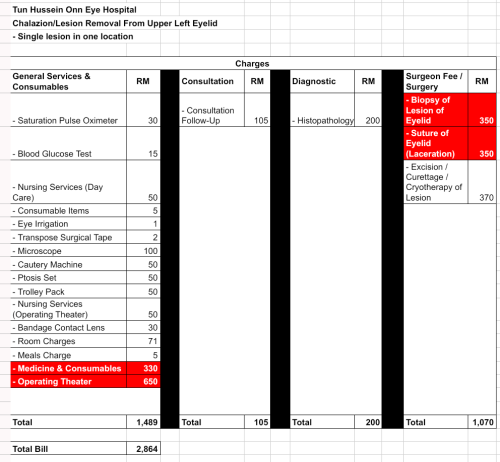

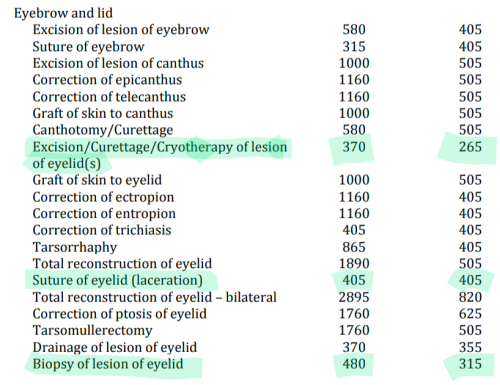

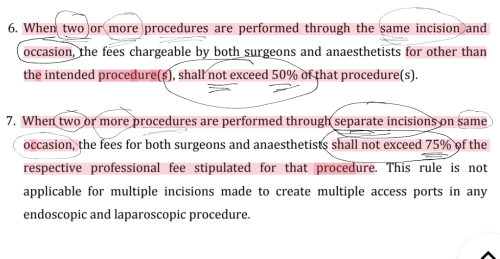

Here is an example where the schedule 13 surgeon fee cap is not respected, and with what I would consider excessive charges for hospital supplies and services (esp. the operating theater and medicine/consumables charges) - all for a simple daycare procedure.

Unbundling/layering are common practices. So why bother having surgeon fee caps in the first place if they aren't going to be enforced????? And this is in a non-profit (Tun Hussein Onn Eye Hospital) - where is all the money going to??? Can't seem to find any financial report online. I would think there are plenty Malaysians who wouldn't mind paying even RM 1k - 1.5k in a government hospital for such procedures. There are many minor procedures like this (within RM 30k) which would benefit from subsidies for full fee paying patients. It's a simple benign chalazion/lesion removal in a single spot, so why should it cost almost RM 3k???? Medicine/consumables/supplies/services and operating theater fees come to about RM 840 and RM 650 respectively, another RM 105 for consultation fees, another RM 200 for biopsy (test), and a whopping RM 1k in surgeon fees.  When there are surgeon fees, why the need for a consultation fee as well??? Why unbundle and layer it with specific surgeon fees for biopsy and eyelid suturing, when it's clear that these should all be covered under the main procedure, which is eyelid lesion excision/curettage/cryotherapy????  » Click to show Spoiler - click again to hide... « Btw, this was done just using novocain. If general anesthesia, another 2k. Go figure. Another schedule 13 breach. Govt to apply diagnostics-related group payment system to basic insurance only, private healthcare model unaffected — HLIB Research The government is planning on implementing the proposed DRG (diagnostic related group) payment model only for new basic health insurance and takaful products - according to to HLIB research, the DRG payment model won't be applicable for existing insurance products/policies. The new products will have an 'extensive provider network' including mid-priced private hospitals, non-profit hospitals, and Rakan KKM facilities. HLIB expects the participation of mid-priced hospitals to be voluntary. They didn't specify which hospitals were deemed mid-priced. My question is, will the DRG pricing model for the new basic health insurance and takaful products still be adhering to the schedule 13 surgeon/anesthetist fee caps and procedure classification, and if so, how will the issue of unbundling/layering of fees and charges be addressed???? Given that even a non-profit, like the Tun Hussein Onn Eye Hospital, practices unbundling/layering of fees/charges, is it realistic to expect adherence by mid-priced hospitals???? If we rule out non-profit and mid-priced hospitals, the 'extensive provider network' will only be left with Rakan KKM facilities. Perhaps even the Rakan KKM facilities don't strictly adhere to the schedule 13 fee caps and procedure classification. This post has been edited by hafizmamak85: Apr 25 2025, 07:25 PM |

|

|

Apr 25 2025, 06:22 PM Apr 25 2025, 06:22 PM

Show posts by this member only | IPv6 | Post

#7149

|

Junior Member

627 posts Joined: Apr 2011 |

Guys, can someone suggest me which standalone medical card in Malaysia best for value now?

For age above 50, min 30k annual limit is enough, 200 board room |

|

|

Apr 25 2025, 06:42 PM Apr 25 2025, 06:42 PM

|

All Stars

14,892 posts Joined: Mar 2015 |

QUOTE(tiramisu83 @ Apr 25 2025, 06:22 PM) Guys, can someone suggest me which standalone medical card in Malaysia best for value now? While waiting for someone to tell you the "best"For age above 50, min 30k annual limit is enough, 200 board room Try explore the "best" as they had suggested while you wait? Best Standalone Medical Cards in Malaysia 2025 https://www.google.com/url?sa=t&source=web&...kMMu5X7-Ojaf1Er Which is the Cheapest Medical Card in Malaysia? https://www.google.com/amp/s/ibanding.com.m...n-malaysia/amp/ https://www.imoney.my/medical-insurance |

|

|

Apr 25 2025, 09:18 PM Apr 25 2025, 09:18 PM

Show posts by this member only | IPv6 | Post

#7151

|

All Stars

24,358 posts Joined: Feb 2011 |

QUOTE(tiramisu83 @ Apr 25 2025, 06:22 PM) Guys, can someone suggest me which standalone medical card in Malaysia best for value now? Sure. I will point you.For age above 50, min 30k annual limit is enough, 200 board room https://www.etiqa.com.my/health/onemedical https://www.generali.com.my/medical-health/emedic-plus https://www.aia.com.my/en/our-products/heal...e-mediflex.html https://www.aia.com.my/en/our-products/heal...-med-basic.html kyleen liked this post

|

|

|

Apr 26 2025, 09:49 AM Apr 26 2025, 09:49 AM

|

Junior Member

762 posts Joined: Jan 2003 |

QUOTE(bryon @ Apr 23 2025, 05:04 PM) Assuming what's shared by Lowyat forumer some time back, Kaotim does not offer guaranteed renewal. Are you using Kaotim now, can confirm this ?This post has been edited by cms: Apr 26 2025, 09:49 AM |

|

|

Apr 26 2025, 02:19 PM Apr 26 2025, 02:19 PM

Show posts by this member only | IPv6 | Post

#7153

|

Junior Member

463 posts Joined: Nov 2009 |

QUOTE(Ramjade @ Apr 25 2025, 09:18 PM) Sure. I will point you. Always check on the average medical pool claims cost, average medical claims size.https://www.etiqa.com.my/health/onemedical https://www.generali.com.my/medical-health/emedic-plus https://www.aia.com.my/en/our-products/heal...e-mediflex.html https://www.aia.com.my/en/our-products/heal...-med-basic.html This post has been edited by hafizmamak85: Apr 26 2025, 02:31 PM |

|

|

|

|

|

Apr 26 2025, 02:35 PM Apr 26 2025, 02:35 PM

Show posts by this member only | IPv6 | Post

#7154

|

Junior Member

463 posts Joined: Nov 2009 |

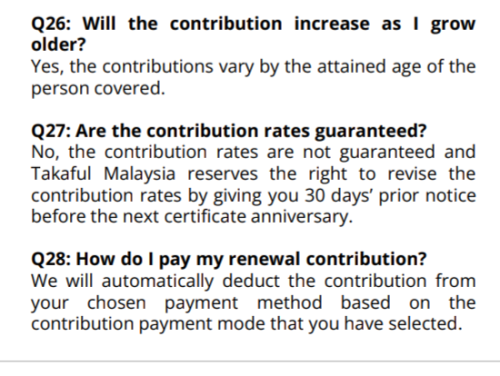

QUOTE(cms @ Apr 26 2025, 09:49 AM) Assuming what's shared by Lowyat forumer some time back, Kaotim does not offer guaranteed renewal. Are you using Kaotim now, can confirm this ?  Contributions are automatically deducted upon renewal. It does however say that contribution rates are not guaranteed but does not specify whether repricing is only done on portfolio basis. Needs to be clarified whether repricing may be done on individual basis. This post has been edited by hafizmamak85: Apr 26 2025, 04:01 PM |

|

|

Apr 26 2025, 03:07 PM Apr 26 2025, 03:07 PM

Show posts by this member only | IPv6 | Post

#7155

|

Junior Member

463 posts Joined: Nov 2009 |

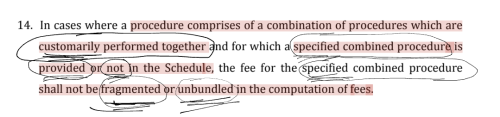

QUOTE(hafizmamak85 @ Apr 24 2025, 02:44 AM) It's a simple benign chalazion/lesion removal in a single spot, so why should it cost almost RM 3k???? Medicine/consumables/supplies/services and operating theater fees come to about RM 840 and RM 650 respectively, another RM 105 for consultation fees, another RM 200 for biopsy (test), and a whopping RM 1k in surgeon fees.  When there are surgeon fees, why the need for a consultation fee as well??? Why unbundle and layer it with specific surgeon fees for biopsy and eyelid suturing, when it's clear that these should all be covered under the main procedure, which is eyelid lesion excision/curettage/cryotherapy????  » Click to show Spoiler - click again to hide... « Btw, this was done just using novocain. If general anesthesia, another 2k. Go figure. Another schedule 13 breach.  Why is fragmenting/unbundling still a big issue if the law does not allow for it???  This post has been edited by hafizmamak85: Apr 26 2025, 03:43 PM |

|

|

Apr 26 2025, 04:36 PM Apr 26 2025, 04:36 PM

Show posts by this member only | IPv6 | Post

#7156

|

All Stars

24,358 posts Joined: Feb 2011 |

QUOTE(hafizmamak85 @ Apr 26 2025, 02:19 PM) You or agent don't have access to average pool claim cost or claim size. So you can forget about this info. This info is only for those running the insurance company not those selling it. |

|

|

Apr 26 2025, 04:50 PM Apr 26 2025, 04:50 PM

Show posts by this member only | IPv6 | Post

#7157

|

Junior Member

463 posts Joined: Nov 2009 |

|

|

|

Apr 26 2025, 05:26 PM Apr 26 2025, 05:26 PM

|

All Stars

14,892 posts Joined: Mar 2015 |

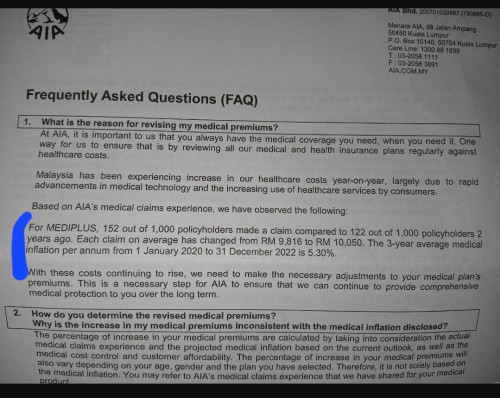

QUOTE(Ramjade @ Apr 26 2025, 04:36 PM) You or agent don't have access to average pool claim cost or claim size. I just checked my old received repricing letter. So you can forget about this info. This info is only for those running the insurance company not those selling it. They did provides some info. Just not sure what those info can help a new potential customers in determining which insurance companies to choose to buy a new plan or help an existing policy holder's to determine if he should cancel it or change to another company. I did not bother with the repricing reason, ...I just continue to pay as asked, since I can still afford it, and the feeling of the need of that coverage which I think I needed it. If I am buying a new plan, I still don't bother with the repricing reasons as I know it is a constant increasing things which does not just happens in Malaysia. Even a strong governance country like Spore are facing this issue too. I strongly beliefs, It is either you buy or continue to keep or you can do the opposites..... the insurance companies don't bother. Average medical inflation is 5.3% pa, yet the premium increase is 25%. Luckily it is not every year premium increase 25%, and luckily BNM said no more than 10% until, .... But hor, .... I just checked my last month cc bill. ... Billed RM4,656, that is another 35.58% from last year of RM3434 This post has been edited by MUM: Apr 26 2025, 07:50 PM Attached thumbnail(s)

|

|

|

Apr 26 2025, 06:08 PM Apr 26 2025, 06:08 PM

Show posts by this member only | IPv6 | Post

#7159

|

Junior Member

463 posts Joined: Nov 2009 |

Well, well, well. Would you just look at that. AIA's Mediplus has a MASSIVE claims frequency of 152 per 1000 but only an average claims size of RM 10.1k. I wonder what in the world could have caused this???? Such a high frequency, but only a miniscule average claims size of RM 10k. Could it be due to AIA's claims philosophy of allowing huge numbers of small medical claims such as for pneumonia, influenza, bronchitis outpatient treatments - so that more insurance consumers get to "feel" the benefits of holding an insurance policy - while denying or delaying a significant number of large claims at the same time. High time the four champion horsemen of the apocalypse: IHH, KPJ, Asia Onehealthcare, Sunway, make their move by collaborating with digital insurers and takaful operators. They should outsource all these small claims to their GP and other specialists networks and shift their focus to more complicated or higher end care cases. Using Dr Gunalan's hospital bill size distribution example below, and assuming only an 8% claims frequency, we can easily deduce that the average claims size in a hospital setting should be around RM 25.6k. QUOTE(hafizmamak85 @ Apr 23 2025, 12:59 PM) You don't have to take my word for it. You can read this write up by one Dr Gunalan Palari Arumugam in CodeBlue This post has been edited by hafizmamak85: Apr 26 2025, 11:57 PMThe Private Medical Insurance And Hospital Charges Conundrum: Part 2 — Dr Gunalan Palari Arumugam The misconception is that our fees are bankrupting patients. Just an example of range of fees, about 60 per cent of hospital bill sizes fall below RM10,000 (mainly medical admissions), 30 per cent between RM10,000 and 50,000 (simple surgeries), and 5 per cent RM50,000 and RM100,000 (complex surgeries), Only about 3 to 5 per cent of cases actually exceeded RM100,000, and this is when a patient presents with a complicated problem (cardiovascular or neurology) and multi-organ failure that needs end organ support via ventilation, dialysis, interventional radiology (coronary or neuro). These are the bills that generally depletes the savings of our patients, if the insurance is not able to cover the costs. Using the above bill size distribution and assuming 8 per 100 policyholders make claims (8%) every year, the monthly premium comes up to RM 180 with a 5% loading and RM 280 with a 40% loading (loading for expenses/profit etc.). It's still going to be somewhat pricy. » Click to show Spoiler - click again to hide... « |

|

|

Apr 26 2025, 06:14 PM Apr 26 2025, 06:14 PM

|

All Stars

14,892 posts Joined: Mar 2015 |

|

| Change to: |  0.0221sec 0.0221sec

0.34 0.34

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 03:11 AM |