i wrote a post about the things to consider when you switch from your current policy from company A to company B. I'm not saying dont do it all, but do take into account the cost involved are complicated.

I'm not fully understanding what you are putting here. did you also approach Allianz to get a new policy? i suppose you dont have a current policy with allianz? you should shop around but do read my previous post about the switching.

► Yes, A approached Alianz agent. They give me some options. Restructured my current GE plan, and buy Allianz medical plan (+ minimum Life).

Also want to clear up some misconception, assuming you are a normal person, non of the medical plans out there have 2 years waiting period. the 2-years is actually referring to the incontestability period, which somehow gets translate to "dont claim within 2 years".

► Allianz has early bird offer to me [takeover campaign], can waive waiting period, no need medical check up. He explained that in the first 2 years of the new policy, I have to pay out of my pocket for chronic diseases, then submit claims. Up to Allianz discretion for approval.

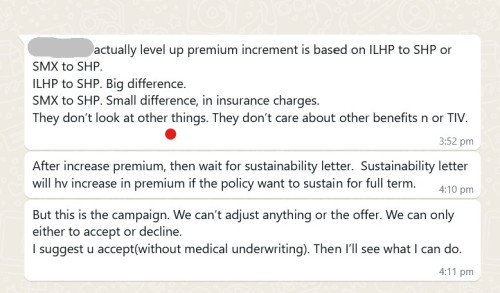

I dont work for GE, and i have no vested interest in GE. I put it in a different analogy, if you are switching from a honda city to honda accord, the jump of car loan installment will be smaller. but if you are switching from axia to accord, i'm sure the jump in car loan instalment is bigger. in the end we are consumers, it's our choice to want that accord or not. i wont say they blame it on the axia being cheap, but the axia is cheaper, that is the reality right?

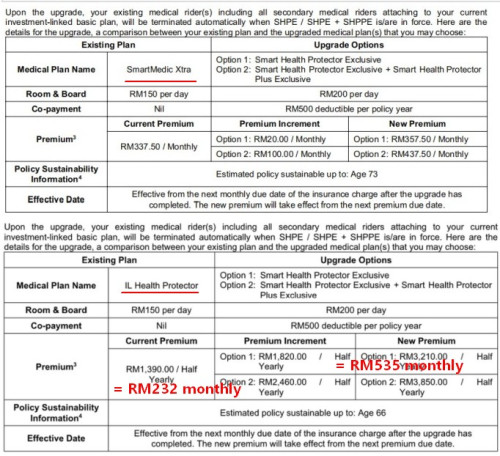

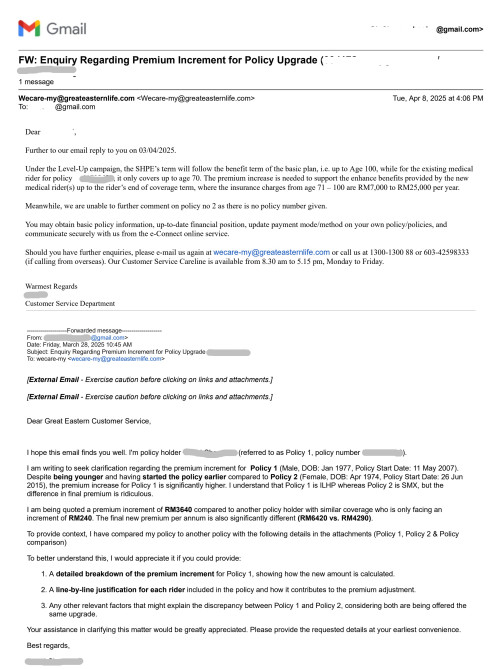

► My situation is: both of me and my colleage being offered to upgrade to the same SHP plan. How come the final premium is different for similar coverage? I'm younger and start the policy earlier (RM6420 vs. RM4290).

► hafizmamak85 pointed this out "It is really baffling to me that Policy 2 is being asked to pay

an extra RM 180 per month or almost RM 2.2k per annum compared to Policy 1 for essentially an extra RM 50k in death & accidental benefits."

added side note on the GE plan: from what i see on the brochure. the SHP Plus offers what i think are not important benefits, dont get it (IF you do decide to upgrade to SHP)

► I won't consider SHP Plus (option 2) . All my calculation is based on SHP option 1.

Mar 27 2025, 05:16 PM

Mar 27 2025, 05:16 PM

Quote

Quote

0.0246sec

0.0246sec

0.70

0.70

7 queries

7 queries

GZIP Disabled

GZIP Disabled