Outline ·

[ Standard ] ·

Linear+

Insurance Talk V7!, Your one stop Insurance Discussion

|

kidmad

|

Dec 22 2021, 01:57 PM Dec 22 2021, 01:57 PM

|

|

QUOTE(CoolStoryWriter @ Dec 22 2021, 12:21 PM) Okay hmm but is the 200k important? Imagine house can settle with the MRTA...then got extra cash of 200kk... Do I still need another 200k? That's 400k, what determines I need only 200k and not 400k? the question is RM400k sufficient or not for your wife and if you have kids.. and perhaps aging parents. RM400k that's like 5 years worth of expenditure only. on top of MRTA i still have 500k life for my parents, 500k life for my wife, next year will have a new born will be buying another 500k for the kid. Medical insurance ada ker belum? don't tell me because you working you have not think of it. This post has been edited by kidmad: Dec 22 2021, 01:58 PM |

|

|

|

|

|

kidmad

|

Apr 23 2025, 11:49 AM Apr 23 2025, 11:49 AM

|

|

QUOTE(hafizmamak85 @ Apr 21 2025, 06:59 PM) There is no continuity of care. That is the point. It's incredibly disruptive. We don't know what level and type of care can be provided at the government facility. This happens in cancer treatment. You run out of insurance coverage then you end up in the government system and there may be issues and other complications due to this. Maybe you might not be able to continue on the same treatment plan as when you were under coverage. It's ok, for those who can't afford it, by all means please go the government facility. But why should anyone go through this when you have insurance coverage???? now others seem to have already shared their point of view and let me share mine with you. a Bypass surgery in UMSC, i had to fork out RM90k+ from my own pocket for my mum. I wish she had some sort of insurance even the cheaper ones which most likely she need to pay a couple of thousand at age 65. RM100k or RM150k covers ALOT of illness that's what i can tell you now. If my mum needs to join the queue in Serdang, most likely she's dead already. The queue alone with take more than a year just for an angiogram another 6 - 8 months to obtain the right amount of stent. it's a good option for the mass public which doesn't have enough in my books. of course if you can afford those RM400 - 600 monthly premium by all means go for it.. but if you only have RM100 to spare at age 30/40 these are good options. |

|

|

|

|

|

kidmad

|

Apr 23 2025, 01:43 PM Apr 23 2025, 01:43 PM

|

|

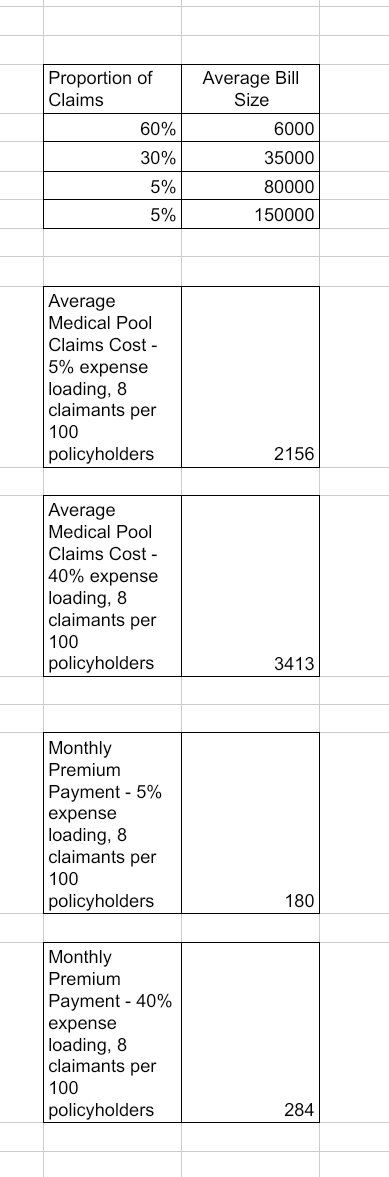

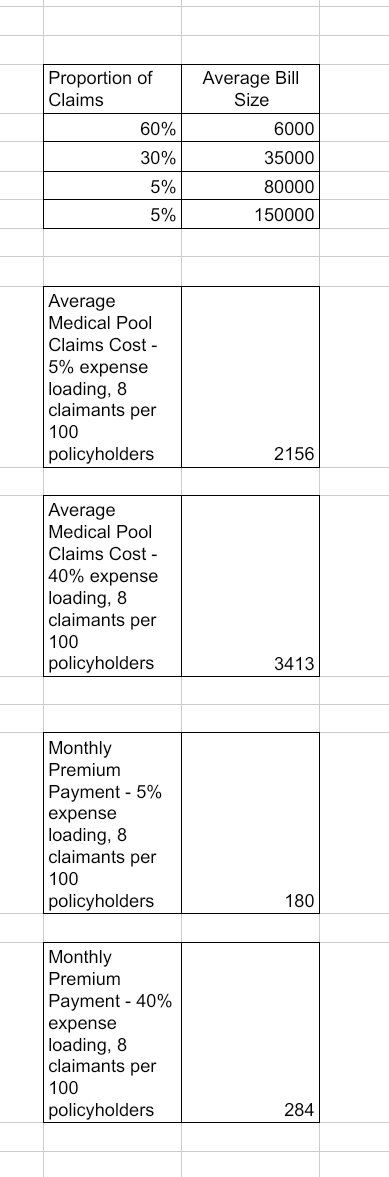

QUOTE(hafizmamak85 @ Apr 23 2025, 12:59 PM) I'm sorry for what your family has had to go through. Yes, you are right, a significant number of treatments/procedures can be covered within a 150k coverage. But what makes you think RM 100 per month is sufficient to cover sub RM 150k treatments/procedures??? If an ITO did price it as such, without high deductibles like RM 5000, it's my view that they might likely be denying/delaying claims. You don't have to take my word for it. You can read this write up by one Dr Gunalan Palari Arumugam in CodeBlue The Private Medical Insurance And Hospital Charges Conundrum: Part 2 — Dr Gunalan Palari Arumugam The misconception is that our fees are bankrupting patients. Just an example of range of fees, about 60 per cent of hospital bill sizes fall below RM10,000 (mainly medical admissions), 30 per cent between RM10,000 and 50,000 (simple surgeries), and 5 per cent RM50,000 and RM100,000 (complex surgeries),

Only about 3 to 5 per cent of cases actually exceeded RM100,000, and this is when a patient presents with a complicated problem (cardiovascular or neurology) and multi-organ failure that needs end organ support via ventilation, dialysis, interventional radiology (coronary or neuro). These are the bills that generally depletes the savings of our patients, if the insurance is not able to cover the costs.Using the above bill size distribution and assuming 8 per 100 policyholders make claims (8%) every year, the monthly premium comes up to RM 180 with a 5% loading and RM 280 with a 40% loading (loading for expenses/profit etc.).It's still going to be somewhat pricy.  now let me correct you. a term insurance with RM150k coverage most likely my mum have to pay RM6k+ per annum definitely not RM100. |

|

|

|

|

|

kidmad

|

Apr 23 2025, 04:45 PM Apr 23 2025, 04:45 PM

|

|

QUOTE(hafizmamak85 @ Apr 23 2025, 02:03 PM) The point was that even the 30/40 year olds may have to pay above RM 250 a month so that people of your mother's age and above can get a not so pricy premium of below RM 6k again please experience before sharing wrong info. at age 40 the term insurance i bought for smartcare optimum from generalli only cost me rm1.6k per annum. from etiqa and other with lower coverage its as low as rm800 - 1300. it's not that expensive. its a good start for anyone who wants extra protection. |

|

|

|

|

|

kidmad

|

Apr 23 2025, 04:47 PM Apr 23 2025, 04:47 PM

|

|

QUOTE(Wedchar2912 @ Apr 22 2025, 08:42 PM) I'm not really sure if it is worth while to so called get a "future proof" card as in having medical coverage with high limits... as you said, many stories about providers rejecting certain "exotic" treatment and now them hiking medical premium exorbitantly... essentially pricing the policyholder out of his medical coverage when he needed it most. And this is despite him paying from start while under-utilizing the insurance all this while. And that is also assuming if one can survive even one incident that cost 1.5 million ringgit treatment! plus how many exotic illness would need a treatment of say 2 million ringgit? these are like super rare events. (but providers greed is a lot more common and infinite) But if one can afford the coverage, sure... i always tell ppl you need anything above rm1m for insurance.. you would rather die than hanging on.. |

|

|

|

|

Dec 22 2021, 01:57 PM

Dec 22 2021, 01:57 PM

Quote

Quote

0.2017sec

0.2017sec

0.47

0.47

7 queries

7 queries

GZIP Disabled

GZIP Disabled